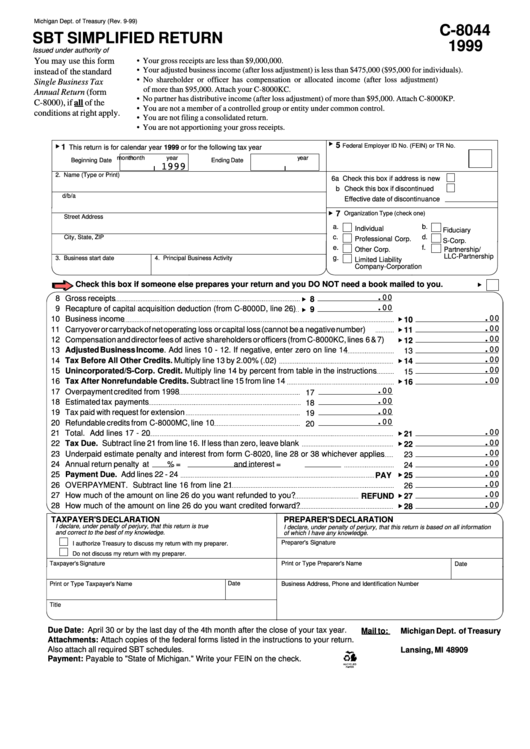

Form C-8044 - Sbt Simplified Return - 1999

ADVERTISEMENT

Michigan Dept. of Treasury (Rev. 9-99)

C-8044

SBT SIMPLIFIED RETURN

1999

Issued under authority of P.A. 228 of 1975. See instruction booklet for filing guidelines.

• Your gross receipts are less than $9,000,000.

You may use this form

• Your adjusted business income (after loss adjustment) is less than $475,000 ($95,000 for individuals).

instead of the standard

• No shareholder or officer has compensation or allocated income (after loss adjustment)

Single Business Tax

of more than $95,000. Attach your C-8000KC.

Annual Return (form

• No partner has distributive income (after loss adjustment) of more than $95,000. Attach C-8000KP.

C-8000), if all of the

• You are not a member of a controlled group or entity under common control.

conditions at right apply.

• You are not filing a consolidated return.

• You are not apportioning your gross receipts.

.

.

5

Federal Employer ID No. (FEIN) or TR No.

1

This return is for calendar year 1999 or for the following tax year

month

year

month

year

Beginning Date

Ending Date

1999

2. Name (Type or Print)

6a

Check this box if address is new

b

Check this box if discontinued

d/b/a

Effective date of discontinuance

.

7

Organization Type (check one)

Street Address

a.

b.

Individual

Fiduciary

c.

d.

City, State, ZIP

Professional Corp.

S-Corp.

e.

f.

Other Corp.

Partnership/

LLC-Partnership

g.

3. Business start date

4. Principal Business Activity

Limited Liability

Company-Corporation

.

Check this box if someone else prepares your return and you DO NOT need a book mailed to you.

.

.00

8

Gross receipts

8

.

.00

9

Recapture of capital acquisition deduction (from C-8000D, line 26)

9

.

.00

10

Business income

10

.

.00

11

Carryover or carryback of net operating loss or capital loss (cannot be a negative number)

11

.

.00

12

Compensation and director fees of active shareholders or officers (from C-8000KC, lines 6 & 7)

12

.00

13

Adjusted Business Income. Add lines 10 - 12. If negative, enter zero on line 14

13

.

.00

14

Tax Before All Other Credits. Multiply line 13 by 2.00% (.02)

14

.00

15

Unincorporated/S-Corp. Credit. Multiply line 14 by percent from table in the instructions

15

.

.00

16

Tax After Nonrefundable Credits. Subtract line 15 from line 14

16

.00

17

Overpayment credited from 1998

17

.00

18

Estimated tax payments

18

.00

19

Tax paid with request for extension

19

.00

20

Refundable credits from C-8000MC, line 10

20

.

.00

21

Total. Add lines 17 - 20

21

.

.00

22

Tax Due. Subtract line 21 from line 16. If less than zero, leave blank

22

.00

23

Underpaid estimate penalty and interest from form C-8020, line 28 or 38 whichever applies

23

.00

24

Annual return penalty at

% =

and interest =

24

.

.00

25

Payment Due. Add lines 22 - 24

PAY

25

.00

26

OVERPAYMENT. Subtract line 16 from line 21

26

.

.00

27

How much of the amount on line 26 do you want refunded to you?

REFUND

27

.

.00

28

How much of the amount on line 26 do you want credited forward?

28

TAXPAYER'S DECLARATION

PREPARER'S DECLARATION

I declare, under penalty of perjury, that this return is true

I declare, under penalty of perjury, that this return is based on all information

and correct to the best of my knowledge.

of which I have any knowledge.

Preparer's Signature

I authorize Treasury to discuss my return with my preparer.

Do not discuss my return with my preparer.

Taxpayer's Signature

Print or Type Preparer's Name

Date

Date

Print or Type Taxpayer's Name

Business Address, Phone and Identification Number

Title

Due Date: April 30 or by the last day of the 4th month after the close of your tax year.

Mail to:

Michigan Dept. of Treasury

Attachments: Attach copies of the federal forms listed in the instructions to your return.

P.O. Box 30059

Also attach all required SBT schedules.

Lansing, MI 48909

Payment: Payable to "State of Michigan." Write your FEIN on the check.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1