Instructions For Schedule Nr, Nonresident And Part-Year Resident Schedule - 2016

ADVERTISEMENT

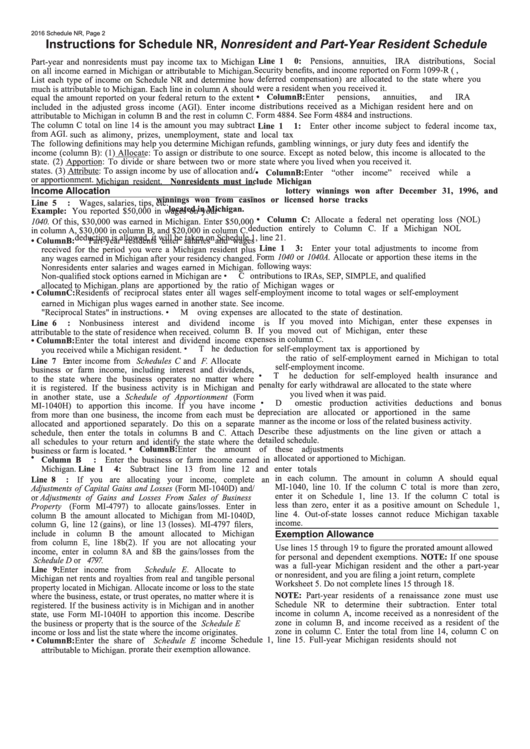

2016 Schedule NR, Page 2

Instructions for Schedule NR, Nonresident and Part-Year Resident Schedule

Line 1 0: Pensions, annuities, IRA distributions, Social

Part-year and nonresidents must pay income tax to Michigan

Security benefits, and income reported on Form 1099-R (e.g.,

on all income earned in Michigan or attributable to Michigan.

deferred compensation) are allocated to the state where you

List each type of income on Schedule NR and determine how

were a resident when you received it.

much is attributable to Michigan. Each line in column A should

• Column B: Enter

pensions,

annuities,

and

IRA

equal the amount reported on your federal return to the extent

distributions received as a Michigan resident here and on

included in the adjusted gross income (AGI). Enter income

Form 4884. See Form 4884 and instructions.

attributable to Michigan in column B and the rest in column C.

The column C total on line 14 is the amount you may subtract

Line 1 1: Enter other income subject to federal income tax,

from AGI.

such as alimony, prizes, unemployment, state and local tax

The following definitions may help you determine Michigan

refunds, gambling winnings, or jury duty fees and identify the

income (column B): (1) Allocate: To assign or distribute to one

source. Except as noted below, this income is allocated to the

state. (2) Apportion: To divide or share between two or more

state where you lived when you received it.

states. (3) Attribute: To assign income by use of allocation and/

• Column B: Enter “other income” received while a

or apportionment.

Michigan resident. Nonresidents must include Michigan

Income Allocation

lottery winnings won after December 31, 1996, and

winnings won from casinos or licensed horse tracks

Line 5 : Wages, salaries, tips, etc.

located in Michigan.

Example: You reported $50,000 in wages on your U.S. Form

• Column C: Allocate a federal net operating loss (NOL)

1040. Of this, $30,000 was earned in Michigan. Enter $50,000

deduction entirely to Column C. If a Michigan NOL

in column A, $30,000 in column B, and $20,000 in column C.

deduction is allowed, it will be taken on Schedule 1, line 21.

• Column B:

Part-year residents enter salaries and wages

Line 1 3: Enter your total adjustments to income from U.S.

received for the period you were a Michigan resident plus

Form 1040 or 1040A. Allocate or apportion these items in the

any wages earned in Michigan after your residency changed.

following ways:

Nonresidents enter salaries and wages earned in Michigan.

Non-qualified stock options earned in Michigan are

• C ontributions to IRAs, SEP, SIMPLE, and qualified

allocated to Michigan.

plans are apportioned by the ratio of Michigan wages or

• Column C: Residents of reciprocal states enter all wages

self-employment income to total wages or self-employment

earned in Michigan plus wages earned in another state. See

income.

"Reciprocal States" in instructions.

• M oving expenses are allocated to the state of destination.

If you moved into Michigan, enter these expenses in

Line 6 : Nonbusiness interest and dividend income is

column B. If you moved out of Michigan, enter these

attributable to the state of residence when received.

expenses in column C.

• Column B: Enter the total interest and dividend income

• T he deduction for self-employment tax is apportioned by

you received while a Michigan resident.

the ratio of self-employment earned in Michigan to total

Line 7 :

Enter income from U.S. Schedules C and F. Allocate

self-employment income.

business or farm income, including interest and dividends,

• T he deduction for self-employed health insurance and

to the state where the business operates no matter where

penalty for early withdrawal are allocated to the state where

it is registered. If the business activity is in Michigan and

you lived when it was paid.

in another state, use a Schedule of Apportionment (Form

• D omestic production activities deductions and bonus

MI-1040H) to apportion this income. If you have income

depreciation are allocated or apportioned in the same

from more than one business, the income from each must be

manner as the income or loss of the related business activity.

allocated and apportioned separately. Do this on a separate

Describe these adjustments on the line given or attach a

schedule, then enter the totals in columns B and C. Attach

detailed schedule.

all schedules to your return and identify the state where the

• Column B: Enter the amount of these adjustments

business or farm is located.

allocated or apportioned to Michigan.

• C olumn B : Enter the business or farm income earned in

Michigan.

Line 1 4: Subtract line 13 from line 12 and enter totals

in each column. The amount in column A should equal

Line 8 : If you are allocating your income, complete an

MI-1040, line 10. If the column C total is more than zero,

Adjustments of Capital Gains and Losses (Form MI-1040D) and/

enter it on Schedule 1, line 13. If the column C total is

or Adjustments of Gains and Losses From Sales of Business

less than zero, enter it as a positive amount on Schedule 1,

Property (Form MI-4797) to allocate gains/losses. Enter in

line 4. Out-of-state losses cannot reduce Michigan taxable

column B the amount allocated to Michigan from MI-1040D,

income.

column G, line 12 (gains), or line 13 (losses). MI-4797 filers,

include in column B the amount allocated to Michigan

Exemption Allowance

from column E, line 18b(2). If you are not allocating your

Use lines 15 through 19 to figure the prorated amount allowed

income, enter in column 8A and 8B the gains/losses from the

for personal and dependent exemptions. NOTE: If one spouse

U.S. Schedule D or U.S. Form 4797.

was a full-year Michigan resident and the other a part-year

Line 9: Enter income from U.S. Schedule E. Allocate to

or nonresident, and you are filing a joint return, complete

Michigan net rents and royalties from real and tangible personal

Worksheet 5. Do not complete lines 15 through 18.

property located in Michigan. Allocate income or loss to the state

NOTE: Part-year residents of a renaissance zone must use

where the business, estate, or trust operates, no matter where it is

Schedule NR to determine their subtraction. Enter total

registered. If the business activity is in Michigan and in another

income in column A, income received as a nonresident of the

state, use Form MI-1040H to apportion this income. Describe

zone in column B, and income received as a resident of the

the business or property that is the source of the U.S. Schedule E

zone in column C. Enter the total from line 14, column C on

income or loss and list the state where the income originates.

Schedule 1, line 15. Full-year Michigan residents should not

• Column B: Enter the share of U.S. Schedule E income

prorate their exemption allowance.

attributable to Michigan.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1