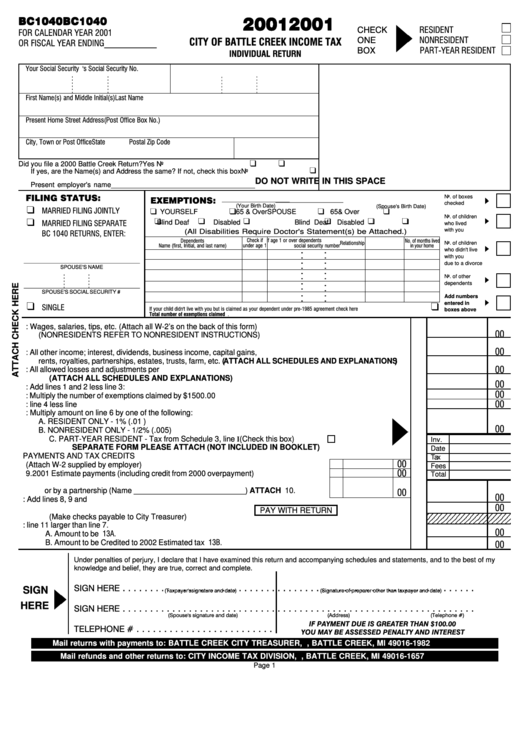

Form Bc1040 - City Of Battle Creek Income Tax Individual Return - 2001

ADVERTISEMENT

2001

2001

2001

2001

2001

BC1040

BC1040

BC1040

BC1040

BC1040

CHECK

RESIDENT

FOR CALENDAR YEAR 2001

ONE

NONRESIDENT

CITY OF BATTLE CREEK INCOME TAX

OR FISCAL YEAR ENDING____________

BOX

PART-YEAR RESIDENT

INDIVIDUAL RETURN

Your Social Security No.

Spouse's Social Security No.

First Name(s) and Middle Initial(s)

Last Name

Present Home Street Address

(Post Office Box No.)

City, Town or Post Office

State

Postal Zip Code

Did you file a 2000 Battle Creek Return?

Yes

No

G

G

If yes, are the Name(s) and Address the same? If not, check this box

No

G

DO NOT WRITE IN THIS SPACE

Present employer's name_____________________________________

FILING STATUS:

No. of boxes

EXEMPTIONS:

__________________________

__________________________

checked

(Your Birth Date)

(Spouse's Birth Date)

MARRIED FILING JOINTLY

G

YOURSELF

65 & Over

SPOUSE

65& Over

G

G

G

G

No. of children

MARRIED FILING SEPARATE

Blind

Deaf

Disabled

B lind

Deaf

Disabled

G

who lived

G

G

G

G

G

G

with you

BC 1040 RETURNS, ENTER:

(All Disabilities Require Doctor's Statement(s) be Attached.)

Check if

If age 1 or over dependents

Dependents

No. of months lived

Relationship

No. of children

Name (first, Initial, and last name)

under age 1

social security number

in your home

who didn't live

with you

_______________________________________

due to a divorce

SPOUSE'S NAME

No. of other

dependents

_______________________________________

SPOUSE'S SOCIAL SECURITY #

Add numbers

entered in

SINGLE

G

G

If your child didn't live with you but is claimed as your dependent under pre-1985 agreement check here ........................................................

boxes above

Total number of exemptions claimed ............................................................................................................................................................................................................ .

1. TOTAL W-2 INCOME: Wages, salaries, tips, etc. (Attach all W-2’s on the back of this form)

00

(NONRESIDENTS REFER TO NONRESIDENT INSTRUCTIONS) .................................................................... 1.

00

2. ADDITIONS TO INCOME: All other income; interest, dividends, business income, capital gains, ............................. 2.

rents, royalties, partnerships, estates, trusts, farm, etc. (ATTACH ALL SCHEDULES AND EXPLANATIONS)

00

3. SUBTRACTIONS FROM INCOME: All allowed losses and adjustments per instructions .......................................... 3.

(ATTACH ALL SCHEDULES AND EXPLANATIONS)

00

4. ADJUSTED INCOME: Add lines 1 and 2 less line 3: ................................................................................................. 4.

00

5. EXEMPTIONS: Multiply the number of exemptions claimed by $1500.00 ................................................................. 5.

00

6. TAXABLE INCOME: line 4 less line 5 ........................................................................................................................ 6.

7. TAX: Multiply amount on line 6 by one of the following:

A. RESIDENT ONLY - 1% (.01 ) .............................................................................................................................

00

B. NONRESIDENT ONLY - 1/2% (.005) ............................................................................................................... 7.

C. PART-YEAR RESIDENT - Tax from Schedule 3, line I ..........(Check this box) ...................................................

Inv.

SEPARATE FORM PLEASE ATTACH (NOT INCLUDED IN BOOKLET)

Date

PAYMENTS AND TAX CREDITS

Tax

00

8. Battle Creek tax withheld (Attach W-2 supplied by employer) ............................................ 8.

Fees

00

9. 2001 Estimate payments (including credit from 2000 overpayment) .................................. 9.

Total

10. Credit for income tax paid to another Michigan municipality

00

or by a partnership (Name __________________________) ATTACH COPIES ......... 10.

00

11. TOTAL PAYMENTS AND CREDITS: Add lines 8, 9 and 10. ..................................................................................... 11.

00

12. BALANCE DUE line 7 larger than line 11 ................................................................................................................ 12.

PAY WITH RETURN

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0

(Make checks payable to City Treasurer)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0

13. OVERPAYMENT: line 11 larger than line 7.

00

A. Amount to be Refunded .................................................................................................................................. 13A.

B. Amount to be Credited to 2002 Estimated tax ................................................................................................. 13B.

00

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my

knowledge and belief, they are true, correct and complete.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

SIGN HERE

SIGN

(Taxpayer's signature and date)

(Signature of preparer other than taxpayer and date)

HERE

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

SIGN HERE

(Spouse's signature and date)

(Address)

(Telephone #)

IF PAYMENT DUE IS GREATER THAN $100.00

. . . . . . . . . . . . . . . . . . . . . . . . .

TELEPHONE #

YOU MAY BE ASSESSED PENALTY AND INTEREST

Mail returns with payments to: BATTLE CREEK CITY TREASURER, P.O. BOX 1982, BATTLE CREEK, MI 49016-1982

Mail refunds and other returns to: CITY INCOME TAX DIVISION, P.O. BOX 1657, BATTLE CREEK, MI 49016-1657

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2