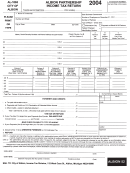

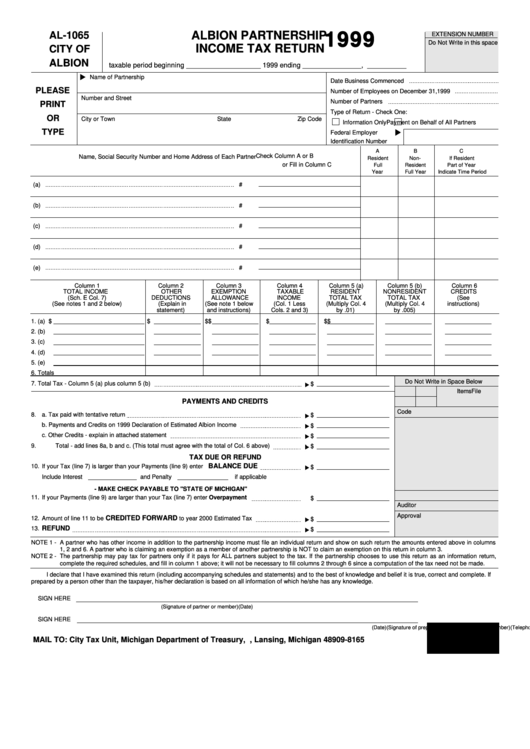

Form Al-1065 - Albion Partnership Income Tax Return - 1999

ADVERTISEMENT

ALBION PARTNERSHIP

AL-1065

1999

EXTENSION NUMBER

Do Not Write in this space

INCOME TAX RETURN

CITY OF

ALBION

taxable period beginning ___________________ 1999 ending _______________, __________

Name of Partnership

Date Business Commenced

PLEASE

Number of Employees on December 31,1999

Number and Street

Number of Partners

PRINT

Type of Return - Check One:

OR

City or Town

State

Zip Code

Information Only

Payment on Behalf of All Partners

TYPE

Federal Employer

Identification Number

A

B

C

Check Column A or B

Name, Social Security Number and Home Address of Each Partner

Resident

Non-

If Resident

or Fill in Column C

Full

Resident

Part of Year

Year

Full Year

Indicate Time Period

(a)

S.S.#

(b)

S.S.#

(c)

S.S.#

(d)

S.S.#

(e)

S.S.#

Column 1

Column 2

Column 3

Column 4

Column 5 (a)

Column 5 (b)

Column 6

TOTAL INCOME

OTHER

EXEMPTION

TAXABLE

RESIDENT

NONRESIDENT

CREDITS

(Sch. E Col. 7)

DEDUCTIONS

ALLOWANCE

INCOME

TOTAL TAX

TOTAL TAX

(See

(See notes 1 and 2 below)

(Explain in

(See note 1 below

(Col. 1 Less

(Multiply Col. 4

(Multiply Col. 4

instructions)

statement)

and instructions)

Cols. 2 and 3)

by .01)

by .005)

1. (a) $

$

$

$

$

$

$

2. (b)

3. (c)

4. (d)

5. (e)

6. Totals

Do Not Write in Space Below

7. Total Tax - Column 5 (a) plus column 5 (b)

$

File

Items

PAYMENTS AND CREDITS

Code

8.

a. Tax paid with tentative return

$

b. Payments and Credits on 1999 Declaration of Estimated Albion Income

$

c. Other Credits - explain in attached statement

$

9.

Total - add lines 8a, b and c. (This total must agree with the total of Col. 6 above)

$

TAX DUE OR REFUND

BALANCE DUE

10.

If your Tax (line 7) is larger than your Payments (line 9) enter

$

Include Interest

and Penalty

if applicable

- MAKE CHECK PAYABLE TO "STATE OF MICHIGAN"

11.

If your Payments (line 9) are larger than your Tax (line 7) enter Overpayment

$

Auditor

Approval

CREDITED FORWARD

12.

Amount of line 11 to be

to year 2000 Estimated Tax

$

REFUND

13.

$

NOTE 1 -

A partner who has other income in addition to the partnership income must file an individual return and show on such return the amounts entered above in columns

1, 2 and 6. A partner who is claiming an exemption as a member of another partnership is NOT to claim an exemption on this return in column 3.

NOTE 2 -

The partnership may pay tax for partners only if it pays for ALL partners subject to the tax. If the partnership chooses to use this return as an information return,

complete the required schedules, and fill in column 1 above; it will not be necessary to fill columns 2 through 6 since a computation of the tax need not be made.

I declare that I have examined this return (including accompanying schedules and statements) and to the best of knowledge and belief it is true, correct and complete. If

prepared by a person other than the taxpayer, his/her declaration is based on all information of which he/she has any knowledge.

SIGN HERE

(Signature of partner or member)

(Date)

SIGN HERE

(Signature of preparer other than partner or member)

(Telephone number)

(Date)

ALBION 52

MAIL TO: City Tax Unit, Michigan Department of Treasury, P.O. Box 30665, Lansing, Michigan 48909-8165

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4