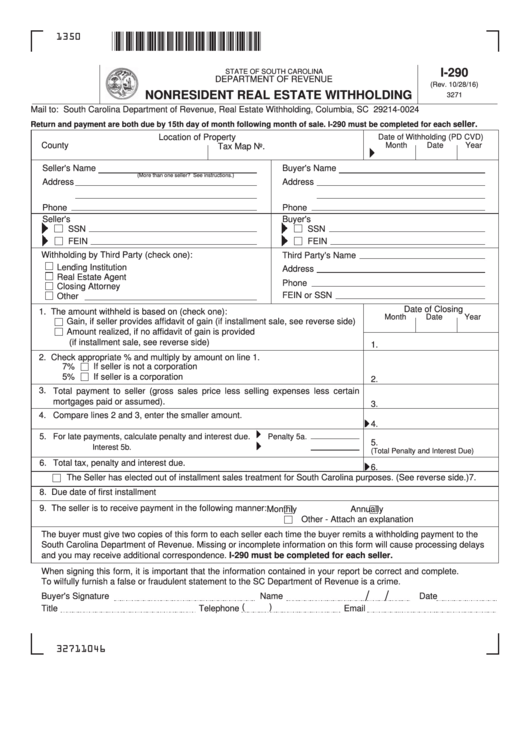

Form I-290 - Nonresident Real Estate Withholding

ADVERTISEMENT

1350

I-290

STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE

(Rev. 10/28/16)

NONRESIDENT REAL ESTATE WITHHOLDING

3271

Mail to: South Carolina Department of Revenue, Real Estate Withholding, Columbia, SC 29214-0024

eller.

Return and payment are both due by 15th day of month following month of sale. I-290 must be completed for each s

Location of Property

Date of Withholding (PD CVD)

County

Month

Date

Year

Tax Map No.

Seller's Name

Buyer's Name

(More than one seller? See instructions.)

Address

Address

Phone

Phone

Seller's

Buyer's

SSN

SSN

FEIN

FEIN

Withholding by Third Party (check one):

Third Party's Name

Lending Institution

Address

Real Estate Agent

Phone

Closing Attorney

FEIN or SSN

Other

Date of Closing

1. The amount withheld is based on (check one):

Month

Date

Year

Gain, if seller provides affidavit of gain (if installment sale, see reverse side)

Amount realized, if no affidavit of gain is provided

(if installment sale, see reverse side)

1.

2. Check appropriate % and multiply by amount on line 1.

7%

If seller is not a corporation

5%

If seller is a corporation

2.

3.

Total payment to seller (gross sales price less selling expenses less certain

mortgages paid or assumed).

3.

4.

Compare lines 2 and 3, enter the smaller amount.

4.

5.

For late payments, calculate penalty and interest due.

Penalty 5a.

5.

Interest 5b.

(Total Penalty and Interest Due)

6.

Total tax, penalty and interest due.

6.

7.

The Seller has elected out of installment sales treatment for South Carolina purposes. (See reverse side.)

8. Due date of first installment

9. The seller is to receive payment in the following manner:

Monthly

Annually

Other - Attach an explanation

The buyer must give two copies of this form to each seller each time the buyer remits a withholding payment to the

South Carolina Department of Revenue. Missing or incomplete information on this form will cause processing delays

and you may receive additional correspondence. I-290 must be completed for each seller.

When signing this form, it is important that the information contained in your report be correct and complete.

To wilfully furnish a false or fraudulent statement to the SC Department of Revenue is a crime.

/

/

Buyer's Signature

Name

Date

(

)

Title

Telephone

Email

32711046

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1