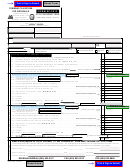

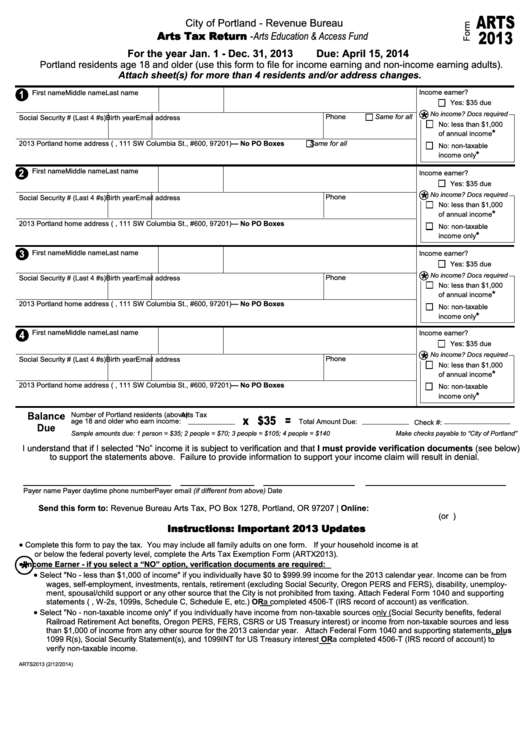

Form Arts 2013 - Arts Tax Return - Arts Education & Access Fund

ADVERTISEMENT

City of Portland - Revenue Bureau

Arts Tax Return - Arts Education & Access Fund

For the year Jan. 1 - Dec. 31, 2013

Due: April 15, 2014

Portland residents age 18 and older (use this form to file for income earning and non-income earning adults).

Attach sheet(s) for more than 4 residents and/or address changes.

Income earner?

First name

Middle name

Last name

Yes: $35 due

*

No income? Docs required

Phone

Same for all

Social Security # (Last 4 #s) Birth year

Email address

No: less than $1,000

*

of annual income

2013 Portland home address (e.g., 111 SW Columbia St., #600, 97201) — No PO Boxes

Same for all

No: non-taxable

*

income only

First name

Middle name

Last name

Income earner?

Yes: $35 due

*

No income? Docs required

Phone

Social Security # (Last 4 #s) Birth year

Email address

No: less than $1,000

*

of annual income

2013 Portland home address (e.g., 111 SW Columbia St., #600, 97201) — No PO Boxes

No: non-taxable

*

income only

First name

Middle name

Last name

Income earner?

Yes: $35 due

*

No income? Docs required

Phone

Social Security # (Last 4 #s) Birth year

Email address

No: less than $1,000

*

of annual income

2013 Portland home address (e.g., 111 SW Columbia St., #600, 97201) — No PO Boxes

No: non-taxable

*

income only

First name

Middle name

Last name

Income earner?

Yes: $35 due

*

No income? Docs required

Phone

Social Security # (Last 4 #s) Birth year

Email address

No: less than $1,000

*

of annual income

2013 Portland home address (e.g., 111 SW Columbia St., #600, 97201) — No PO Boxes

No: non-taxable

*

income only

Number of Portland residents (above)

Arts Tax

age 18 and older who earn income:

Total Amount Due:

Check #:

Sample amounts due: 1 person = $35; 2 people = $70; 3 people = $105; 4 people = $140

Make checks payable to “City of Portland”

I understand that if I selected “No” income it is subject to verification and that I must provide verification documents (see below)

to support the statements above. Failure to provide information to support your income claim will result in denial.

Payer name

Date

Payer daytime phone number

Payer email (if different from above)

Send this form to: Revenue Bureau Arts Tax, PO Box 1278, Portland, OR 97207 | Online:

(or )

Instructions: Important 2013 Updates

Complete this form to pay the tax. You may include all family adults on one form. If your household income is at

or below the federal poverty level, complete the Arts Tax Exemption Form (ARTX2013).

*

Income Earner - if you select a “NO” option, verification documents are required:

Select "No - less than $1,000 of income" if you individually have $0 to $999.99 income for the 2013 calendar year. Income can be from

wages, self-employment, investments, rentals, retirement (excluding Social Security, Oregon PERS and FERS), disability, unemploy-

ment, spousal/child support or any other source that the City is not prohibited from taxing. Attach Federal Form 1040 and supporting

statements (e.g., W-2s, 1099s, Schedule C, Schedule E, etc.) OR a completed 4506-T (IRS record of account) as verification.

Select "No - non-taxable income only" if you individually have income from non-taxable sources only (Social Security benefits, federal

Railroad Retirement Act benefits, Oregon PERS, FERS, CSRS or US Treasury interest) or income from non-taxable sources and less

than $1,000 of income from any other source for the 2013 calendar year. Attach Federal Form 1040 and supporting statements, plus

1099 R(s), Social Security Statement(s), and 1099INT for US Treasury interest OR a completed 4506-T (IRS record of account) to

verify non-taxable income.

ARTS2013 (2/12/2014)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1