Form Ia 4562a - Iowa Depreciation Adjustment Schedule - 2011

ADVERTISEMENT

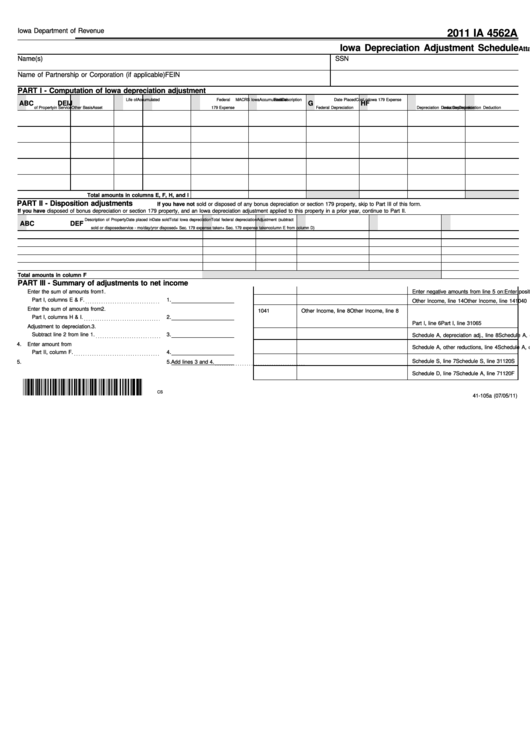

Iowa Department of Revenue

2011 IA 4562A

Iowa Depreciation Adjustment Schedule

Attach a copy of this form to your Iowa income tax return.

Name(s)

SSN

Name of Partnership or Corporation (if applicable)

FEIN

PART I - Computation of Iowa depreciation adjustment

Description

Date Placed

Life of

Cost or

Federal

Federal

Accumulated

Iowa 179 Expense

MACRS Iowa

Accumulated

A

B

C

D

E

F

G

H

I

J

of Property

in Service

Asset

Other Basis

179 Expense

Depreciation Deduction

Federal Depreciation

Depreciation Deduction

Iowa Depreciation

Total amounts in columns E, F, H, and I

PART II - Disposition adjustments

If you have not sold or disposed of any bonus depreciation or section 179 property, skip to Part III of this form.

If you have disposed of bonus depreciation or section 179 property, and an Iowa depreciation adjustment applied to this property in a prior year, continue to Part II.

Description of Property

Date placed in

Date sold

Total Iowa depreciation

Total federal depreciation

Adjustment (subtract

A

B

C

D

E

F

sold or disposed

service - mo/day/yr

or disposed

+ Sec. 179 expense taken

+ Sec. 179 expense taken

column E from column D)

Total amounts in column F

PART III - Summary of adjustments to net income

1.

Enter the sum of amounts from

For Iowa Form:

Enter positive amounts from line 5 on:

Enter negative amounts from line 5 on:

Part I, columns E & F.

1.

1040

Other Income, line 14

Other Income, line 14

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.

Enter the sum of amounts from

1041

Other Income, line 8

Other Income, line 8

Part I, columns H & I.

2.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1065

Part I, line 3

Part I, line 6

3.

Adjustment to depreciation.

Subtract line 2 from line 1.

3.

1120

Schedule A, depreciation adj., line 8

Schedule A, depreciation adj., line 8

. . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.

Enter amount from

1120A

Schedule A, other additions, line 4

Schedule A, other reductions, line 4

Part II, column F.

4.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1120S

Schedule S, line 3

Schedule S, line 7

5.

Add lines 3 and 4.

5.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1120F

Schedule A, line 7

Schedule D, line 7

CS

41-105a (07/05/11)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1