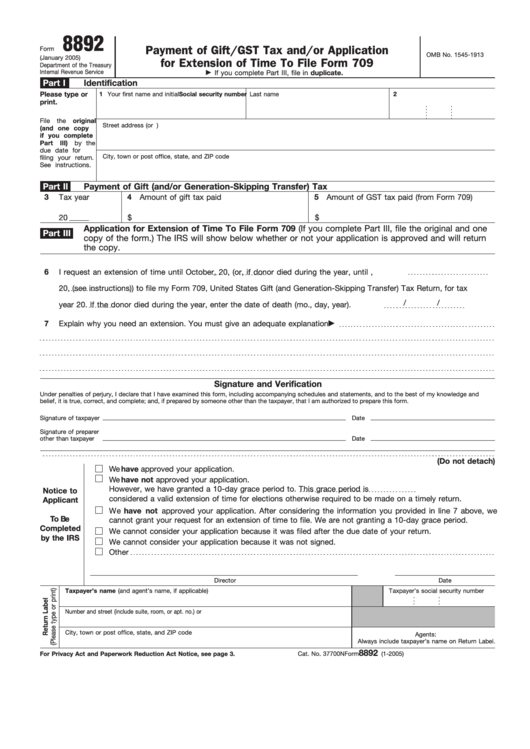

8892

Payment of Gift/GST Tax and/or Application

Form

OMB No. 1545-1913

(January 2005)

for Extension of Time To File Form 709

Department of the Treasury

Internal Revenue Service

If you complete Part III, file in duplicate.

Part I

Identification

Please type or

1

Your first name and initial

Last name

2

Social security number

print.

File

the original

Street address (or P.O. box if mail is not delivered to street address)

(and one copy

if you complete

Part

III) by the

due date for

City, town or post office, state, and ZIP code

filing your return.

See instructions.

Part II

Payment of Gift (and/or Generation-Skipping Transfer) Tax

3

Tax year

4

Amount of gift tax paid

5

Amount of GST tax paid (from Form 709)

20

$

$

Application for Extension of Time To File Form 709 (If you complete Part III, file the original and one

Part III

copy of the form.) The IRS will show below whether or not your application is approved and will return

the copy.

6

I request an extension of time until October

, 20

, (or, if donor died during the year, until

,

20

, (see instructions)) to file my Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return, for tax

/

/

year 20

. If the donor died during the year, enter the date of death (mo., day, year)

.

7

Explain why you need an extension. You must give an adequate explanation

Signature and Verification

Under penalties of perjury, I declare that I have examined this form, including accompanying schedules and statements, and to the best of my knowledge and

belief, it is true, correct, and complete; and, if prepared by someone other than the taxpayer, that I am authorized to prepare this form.

Signature of taxpayer

Date

Signature of preparer

other than taxpayer

Date

(Do not detach)

We have approved your application.

We have not approved your application.

However, we have granted a 10-day grace period to

. This grace period is

Notice to

considered a valid extension of time for elections otherwise required to be made on a timely return.

Applicant

We have not approved your application. After considering the information you provided in line 7 above, we

To Be

cannot grant your request for an extension of time to file. We are not granting a 10-day grace period.

Completed

We cannot consider your application because it was filed after the due date of your return.

by the IRS

We cannot consider your application because it was not signed.

Other

Director

Date

Taxpayer’s name (and agent’s name, if applicable)

Taxpayer’s social security number

Number and street (include suite, room, or apt. no.) or P.O. box number

City, town or post office, state, and ZIP code

Agents:

Always include taxpayer’s name on Return Label.

8892

For Privacy Act and Paperwork Reduction Act Notice, see page 3.

Cat. No. 37700N

Form

(1-2005)

1

1