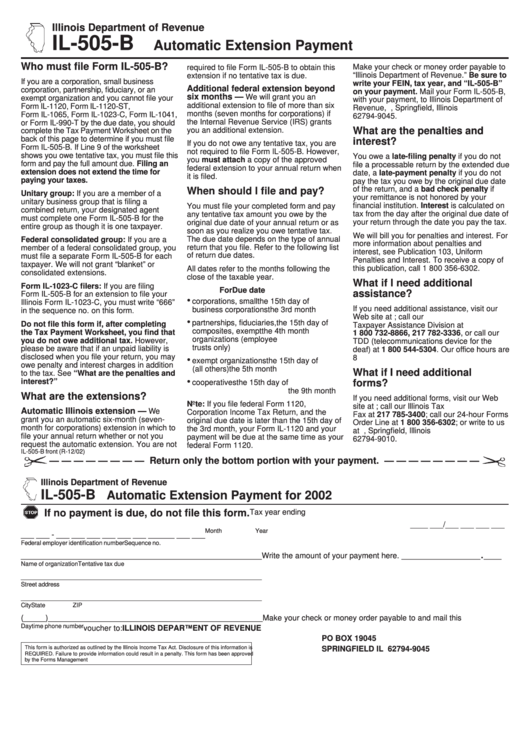

Form Il-505-B - Automatic Extension Payment - 2002

ADVERTISEMENT

Illinois Department of Revenue

IL-505-B

Automatic Extension Payment

Who must file Form IL-505-B?

Make your check or money order payable to

required to file Form IL-505-B to obtain this

“Illinois Department of Revenue.” Be sure to

extension if no tentative tax is due.

If you are a corporation, small business

write your FEIN, tax year, and “IL-505-B”

Additional federal extension beyond

corporation, partnership, fiduciary, or an

on your payment. Mail your Form IL-505-B,

six months —

We will grant you an

exempt organization and you cannot file your

with your payment, to Illinois Department of

additional extension to file of more than six

Form IL-1120, Form IL-1120-ST,

Revenue, P .O. Box 19045, Springfield, Illinois

months (seven months for corporations) if

Form IL-1065, Form IL-1023-C, Form IL-1041,

62794-9045.

the Internal Revenue Service (IRS) grants

or Form IL-990-T by the due date, you should

you an additional extension.

What are the penalties and

complete the Tax Payment Worksheet on the

back of this page to determine if you must file

interest?

If you do not owe any tentative tax, you are

Form IL-505-B. If Line 9 of the worksheet

not required to file Form IL-505-B. However,

shows you owe tentative tax, you must file this

You owe a late-filing penalty if you do not

you must attach a copy of the approved

form and pay the full amount due. Filing an

file a processable return by the extended due

federal extension to your annual return when

extension does not extend the time for

date, a late-payment penalty if you do not

it is filed.

paying your taxes.

pay the tax you owe by the original due date

of the return, and a bad check penalty if

When should I file and pay?

Unitary group: If you are a member of a

your remittance is not honored by your

unitary business group that is filing a

financial institution. Interest is calculated on

You must file your completed form and pay

combined return, your designated agent

tax from the day after the original due date of

any tentative tax amount you owe by the

must complete one Form IL-505-B for the

your return through the date you pay the tax.

original due date of your annual return or as

entire group as though it is one taxpayer.

soon as you realize you owe tentative tax.

We will bill you for penalties and interest. For

The due date depends on the type of annual

Federal consolidated group: If you are a

more information about penalties and

return that you file. Refer to the following list

member of a federal consolidated group, you

interest, see Publication 103, Uniform

of return due dates.

must file a separate Form IL-505-B for each

Penalties and Interest. To receive a copy of

taxpayer. We will not grant “blanket” or

All dates refer to the months following the

this publication, call 1 800 356-6302.

consolidated extensions.

close of the taxable year.

What if I need additional

Form IL-1023-C filers: If you are filing

For

Due date

assistance?

Form IL-505-B for an extension to file your

•

corporations, small

the 15th day of

Illinois Form IL-1023-C, you must write “666”

If you need additional assistance, visit our

business corporations

the 3rd month

in the sequence no. on this form.

Web site at call our

•

partnerships, fiduciaries,

the 15th day of

Do not file this form if, after completing

Taxpayer Assistance Division at

composites, exempt

the 4th month

the Tax Payment Worksheet, you find that

1 800 732-8866, 217 782-3336, or call our

organizations (employee

you do not owe additional tax. However,

TDD (telecommunications device for the

trusts only)

please be aware that if an unpaid liability is

deaf) at 1 800 544-5304. Our office hours are

disclosed when you file your return, you may

8 a.m. to 5 p.m.

•

exempt organizations

the 15th day of

owe penalty and interest charges in addition

(all others)

the 5th month

What if I need additional

to the tax. See “What are the penalties and

•

interest?”

forms?

cooperatives

the 15th day of

the 9th month

What are the extensions?

If you need additional forms, visit our Web

Note: If you file federal Form 1120, U.S.

site at call our Illinois Tax

Automatic Illinois extension —

We

Corporation Income Tax Return, and the

Fax at 217 785-3400; call our 24-hour Forms

grant you an automatic six-month (seven-

original due date is later than the 15th day of

Order Line at 1 800 356-6302; or write to us

month for corporations) extension in which to

the 3rd month, your Form IL-1120 and your

at P .O. Box 19010, Springfield, Illinois

file your annual return whether or not you

payment will be due at the same time as your

62794-9010.

request the automatic extension. You are not

federal Form 1120.

IL-505-B front (R-12/02)

— — — — — — — — Return only the bottom portion with your payment. — — — — — — — —

Illinois Department of Revenue

IL-505-B

Automatic Extension Payment for 2002

If no payment is due, do not file this form.

Tax year ending

____ ___/___ ___ ___ ___

Month

Year

___ ___ - ___ ___ ___ ___ ___ ___ ___

___ ___ ___

Federal employer identification number

Sequence no.

.

_______________________________________________________

Write the amount of your payment here. __________________

____

Name of organization

Tentative tax due

_______________________________________________________

Street address

_______________________________________________________

City

State

ZIP

(_____)_________________________________________________

Make your check or money order payable to and mail this

Daytime phone number

voucher to:

ILLINOIS DEPARTMENT OF REVENUE

PO BOX 19045

This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this information is

SPRINGFIELD IL 62794-9045

REQUIRED. Failure to provide information could result in a penalty. This form has been approved

by the Forms Management Center.

IL-492-0067

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2