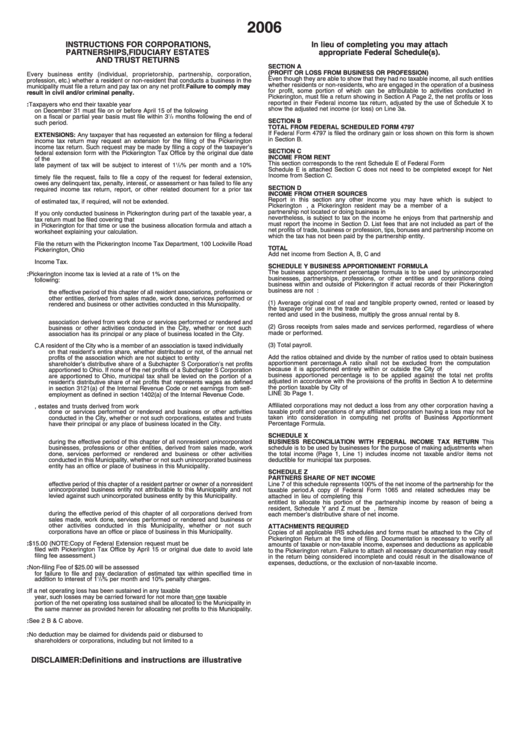

Instructions For Corporations, Partnerships, Fiduciary Estates And Trust Returns - Pickerington Income Tax Department - 2006

ADVERTISEMENT

2006

INSTRUCTIONS FOR CORPORATIONS,

In lieu of completing you may attach

PARTNERSHIPS, FIDUCIARY ESTATES

appropriate Federal Schedule(s).

AND TRUST RETURNS

SECTION A

(PROFIT OR LOSS FROM BUSINESS OR PROFESSION)

Every business entity (individual, proprietorship, partnership, corporation,

Even though they are able to show that they had no taxable income, all such entities

profession, etc.) whether a resident or non-resident that conducts a business in the

whether residents or non-residents, who are engaged in the operation of a business

municipality must file a return and pay tax on any net profit. Failure to comply may

for profit, some portion of which can be attributable to activities conducted in

result in civil and/or criminal penalty.

Pickerington, must file a return showing in Section A Page 2, the net profits or loss

reported in their Federal income tax return, adjusted by the use of Schedule X to

1. WHEN AND WHERE TO FILE RETURNS: Taxpayers who end their taxable year

show the adjusted net income (or loss) on Line 3a.

on December 31 must file on or before April 15 of the following year. Taxpayers

on a fiscal or partial year basis must file within 3

1

/

months following the end of

2

SECTION B

such period.

TOTAL FROM FEDERAL SCHEDULED FORM 4797

If Federal Form 4797 is filed the ordinary gain or loss shown on this form is shown

EXTENSIONS: Any taxpayer that has requested an extension for filing a federal

in Section B.

income tax return may request an extension for the filing of the Pickerington

income tax return. Such request may be made by filing a copy of the taxpayer’s

SECTION C

federal extension form with the Pickerington Tax Office by the original due date

INCOME FROM RENT

of the return. The extension will not extend the due date of the tax owed and any

This section corresponds to the rent Schedule E of Federal Form 1040. If a copy of

late payment of tax will be subject to interest of 1

1

/

% per month and a 10%

2

Schedule E is attached Section C does not need to be completed except for Net

penalty. The Tax Office may deny an extension request if the taxpayer fails to

Income from Section C.

timely file the request, fails to file a copy of the request for federal extension,

owes any delinquent tax, penalty, interest, or assessment or has failed to file any

SECTION D

required income tax return, report, or other related document for a prior tax

INCOME FROM OTHER SOURCES

period. Be advised that the due date for the filing of the current year declaration

Report in this section any other income you may have which is subject to

of estimated tax, if required, will not be extended.

Pickerington tax. For example, a Pickerington resident may be a member of a

partnership not located or doing business in Pickerington. This Pickerington resident

If you only conducted business in Pickerington during part of the taxable year, a

nevertheless, is subject to tax on the income he enjoys from that partnership and

tax return must be filed covering that time. Report the amount of income earned

must report the income in Section D. List fees that are not included as part of the

in Pickerington for that time or use the business allocation formula and attach a

net profits of trade, business or profession, tips, bonuses and partnership income on

worksheet explaining your calculation.

which the tax has not been paid by the partnership entity.

File the return with the Pickerington Income Tax Department, 100 Lockville Road

TOTAL

Pickerington, Ohio 43147. The total amount due must be paid when the return is

Add net income from Section A, B, C and D. Enter this total on Page 1 Line 1.

filed. Checks or money orders should be made payable to the City of Pickerington

Income Tax.

SCHEDULE Y BUSINESS APPORTIONMENT FORMULA

The business apportionment percentage formula is to be used by unincorporated

2. TAXABLE INCOME: Pickerington income tax is levied at a rate of 1% on the

businesses, partnerships, professions, or other entities and corporations doing

following:

business within and outside of Pickerington if actual records of their Pickerington

A.

On the portion attributable to this Municipality of the net profits earned during

business are not maintained. Determine the ratio of the Pickerington portion of:

the effective period of this chapter of all resident associations, professions or

other entities, derived from sales made, work done, services performed or

(1) Average original cost of real and tangible property owned, rented or leased by

rendered and business or other activities conducted in this Municipality.

the taxpayer for use in the trade or business. To determine the value of property

rented and used in the business, multiply the gross annual rental by 8.

B.

An association shall be taxed as an entity on the net profits of the

association derived from work done or services performed or rendered and

(2) Gross receipts from sales made and services performed, regardless of where

business or other activities conducted in the City, whether or not such

made or performed.

association has its principal or any place of business located in the City.

(3) Total payroll.

C.

A resident of the City who is a member of an association is taxed individually

on that resident’s entire share, whether distributed or not, of the annual net

Add the ratios obtained and divide by the number of ratios used to obtain business

profits of the association which are not subject to entity filing. The resident

apportionment percentage. A ratio shall not be excluded from the computation

shareholder’s distributive share of a Subchapter S Corporation’s net profits

because it is apportioned entirely within or outside the City of Pickerington. The

apportioned to Ohio. If none of the net profits of a Subchapter S Corporation

business apportioned percentage is to be applied against the total net profits

are apportioned to Ohio, municipal tax shall be levied on the portion of a

adjusted in accordance with the provisions of the profits in Section A to determine

resident’s distributive share of net profits that represents wages as defined

the portion taxable by City of Pickerington. ENTER AVERAGE PERCENTAGE ON

in section 3121(a) of the Internal Revenue Code or net earnings from self-

LINE 3b Page 1.

employment as defined in section 1402(a) of the Internal Revenue Code.

Affiliated corporations may not deduct a loss from any other corporation having a

D.

On the net profits of all corporations, estates and trusts derived from work

taxable profit and operations of any affiliated corporation having a loss may not be

done or services performed or rendered and business or other activities

taken into consideration in computing net profits of Business Apportionment

conducted in the City, whether or not such corporations, estates and trusts

Percentage Formula.

have their principal or any place of business located in the City.

E.

On the portion attributable to this Municipality of the net profits earned

SCHEDULE X

during the effective period of this chapter of all nonresident unincorporated

BUSINESS RECONCILIATION WITH FEDERAL INCOME TAX RETURN This

businesses, professions or other entities, derived from sales made, work

schedule is to be used by businesses for the purpose of making adjustments when

done, services performed or rendered and business or other activities

the total income (Page 1, Line 1) includes income not taxable and/or items not

conducted in this Municipality, whether or not such unincorporated business

deductible for municipal tax purposes.

entity has an office or place of business in this Municipality.

SCHEDULE Z

F.

On the portion of the distributive share of the net profits earned during the

PARTNERS SHARE OF NET INCOME

effective period of this chapter of a resident partner or owner of a nonresident

Line 7 of this schedule represents 100% of the net income of the partnership for the

unincorporated business entity not attributable to this Municipality and not

taxable period. A copy of Federal Form 1065 and related schedules may be

levied against such unincorporated business entity by this Municipality.

attached in lieu of completing this schedule. If any member of the partnership is

entitled to allocate his portion of the partnership income by reason of being a

G.

On the portion attributable to this Municipality of the net profits earned

resident, Schedule Y and Z must be completed. If this schedule is used, itemize

during the effective period of this chapter of all corporations derived from

each member’s distributive share of net income.

sales made, work done, services performed or rendered and business or

other activities conducted in this Municipality, whether or not such

ATTACHMENTS REQUIRED

corporations have an office or place of business in this Municipality.

Copies of all applicable IRS schedules and forms must be attached to the City of

Pickerington Return at the time of filing. Documentation is necessary to verify all

3. LATE FILING FEE: $15.00 (NOTE: Copy of Federal Extension request must be

amounts of taxable or non-taxable income, expenses and deductions as applicable

filed with Pickerington Tax Office by April 15 or original due date to avoid late

to the Pickerington return. Failure to attach all necessary documentation may result

filing fee assessment.)

in the return being considered incomplete and could result in the disallowance of

expenses, deductions, or the exclusion of non-taxable income.

4. DECLARATION OF ESTIMATED TAX: Non-filing Fee of $25.00 will be assessed

for failure to file and pay declaration of estimated tax within specified time in

addition to interest of 1

1

/

% per month and 10% penalty charges.

2

5. OPERATING LOSSES: If a net operating loss has been sustained in any taxable

year, such losses may be carried forward for not more than one taxable year. The

portion of the net operating loss sustained shall be allocated to the Municipality in

the same manner as provided herein for allocating net profits to this Municipality.

6. PARTNERSHIPS: See 2 B & C above.

7. R.E.I.T.: No deduction may be claimed for dividends paid or disbursed to

shareholders or corporations, including but not limited to a R.E.I.T.

DISCLAIMER: Definitions and instructions are illustrative only. The tax ordinance supercedes any interpretation presented.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1