PRINT

CLEAR

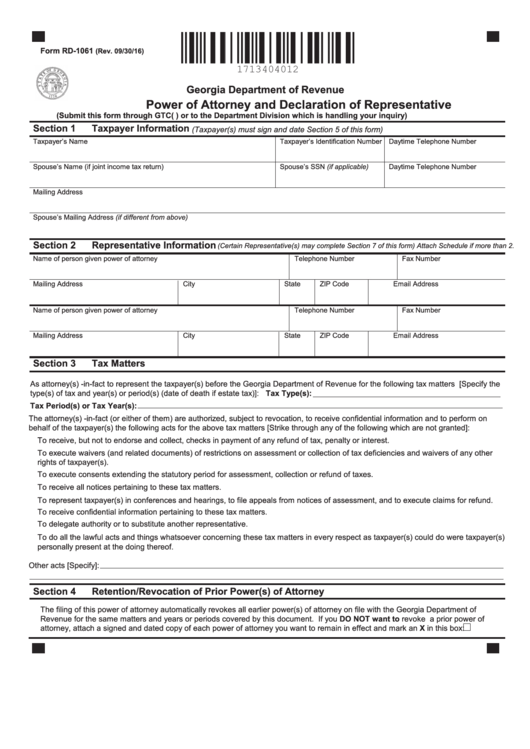

Form RD-1061

(Rev. 09/30/16)

Georgia Department of Revenue

Power of Attorney and Declaration of Representative

(Submit this form through GTC(https://gtc.dor.ga.gov/_/) or to the Department Division which is handling your inquiry)

Section 1

Taxpayer Information

(Taxpayer(s) must sign and date Section 5 of this form)

Taxpayer’s Name

Taxpayer’s Identification Number

Daytime Telephone Number

Spouse’s Name (if joint income tax return)

Spouse’s SSN (if applicable)

Daytime Telephone Number

Mailing Address

Spouse’s Mailing Address (if different from above)

Section 2

Representative Information

(Certain Representative(s) may complete Section 7 of this form) Attach Schedule if more than 2.

Name of person given power of attorney

Telephone Number

Fax Number

Mailing Address

City

State

ZIP Code

Email Address

Name of person given power of attorney

Telephone Number

Fax Number

Mailing Address

City

State

ZIP Code

Email Address

Section 3

Tax Matters

As attorney(s) -in-fact to represent the taxpayer(s) before the Georgia Department of Revenue for the following tax matters [Specify the

type(s) of tax and year(s) or period(s) (date of death if estate tax)]:

Tax Type(s):

Tax Period(s) or Tax Year(s):

The attorney(s) -in-fact (or either of them) are authorized, subject to revocation, to receive confidential information and to perform on

behalf of the taxpayer(s) the following acts for the above tax matters [Strike through any of the following which are not granted]:

To receive, but not to endorse and collect, checks in payment of any refund of tax, penalty or interest.

To execute waivers (and related documents) of restrictions on assessment or collection of tax deficiencies and waivers of any other

rights of taxpayer(s).

To execute consents extending the statutory period for assessment, collection or refund of taxes.

To receive all notices pertaining to these tax matters.

To represent taxpayer(s) in conferences and hearings, to file appeals from notices of assessment, and to execute claims for refund.

To receive confidential information pertaining to these tax matters.

To delegate authority or to substitute another representative.

To do all the lawful acts and things whatsoever concerning these tax matters in every respect as taxpayer(s) could do were taxpayer(s)

personally present at the doing thereof.

Other acts [Specify]:

Section 4

Retention/Revocation of Prior Power(s) of Attorney

The filing of this power of attorney automatically revokes all earlier power(s) of attorney on file with the Georgia Department of

Revenue for the same matters and years or periods covered by this document. If you DO NOT want to revoke a prior power of

attorney, attach a signed and dated copy of each power of attorney you want to remain in effect and mark an X in this box:

1

1 2

2