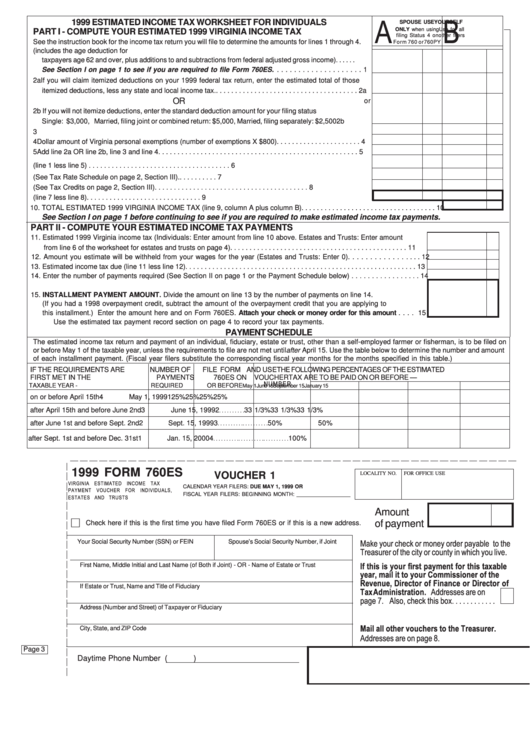

1999 ESTIMATED INCOME TAX WORKSHEET FOR INDIVIDUALS

SPOUSE USE

YOURSELF

ONLY when using

Use for all

PART I - COMPUTE YOUR ESTIMATED 1999 VIRGINIA INCOME TAX

filing Status 4 on

other filers

See the instruction book for the income tax return you will file to determine the amounts for lines 1 through 4.

Form 760 or 760PY

1. Expected Virginia ADJUSTED GROSS INCOME subject to tax in 1999 (includes the age deduction for

taxpayers age 62 and over, plus additions to and subtractions from federal adjusted gross income) . . . . . .

See Section I on page 1 to see if you are required to file Form 760ES. . . . . . . . . . . . . . . . . . . . . 1

2a If you will claim itemized deductions on your 1999 federal tax return, enter the estimated total of those

itemized deductions, less any state and local income tax. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2a

OR

or

2b If you will not itemize deductions, enter the standard deduction amount for your filing status

Single: $3,000, Married, filing joint or combined return: $5,000, Married, filing separately: $2,500

2b

3. Expected amount of qualifying child and dependent care expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Dollar amount of Virginia personal exemptions (number of exemptions X $800) . . . . . . . . . . . . . . . . . . . . . . 4

5 Add line 2a OR line 2b, line 3 and line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6. ESTIMATED Virginia TAXABLE INCOME (line 1 less line 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7. Virginia INCOME TAX for amount on Line 6 (See Tax Rate Schedule on page 2, Section III). . . . . . . . . . . 7

8. TAX CREDITS (See Tax Credits on page 2, Section III) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9. YOUR ESTIMATED 1999 VIRGINIA INCOME TAX (line 7 less line 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10. TOTAL ESTIMATED 1999 VIRGINIA INCOME TAX (line 9, column A plus column B) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

See Section I on page 1 before continuing to see if you are required to make estimated income tax payments.

PART II - COMPUTE YOUR ESTIMATED INCOME TAX PAYMENTS

11. Estimated 1999 Virginia income tax (Individuals: Enter amount from line 10 above. Estates and Trusts: Enter amount

from line 6 of the worksheet for estates and trusts on page 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12. Amount you estimate will be withheld from your wages for the year (Estates and Trusts: Enter 0) . . . . . . . . . . . . . . . . . 12

13. Estimated income tax due (line 11 less line 12) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14. Enter the number of payments required (See Section II on page 1 or the Payment Schedule below) . . . . . . . . . . . . . . . . . 14

15. INSTALLMENT PAYMENT AMOUNT. Divide the amount on line 13 by the number of payments on line 14.

(If you had a 1998 overpayment credit, subtract the amount of the overpayment credit that you are applying to

this installment.) Enter the amount here and on Form 760ES. Attach your check or money order for this amount . . . . 15

Use the estimated tax payment record section on page 4 to record your tax payments.

PAYMENT SCHEDULE

The estimated income tax return and payment of an individual, fiduciary, estate or trust, other than a self-employed farmer or fisherman, is to be filed on

or before May 1 of the taxable year, unless the requirements to file are not met until after April 15. Use the table below to determine the number and amount

of each installment payment. (Fiscal year filers substitute the corresponding fiscal year months for the months specified in this table.)

IF THE REQUIREMENTS ARE

NUMBER OF

FILE FORM

AND USE

THE FOLLOWING PERCENTAGES OF THE ESTIMATED

FIRST MET IN THE

PAYMENTS

760ES ON

VOUCHER

TAX ARE TO BE PAID ON OR BEFORE —

TAXABLE YEAR -

REQUIRED

OR BEFORE

May 1

June 15

September 15

January 15

on or before April 15th

4

May 1, 1999

1

25%

25%

25%

25%

after April 15th and before June 2nd

3

June 15, 1999

2

33 1/3%

33 1/3%

33 1/3%

. . . . . . . . . .

after June 1st and before Sept. 2nd

2

Sept. 15, 1999

3

50%

50%

. . . . . . . . . .

. . . . . . . . . .

after Sept. 1st and before Dec. 31st

1

Jan. 15, 2000

4

100%

. . . . . . . . . .

. . . . . . . . . .

. . . . . . . . . .

1999 FORM 760ES

VOUCHER 1

LOCALITY NO.

FOR OFFICE USE

CALENDAR YEAR FILERS: DUE MAY 1, 1999 OR

FISCAL YEAR FILERS: BEGINNING MONTH: __________________

Amount

of payment

Check here if this is the first time you have filed Form 760ES or if this is a new address.

Your Social Security Number (SSN) or FEIN

Spouse’s Social Security Number, if Joint

First Name, Middle Initial and Last Name (of Both if Joint) - OR - Name of Estate or Trust

If Estate or Trust, Name and Title of Fiduciary

Address (Number and Street) of Taxpayer or Fiduciary

City, State, and ZIP Code

Page 3

Daytime Phone Number (

)

1

1 2

2 3

3