Allianz Life Insurance Company

of North America

PO Box 561

Minneapolis, MN 55440

Overnight Address:

Phone: 800.624.0197

5701 Golden Hills Drive

Fax: 800.721.2708

Minneapolis, MN 55416-1297

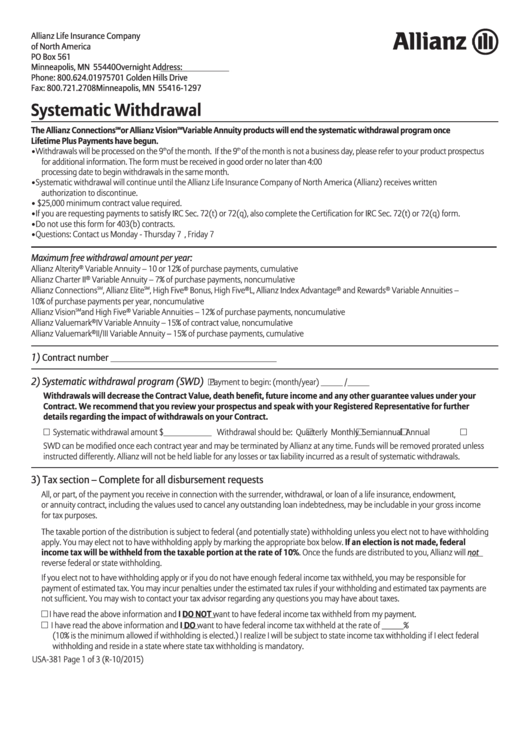

Systematic Withdrawal

SM

SM

The Allianz Connections

or Allianz Vision

Variable Annuity products will end the systematic withdrawal program once

Lifetime Plus Payments have begun.

• Withdrawals will be processed on the 9

of the month. If the 9

of the month is not a business day, please refer to your product prospectus

th

th

for additional information. The form must be received in good order no later than 4:00 p.m. Eastern time on the Business Day prior to the

processing date to begin withdrawals in the same month.

• Systematic withdrawal will continue until the Allianz Life Insurance Company of North America (Allianz) receives written

authorization to discontinue.

• $25,000 minimum contract value required.

• If you are requesting payments to satisfy IRC Sec. 72(t) or 72(q), also complete the Certification for IRC Sec. 72(t) or 72(q) form.

• Do not use this form for 403(b) contracts.

• Questions: Contact us Monday - Thursday 7 a.m. - 6 p.m., Friday 7 a.m. - 5 p.m. Central time

Maximum free withdrawal amount per year:

Allianz Alterity

®

Variable Annuity – 10 or 12% of purchase payments, cumulative

Allianz Charter II

®

Variable Annuity – 7% of purchase payments, noncumulative

Allianz Connections

SM

, Allianz Elite

SM

, High Five

®

Bonus, High Five

®

L, Allianz Index Advantage

®

and Rewards

®

Variable Annuities –

10% of purchase payments per year, noncumulative

Allianz Vision

and High Five

Variable Annuities – 12% of purchase payments, noncumulative

SM

®

Allianz Valuemark

®

IV Variable Annuity – 15% of contract value, noncumulative

Allianz Valuemark

®

II/III Variable Annuity – 15% of purchase payments, cumulative

1)

Contract number ___________________________________

2) Systematic withdrawal program (SWD)

Payment to begin: (month/year) _____ /_____

Withdrawals will decrease the Contract Value, death benefit, future income and any other guarantee values under your

Contract. We recommend that you review your prospectus and speak with your Registered Representative for further

details regarding the impact of withdrawals on your Contract.

Systematic withdrawal amount $___________ Withdrawal should be:

Quarterly

Monthly

Semiannual

Annual

SWD can be modified once each contract year and may be terminated by Allianz at any time. Funds will be removed prorated unless

instructed differently. Allianz will not be held liable for any losses or tax liability incurred as a result of systematic withdrawals.

3) Tax section – Complete for all disbursement requests

All, or part, of the payment you receive in connection with the surrender, withdrawal, or loan of a life insurance, endowment,

or annuity contract, including the values used to cancel any outstanding loan indebtedness, may be includable in your gross income

for tax purposes.

The taxable portion of the distribution is subject to federal (and potentially state) withholding unless you elect not to have withholding

apply. You may elect not to have withholding apply by marking the appropriate box below. If an election is not made, federal

income tax will be withheld from the taxable portion at the rate of 10%. Once the funds are distributed to you, Allianz will not

reverse federal or state withholding.

If you elect not to have withholding apply or if you do not have enough federal income tax withheld, you may be responsible for

payment of estimated tax. You may incur penalties under the estimated tax rules if your withholding and estimated tax payments are

not sufficient. You may wish to contact your tax advisor regarding any questions you may have about taxes.

I have read the above information and I DO NOT want to have federal income tax withheld from my payment.

I have read the above information and I DO want to have federal income tax withheld at the rate of _____%

(10% is the minimum allowed if withholding is elected.) I realize I will be subject to state income tax withholding if I elect federal

withholding and reside in a state where state tax withholding is mandatory.

USA-381

Page 1 of 3

(R-10/2015)

1

1 2

2 3

3