Form 511-Rf - Oklahoma Claim For Refund - 2000

ADVERTISEMENT

For Office Use Only

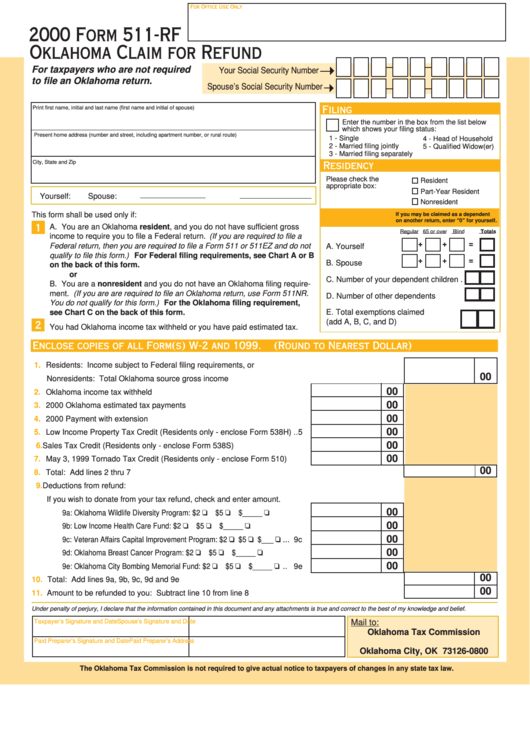

2000 Form 511-RF

Oklahoma Claim for Refund

For taxpayers who are not required

Your Social Security Number

to file an Oklahoma return.

Spouse’s Social Security Number

Print first name, initial and last name (first name and initial of spouse)

Filing Status...

Enter the number in the box from the list below

which shows your filing status:

Present home address (number and street, including apartment number, or rural route)

1 - Single

4 - Head of Household

2 - Married filing jointly

5 - Qualified Widow(er)

3 - Married filing separately

City, State and Zip

Residency Status...

Please check the

Resident

appropriate box:

Part-Year Resident

Occupation...

Yourself:

Spouse:

Nonresident

Notice...

This form shall be used only if:

If you may be claimed as a dependent

Exemptions...

on another return, enter “0” for yourself.

A. You are an Oklahoma resident, and you do not have sufficient gross

1

Regular 65 or over

Blind

Totals

income to require you to file a Federal return. (If you are required to file a

+

+

=

Federal return, then you are required to file a Form 511 or 511EZ and do not

A. Yourself ................

qualify to file this form.) For Federal filing requirements, see Chart A or B

+

+

=

B. Spouse ................

on the back of this form.

or

C. Number of your dependent children .

B. You are a nonresident and you do not have an Oklahoma filing require-

ment. (If you are are required to file an Oklahoma return, use Form 511NR.

D. Number of other dependents ............

You do not qualify for this form.) For the Oklahoma filing requirement,

see Chart C on the back of this form.

E. Total exemptions claimed

(add A, B, C, and D) .......................

2

You had Oklahoma income tax withheld or you have paid estimated tax.

Enclose copies of all Form(s) W-2 and 1099.

(Round to Nearest Dollar)

1.

Residents: Income subject to Federal filing requirements, or

00

Nonresidents: Total Oklahoma source gross income ............................................................................ 1

00

2.

Oklahoma income tax withheld ................................................................. 2

00

3.

2000 Oklahoma estimated tax payments .................................................. 3

00

4.

2000 Payment with extension ................................................................. 4

00

5.

Low Income Property Tax Credit (Residents only - enclose Form 538H) ..5

00

6.

Sales Tax Credit (Residents only - enclose Form 538S) ...........................6

00

7.

May 3, 1999 Tornado Tax Credit (Residents only - enclose Form 510) .... 7

00

8.

Total: Add lines 2 thru 7 ........................................................................................................................ 8

9.

Deductions from refund:

If you wish to donate from your tax refund, check and enter amount.

00

9a: Oklahoma Wildlife Diversity Program: $2

$5

$_____

........ 9a

00

9b: Low Income Health Care Fund: $2

$5

$_____

............... 9b

00

9c: Veteran Affairs Capital Improvement Program: $2

$5

$___

... 9c

00

9d: Oklahoma Breast Cancer Program: $2

$5

$_____

......... 9d

00

9e: Oklahoma City Bombing Memorial Fund: $2

$5

$_____

.. 9e

00

10.

Total: Add lines 9a, 9b, 9c, 9d and 9e .................................................................................................. 10

00

11.

Amount to be refunded to you: Subtract line 10 from line 8 ................................................................ 11

Under penalty of perjury, I declare that the information contained in this document and any attachments is true and correct to the best of my knowledge and belief.

Taxpayer’s Signature and Date

Spouse’s Signature and Date

Mail to:

Oklahoma Tax Commission

P.O. Box 26800

Paid Preparer’s Signature and Date

Paid Preparer’s Address

Oklahoma City, OK 73126-0800

The Oklahoma Tax Commission is not required to give actual notice to taxpayers of changes in any state tax law.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2