Form Ar1002nr - Nonresident Fiduciary Return

ADVERTISEMENT

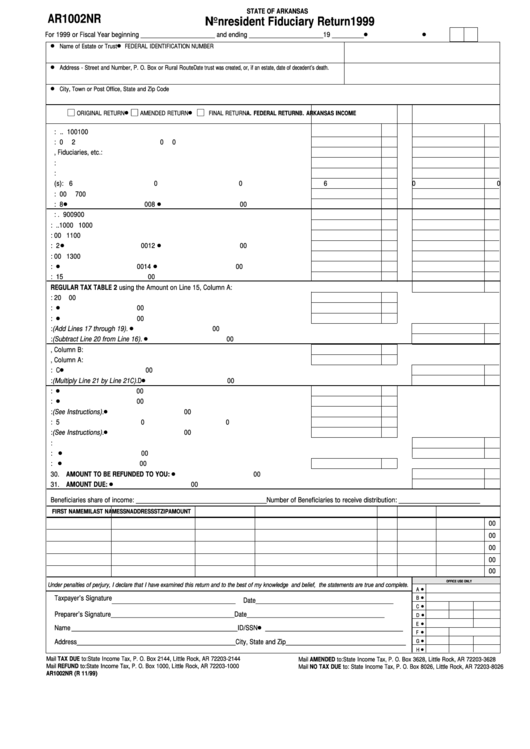

STATE OF ARKANSAS

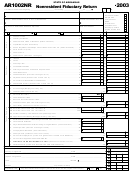

AR1002NR

Nonresident Fiduciary Return

1999

For 1999 or Fiscal Year beginning _____________________ and ending _____________________19 _________

Name of Estate or Trust

FEDERAL IDENTIFICATION NUMBER

Address - Street and Number, P. O. Box or Rural Route

Date trust was created, or, if an estate, date of decedent’s death.

City, Town or Post Office, State and Zip Code

ORIGINAL RETURN

AMENDED RETURN

FINAL RETURN

A. FEDERAL RETURN

B. ARKANSAS INCOME

01. Dividends: .................................................................................................................... 1

00

1

00

02. Interest Income: .......................................................................................................... 2

00

2

00

03. Income from Partnerships, Fiduciaries, etc.: ................................................................ 3

00

3

00

04. Rent and Royalty Income: ........................................................................................... 4

00

4

00

05. Net Profit from Trade or Business: .............................................................................. 5

00

5

00

06. Capital Gain(s): ........................................................................................................... 6

00

6

00

07. Other Income: .............................................................................................................. 7

00

7

00

08. Total Income: ............................................................................................................... 8

00

8

00

09. Interest Paid: ................................................................................................................ 9

00

9

00

10. Taxes Paid: ..................................................................................................................10

00 10

00

11. Other Deductions:.........................................................................................................11

00 11

00

12. Total Deductions: .........................................................................................................12

00 12

00

13. Adjusted Income:..........................................................................................................13

00 13

00

14. Amounts to be distributed to beneficiaries: .................................................................14

00 14

00

15. Net Taxable Income: ....................................................................................................15

00 15

00

16. Enter Tax from REGULAR TAX TABLE 2 using the Amount on Line 15, Column A: ............................................................... 16

00

17. Personal Tax Credit:......................................................................................................17

20

00

18. Other State Tax Credits: ...............................................................................................18

00

19. Business and Incentive Tax Credits: ............................................................................19

00

20. Total Tax Credits:(Add Lines 17 through 19). ........................................................................................................................ 20

00

21. Tax Liability: (Subtract Line 20 from Line 16). ...................................................................................................................... 21

00

21A. Enter the Amount from Line 15, Column B: ................................................................21A

00

21B. Enter the Amount from Line 15, Column A: ................................................................21B

00

21C. Divide Line 21A by Line 21B and enter percentage here: ....................................................................................................21C

00

21D. Apportioned Tax Liability: (Multiply Line 21 by Line 21C). .................................................................................................21D

00

22. Estimated Tax Paid or Credit brought forward from last year: ....................................22

00

23. Tax paid with Extension: ..............................................................................................23

00

24. Payments with Original Return: (See Instructions). ....................................................24

00

25. Total Payments: ...........................................................................................................25

00

26. Overpayments received: (See Instructions). ................................................................26

00

27. Balance of payments subject to liability: .............................................................................................................................. 27

00

28. Overpayment: ....................................................................................................................................................................... 28

00

29. Amount to be applied to 2000 Estimated Tax: ............................................................29

00

30. AMOUNT TO BE REFUNDED TO YOU: .................................................................................................................................. 30

00

31. AMOUNT DUE: ...................................................................................................................................................................... 31

00

Beneficiaries share of income: _____________________________________

Number of Beneficiaries to receive distribution: _______________________

FIRST NAME

MI

LAST NAME

SSN

ADDRESS

ST

ZIP

AMOUNT

00

00

00

00

00

OFFICE USE ONLY

Under penalties of perjury, I declare that I have examined this return and to the best of my knowledge and belief, the statements are true and complete.

A

Taxpayer’s Signature ___________________________________

B

Date

_______________________________________

C

Preparer’s Signature ___________________________________

Date

_______________________________________

D

E

Name _______________________________________________

ID/SSN

_______________________________________

F

Address _____________________________________________

City, State and Zip __________________________________

G

H

Mail TAX DUE to: State Income Tax, P. O. Box 2144, Little Rock, AR 72203-2144

Mail AMENDED to:

State Income Tax, P. O. Box 3628, Little Rock, AR 72203-3628

Mail REFUND to: State Income Tax, P. O. Box 1000, Little Rock, AR 72203-1000

Mail NO TAX DUE to: State Income Tax, P. O. Box 8026, Little Rock, AR 72203-8026

AR1002NR (R 11/99)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1