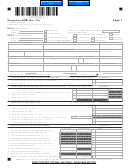

600/2010

Georgia Form

(Corporation) Name_______________________________________FEIN____________________

ADDITIONS TO FEDERAL TAXABLE INCOME

(ROUND TO NEAREST DOLLAR)

SCHEDULE 4

1. State and municipal bond interest (other than Georgia or political subdivision thereof) .....................

1.

2. Net income or net profits taxes imposed by taxing jurisdictions other than Georgia ..........................

2.

3. Expense attributable to tax exempt income ..........................................................................................

3.

4. Net operating loss deducted on Federal return ....................................................................................

4.

5. Federal deduction for income attributable to domestic production activities (IRC Section 199) .........

5.

6. Intangible expenses and related interest cost .....................................................................................

6.

7. Captive REIT expenses and costs .......................................................................................................

7.

8. Other Additions (Attach Schedule) ......................................................................................................

8 .

9. TOTAL - Enter also on LINE 2, SCHEDULE 1 ....................................................................................

9.

SUBTRACTIONS FROM FEDERAL TAXABLE INCOME

(ROUND TO NEAREST DOLLAR)

SCHEDULE 5

1.

1. Interest on obligations of United States (must be reduced by direct and indirect interest expense) .

2.

2. Exception to intangible expenses and related interest cost (Attach IT-Addback)................................

3.

3. Exception to captive REIT expenses and costs (Attach IT-REIT) .......................................................

4

.

4. Other Subtractions (Must Attach Schedule) ......................................... . ..............................................

. 5

5. TOTAL - Enter also on LINE 4, SCHEDULE 1 .......................................................................................

APPORTIONMENT OF INCOME

SCHEDULE 6

A. WITHIN GEORGIA

B. EVERYWHERE

C. DO NOT ROUND

COL (A)/ COL (B)

COMPUTE TO SIX DECIMALS

1.

1. Gross receipts from business.......................................

2.

2. Georgia Ratio (Divide Column A by Column B)...............

COMPUTATION OF GEORGIA NET INCOME

(ROUND TO NEAREST DOLLAR)

SCHEDULE 7

1. Net business income (Schedule 1, Line 5) ...........................................................................................

1.

2. Income allocated everywhere (Must Attach Schedule) .......................................................................

2.

3. Business income subject to apportionment (Line 1 less Line 2) .........................................................

3.

4. Georgia Ratio (Schedule 6, Column C) ........................................

4.

5. Net business income apportioned to Georgia (Line 3 x Line 4) ...........................................................

5.

6. Net income allocated to Georgia (Attach Schedule) ............................................................................

6.

7. Total of Lines 5 and 6 ............................................................................................................................

7.

8. Less: net operating loss apportioned to GA. (from Schedule 11) .......................................................

8.

9. Georgia taxable income (Enter also on Schedule 1, Line 7 ) ...............................................................

9.

COMPUTATION OF GEORGIA NET WORTH RATIO

(TO BE USED BY FOREIGN CORPS ONLY)

SCHEDULE 8

A. Within Georgia

B. Total Everywhere

C. GA. ratio (A/B)

1. Total value of property owned (Total assets from Federal balance sheet)

1.

2. Gross receipts from business ............................................................

2.

3. Totals (Line 1 plus Line 2) .................................................................

3.

4. Georgia Ratio (Divide Line 3A by 3B) .................................................

4.

A copy of the Federal Return and supporting Schedules must be attached, otherwise this return shall be deemed incomplete.

No extension of time for filing will be allowed unless a copy of the request for a Federal extension or Form IT-303 is attached

to this return.

Make check payable to: Georgia Department of Revenue

Mail to: Georgia Department of Revenue, Processing Center, P.O. Box 740397, Atlanta, Georgia 30374-0397

Georgia Public Revenue Code Section 48-2-31 stipulates that taxes shall be paid in lawful money of the United States, free of any expense to the State of Georgia.

Declaration: I/We declare under the penalties of perjury that I/we have examined this return (including accompanying schedules and statements) and to the best of

my/our knowledge and belief it is true, correct, and complete. If prepared by a person other than taxpayer, their declaration is based on all information of which they

have any knowledge.

Check the box to

Email Address:

authorize the

Georgia

Department of

Revenue to discuss

I S

G

N

A

T

U

R

E

O

F

O

F

F

C I

E

R

D

A

T

E

I S

G

N

A

T

U

R

E

O

F

N I

D

V I

D I

U

A

L

O

R

F

R I

M

P

R

E

P

A

R

N I

G

T

H

E

R

E

T

U

R

N

the contents of this

tax return with the

named preparer.

TITLE

IDENTIFICATION OR SOCIAL SECURITY NUMBER

1

1 2

2 3

3 4

4