Form Il-1363 - Application For Cercuit Breaker And Prescription Coverage - 2002

ADVERTISEMENT

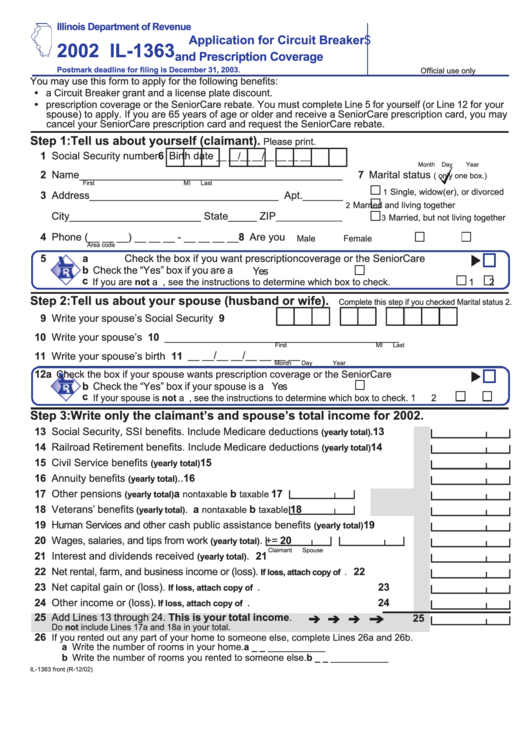

Illinois Department of Revenue

Application for Circuit Breaker

$

2002 IL-1363

and Prescription Coverage

Postmark deadline for filing is December 31, 2003.

Official use only

You may use this form to apply for the following benefits:

• a Circuit Breaker grant and a license plate discount.

• prescription coverage or the SeniorCare rebate. You must complete Line 5 for yourself (or Line 12 for your

spouse) to apply. If you are 65 years of age or older and receive a SeniorCare prescription card, you may

cancel your SeniorCare prescription card and request the SeniorCare rebate.

Step 1: Tell us about yourself (claimant).

Please print.

1 Social Security number

6 Birth date

__ __/__ __/__ __ __ __

Month

Day

Year

2 Name______________________________________________

7 Marital status

(

only one box.)

First

MI

Last

Single, widow(er), or divorced

1

3 Address_________________________________ Apt._______

Married and living together

2

City_______________________ State_____ ZIP

______________

Married, but not living together

3

4 Phone (__ __ __) __ __ __ - __ __ __ __

8 Are you

Male

Female

Area code

5

a Check the box if you want prescription coverage or the SeniorCare rebate ................

b Check the “Yes” box if you are a U.S. citizen........................

Yes

c

If you are not a U.S. citizen, see the instructions to determine which box to check.

1

2

Step 2: Tell us about your spouse (husband or wife).

Complete this step if you checked Marital status 2.

9 Write your spouse’s Social Security number. .. 9

10 Write your spouse’s name. ............................ 10 _________________________________________

First

MI

Last

11 Write your spouse’s birth date. ...................... 11 __ __/__ __/__ __ __ __

Month

Day

Year

12

a Check the box if your spouse wants prescription coverage or the SeniorCare rebate .....

b Check the “Yes” box if your spouse is a U.S. citizen.............

Yes

c

If your spouse is not a U.S. citizen, see the instructions to determine which box to check.

1

2

Step 3: Write only the claimant’s and spouse’s total income for 2002.

13 Social Security, SSI benefits. Include Medicare deductions

13

(yearly total). ...............

14 Railroad Retirement benefits. Include Medicare deductions

. ........... 14

(yearly total)

15 Civil Service benefits

15

(yearly total) ......................................................................................

16 Annuity benefits

..16

(yearly total) .............................................................................................

17 Other pensions

a

.... b

17

(yearly total) ......................

nontaxable

taxable

18 Veterans’ benefits

. ............. a

.... b

18

(yearly total)

nontaxable

taxable

19 Human Services and other cash public assistance benefits

. ............. 19

(yearly total)

20 Wages, salaries, and tips from work

.

+

= 20

(yearly total)

Claimant

Spouse

21 Interest and dividends received

. ...................................................... 21

(yearly total)

22 Net rental, farm, and business income or (loss).

. ......... 22

If loss, attach copy of U.S. 1040

23 Net capital gain or (loss).

.

23

If loss, attach copy of U.S. 1040

24 Other income or (loss)

.

24

. If loss, attach copy of U.S. 1040

25 Add Lines 13 through 24. This is your total income.

25

Do not include Lines 17a and 18a in your total.

26

If you rented out any part of your home to someone else, complete Lines 26a and 26b.

a Write the number of rooms in your home.

a _____________

b Write the number of rooms you rented to someone else. b _____________

IL-1363 front (R-12/02)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2