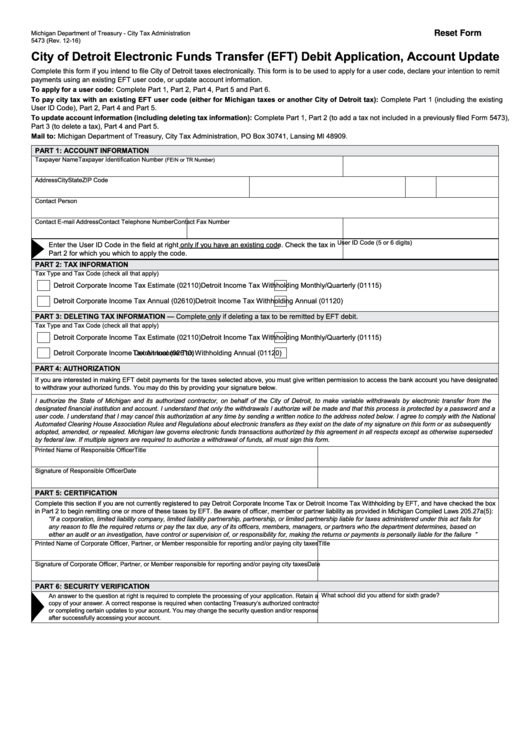

Michigan Department of Treasury - City Tax Administration

Reset Form

5473 (Rev. 12-16)

City of Detroit Electronic Funds Transfer (EFT) Debit Application, Account Update

Complete this form if you intend to file City of Detroit taxes electronically. This form is to be used to apply for a user code, declare your intention to remit

payments using an existing EFT user code, or update account information.

To apply for a user code: Complete Part 1, Part 2, Part 4, Part 5 and Part 6.

To pay city tax with an existing EFT user code (either for Michigan taxes or another City of Detroit tax): Complete Part 1 (including the existing

User ID Code), Part 2, Part 4 and Part 5.

To update account information (including deleting tax information): Complete Part 1, Part 2 (to add a tax not included in a previously filed Form 5473),

Part 3 (to delete a tax), Part 4 and Part 5.

Mail to: Michigan Department of Treasury, City Tax Administration, PO Box 30741, Lansing MI 48909.

PArT 1: ACCoUnT InForMATIon

Taxpayer Name

Taxpayer Identification Number

(FEIN or TR Number)

Address

City

State

ZIP Code

Contact Person

Contact E-mail Address

Contact Telephone Number

Contact Fax Number

User ID Code (5 or 6 digits)

Enter the User ID Code in the field at right only if you have an existing code. Check the tax in

Part 2 for which you which to apply the code.

PArT 2: TAx InForMATIon

Tax Type and Tax Code (check all that apply)

Detroit Corporate Income Tax Estimate (02110)

Detroit Income Tax Withholding Monthly/Quarterly (01115)

Detroit Corporate Income Tax Annual (02610)

Detroit Income Tax Withholding Annual (01120)

PArT 3: DElETIng TAx InForMATIon — Complete only if deleting a tax to be remitted by EFT debit.

Tax Type and Tax Code (check all that apply)

Detroit Corporate Income Tax Estimate (02110)

Detroit Income Tax Withholding Monthly/Quarterly (01115)

Detroit Corporate Income

Tax Annual (02610)

Detroit Income Tax Withholding Annual (01120)

PArT 4: AUThorIzATIon

If you are interested in making EFT debit payments for the taxes selected above, you must give written permission to access the bank account you have designated

to withdraw your authorized funds. You may do this by providing your signature below.

I authorize the State of Michigan and its authorized contractor, on behalf of the City of Detroit, to make variable withdrawals by electronic transfer from the

designated financial institution and account. I understand that only the withdrawals I authorize will be made and that this process is protected by a password and a

user code. I understand that I may cancel this authorization at any time by sending a written notice to the address noted below. I agree to comply with the National

Automated Clearing House Association Rules and Regulations about electronic transfers as they exist on the date of my signature on this form or as subsequently

adopted, amended, or repealed. Michigan law governs electronic funds transactions authorized by this agreement in all respects except as otherwise superseded

by federal law. If multiple signers are required to authorize a withdrawal of funds, all must sign this form.

Printed Name of Responsible Officer

Title

Signature of Responsible Officer

Date

PArT 5: CErTIFICATIon

Complete this section if you are not currently registered to pay Detroit Corporate Income Tax or Detroit Income Tax Withholding by EFT, and have checked the box

in Part 2 to begin remitting one or more of these taxes by EFT. Be aware of officer, member or partner liability as provided in Michigan Compiled Laws 205.27a(5):

“If a corporation, limited liability company, limited liability partnership, partnership, or limited partnership liable for taxes administered under this act fails for

any reason to file the required returns or pay the tax due, any of its officers, members, managers, or partners who the department determines, based on

either an audit or an investigation, have control or supervision of, or responsibility for, making the returns or payments is personally liable for the failure ....”

Printed Name of Corporate Officer, Partner, or Member responsible for reporting and/or paying city taxes

Title

Signature of Corporate Officer, Partner, or Member responsible for reporting and/or paying city taxes

Date

PArT 6: sECUrITy vErIFICATIon

What school did you attend for sixth grade?

An answer to the question at right is required to complete the processing of your application. Retain a

copy of your answer. A correct response is required when contacting Treasury’s authorized contractor

or completing certain updates to your account. You may change the security question and/or response

after successfully accessing your account.

1

1