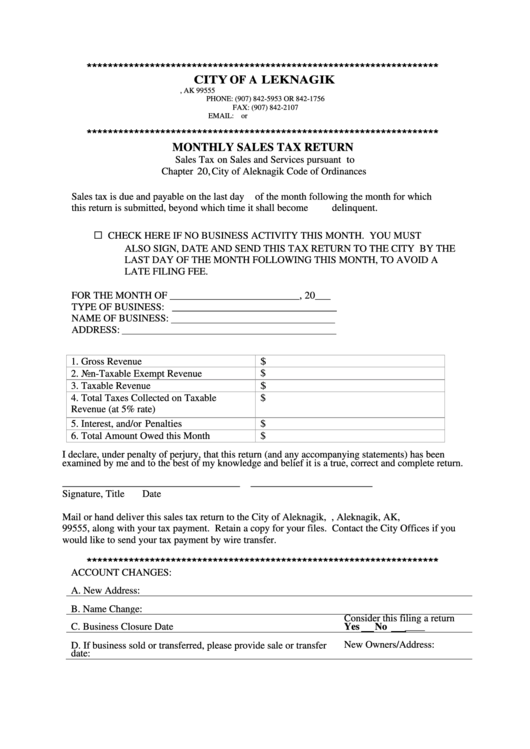

Monthly Sales Tax Return - City Of Aleknagik

ADVERTISEMENT

*******************************************************************

CITY OF A LEKNAGIK

P.O. BOX 33 MAIN STREET ALEKNAGIK, AK 99555

PHONE: (907) 842-5953 OR 842-1756

FAX: (907) 842-2107

EMAIL: or

*******************************************************************

MONTHLY SALES TAX RETURN

Sales Tax on Sales and Services pursuant to

Chapter 20, City of Aleknagik Code of Ordinances

Sales tax is due and payable on the last day of the month following the month for which

this return is submitted , beyond which time it shall become delinquent.

□

CHECK HERE IF NO BUSINESS ACTIVITY THIS MONTH. YOU MUST

ALSO SIGN, DATE AND SEND THIS TAX RETURN TO THE CITY BY THE

LAST DAY OF THE MONTH FOLLOWING THIS MONTH, TO AVOID A

LATE FILING FEE.

FOR THE MONTH OF __________________________, 20___

TYPE OF BUSINESS: _________________________________

NAME OF BUSINESS:

ADDRESS:

1. Gross Revenue

$

2. Non-Taxable Exempt R e v e n u e

$

3. Taxable Revenue

$

4. Total Taxes Collected on Taxable

$

Revenue (at 5% rate)

5. Interest, and/or Penalties

$

6. Total Amount Owed this Month

$

I declare, under penalty of perjury, that this return (and any accompanying statements) has been

examined by me and to the best of my knowledge and belief it is a true, correct and complete return.

___________________________________

________________________

Signature, Title

Date

Mail or hand deliver this sales tax return to the City of Aleknagik, P.O. Box 33, Aleknagik, AK,

99555, along with your tax payment. Retain a copy for your files. Contact the City Offices if you

would like to send your tax payment by wire transfer.

*******************************************************************

ACCOUNT CHANGES:

A. New Address:

B. Name Change:

Consider this filing a return

C. Business Closure Date

Yes

No

____

New Owners/Address:

D. If business sold or transferred, please provide sale or transfer

date:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1