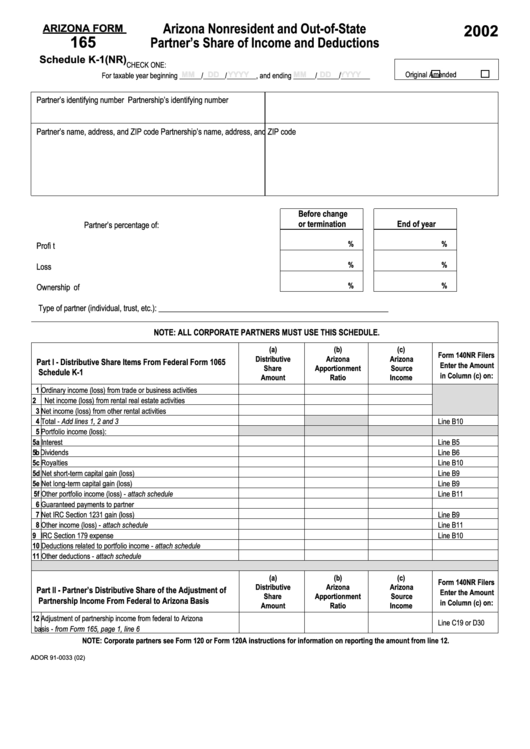

Form 165 - Schedule K-1(Nr) - Arizona Nonresident And Out-Of-State Partner'S Share Of Income And Deductions - 2002

ADVERTISEMENT

Arizona Nonresident and Out-of-State

ARIZONA FORM

2002

165

Partner’s Share of Income and Deductions

Schedule K-1(NR)

CHECK ONE:

MM

MM

DD

DD

YYYY

YYYY

MM

MM

DD

DD

YYYY

YYYY

Original

Amended

For taxable year beginning ______/______/________, and ending ______/______/________

Partner’s identifying number

Partnership’s identifying number

Partner’s name, address, and ZIP code

Partnership’s name, address, and ZIP code

Before change

or termination

End of year

Partner’s percentage of:

%

%

Profi t sharing......................................................................

%

%

Loss sharing.......................................................................

%

%

Ownership of capital ..........................................................

Type of partner (individual, trust, etc.): ___________________________________________________________

NOTE: ALL CORPORATE PARTNERS MUST USE THIS SCHEDULE.

(a)

(b)

(c)

Form 140NR Filers

Distributive

Arizona

Arizona

Part I - Distributive Share Items From Federal Form 1065

Enter the Amount

Share

Apportionment

Source

Schedule K-1

in Column (c) on:

Amount

Ratio

Income

1 Ordinary income (loss) from trade or business activities

2 Net income (loss) from rental real estate activities

3 Net income (loss) from other rental activities

4 Total - Add lines 1, 2 and 3

Line B10

5 Portfolio income (loss):

5a Interest

Line B5

5b Dividends

Line B6

5c Royalties

Line B10

5d Net short-term capital gain (loss)

Line B9

5e Net long-term capital gain (loss)

Line B9

5f Other portfolio income (loss) - attach schedule

Line B11

6 Guaranteed payments to partner

7 Net IRC Section 1231 gain (loss)

Line B9

8 Other income (loss) - attach schedule

Line B11

9 IRC Section 179 expense

Line B10

10 Deductions related to portfolio income - attach schedule

11 Other deductions - attach schedule

(a)

(b)

(c)

Form 140NR Filers

Distributive

Arizona

Arizona

Part II - Partner’s Distributive Share of the Adjustment of

Enter the Amount

Share

Apportionment

Source

Partnership Income From Federal to Arizona Basis

in Column (c) on:

Amount

Ratio

Income

12 Adjustment of partnership income from federal to Arizona

Line C19 or D30

basis - from Form 165, page 1, line 6

NOTE: Corporate partners see Form 120 or Form 120A instructions for information on reporting the amount from line 12.

ADOR 91-0033 (02)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1