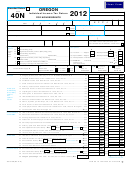

Form 40N

Page 2 –

1999

Federal column

Oregon column

36

36 Amount from front of form, line 35 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

SUBTRACTIONS

•

37

37 Social Security and Tier 1 Railroad retirement income included on line 19 . . . . . . . . .

•

•

38a

38b

38 Other subtractions. Identify ____________________________________________

•

39a

39b

39 Income after subtractions. Line 36 minus lines 37 and 38 . . . . . . . . . . . . . . . . . . . . .

%

40

40 Oregon percentage. Line 39b divided by line 39a (not more than 100%)

DEDUCTIONS AND MODIFICATIONS

•

41

41 Itemized deductions from federal Schedule A, line 28 . . . . . . . . . . . . . . . . . . . . . . .

EITHER,

•

42

42 State income tax claimed as itemized deduction. See instructions, page 17 . . . . . . .

NOT BOTH

43

43 Net Oregon itemized deductions. Line 41 minus line 42 . . . . . . . . . . . . . . . . . . . . . .

}

44

44 Standard deduction from page 17 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

45

45 1999 federal tax ($0 – $3,000, see instructions for the correct amount) . . . . . . . . . .

•

46

46 Other deductions and modifications. Identify ______________________________

47

47 Add lines 44, 45, and 46 or lines 43, 45, and 46. Fill in the larger amount . . . . . . . .

48 Allowable deductions and modifications. Line 47 ✕ line 40 . . . . . . . . . . . . . . . . . . . .

48

•

49

49 Deductions and modifications NOT multiplied by the Oregon percentage. See page 19 . . . . . . . . . .

50

50 Total deductions and other modifications. Add lines 48 and 49 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

•

51

51 Oregon taxable income. Line 39b minus line 50 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

OREGON TAX

•

52

52 Tax on amount shown on line 51. See page 19 . . . . . . . . . . . . . . . . . . . . . . . . . . . .

ADD TOGETHER

•

53

53 Interest on certain installment sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

54

54 TOTAL TAX. Add lines 52 and 53 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

CREDITS

55 Exemption credit. Line 6e ✕ $134 ✕ Oregon percentage from line 40 . . . . . . . . .

55

•

56

56 Earned income credit. See instructions, page 19 . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

57

57 Working family credit. See instructions, page 19 . . . . . . . . . . . . . . . . . . . . . . . . . . .

ADD TOGETHER

•

58

58 Credit for income taxes paid to another state (AZ, CA, IN, VA). Attach proof . . . . . .

•

59

59 Child and dependent care credit. See instructions, page 20 . . . . . . . . . . . . . . . . . . .

•

60

60 Other credits. Identify ________________________________________________

61

61 Total credits. Add lines 55 through 60 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

•

L

62

62 Net income tax. Line 54 minus line 61. If line 61 is more than line 54 fill in -0- . . . . . . . . . . . . . . . . . . . . . . . . . . .

TAX PAYMENTS, PENALTY & INTEREST

•

63

63 Oregon income tax withheld from income. Attach Forms W-2 and 1099 . . . . . . . .

ADD TOGETHER

•

64

64 Estimated tax payments for 1999 and payments made with your extension . . . . . .

65

65 Total payments. Add lines 63 and 64 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

•

L

66

66 Overpayment. Is line 62 less than line 65? If so, line 65 minus line 62 . . . . . . . . . . . . . . . . . . OVERPAYMENT

•

•

L

67

67 Tax-to-pay. Is line 62 more than line 65? If so, line 62 minus line 65 . . . . . . . . . . . . . . . . . . . . . . TAX-TO-PAY

•

68 Penalty and interest for filing or paying late. See instructions on page 21 . . . . . . . .

68

L

ADD TOGETHER

➝

•

69 Interest on estimated tax underpayment. If Form 10 is attached, check

. . . . . .

69

L

70

70 Total penalty and interest due. Add lines 68 and 69 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

71

71 Amount-you-owe. Add lines 67 and 70 . . . . . . . . . . . . . . . . . . . . . . . . . Stop here! . . . . AMOUNT-YOU-OWE

72

72 Refund. Is line 66 more than line 70? If so, line 66 minus line 70 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . REFUND

•

73

L

73 Estimated tax. Fill in the part of line 72 you want applied to your 2000 estimated tax . . . . . . . .

I wish to donate part of my refund, line 72, to the following fund(s):

•

$1,

$5,

$10,

Other $ _____

74

L

74 Oregon Nongame Wildlife . . . . . .

These will reduce

•

•

$1,

$5,

$10,

Other $ _____

75

L

75 Child Abuse Prevention . . . . . . . .

your refund

•

$1,

$5,

$10,

Other $ _____

76

L

76 Alzheimer’s Disease Research . . .

•

77

L

$1,

$5,

$10,

Other $ _____

Stop Domestic & Sexual Violence

77

. . .

•

78

L

$1,

$5,

$10,

Other $ _____

78 AIDS/HIV Education & Services . .

79

79 Total. Add lines 73 through 78. Total can’t be more than the refund on line 72 . . . . . . . . . . . . . . . . . . . . . . . .

80

80 Net refund. Line 72 minus line 79. This is your net refund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . NET REFUND

Attach copy of federal Form 1040, 1040A, 1040EZ or 1040PC. Don’t include Schedules A, B, C or 2441 etc.

Under penalties for false swearing, I declare that I have examined this return, including accompanying schedules and statements. To the best of my knowledge and be-

lief it is true, correct and complete. If prepared by a person other than the taxpayer, this declaration is based on all information of which the preparer has any knowledge.

➨

SIGN

Your signature

Date

Signature of preparer other than taxpayer

License No.

HERE

➨

Spouse’s signature (If filing jointly, BOTH must sign even if only one had income)

Address

1

1 2

2