Page 2

2014 WISCONSIN EMPLOYER REPORT

8

8

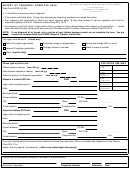

15. Have you or will you issue 1099-Misc. forms for workers who performed service for you?

YES

NO

If yes, please list names and addresses on back of form or attach separate sheet.

16.

You

do

not

have

to

pay

UI

taxes

on

certain

persons.

The

most

common

categories

are

listed

below.

A

more

complete

list

PERMITTED EXCLUSIONS

is found under

on page 3.

16a. If you have any employees in any of the categories below check all that apply.

Partners in a general partnership.

Insurance or real estate sales people paid by commission only.

Members of a Limited Liability Company (LLC) not electing to be taxed as a corporation

Unpaid corporate officers.

for federal tax purposes.

Agricultural labor on employer's farm.

(Note: Ag. exclusion on page 3)

Other:

Other:

Indicate appropriate alphabetical letter as shown on page 3 under the heading

COMMON PERMITTED EXCLUSIONS.

Describe the exclusion if not listed under COMMON PERMITTED EXCLUSIONS:

sole proprietorship,

If your business is a

check if any of the following family members received wages from you.

16b.

8

8

Father

Child under 18 - birthdate: _______________________

8

8

Mother

Child under 18 - birthdate: _______________________

8

8

Spouse

Child under 18 - birthdate: _______________________

DO

NOT

INCLUDE

ANY

PERSON

FROM

THE

17.

In

how

many

weeks

of

2014

have

you

had

employees

either

full

or

part-time?

ABOVE

PERMITTED

EXCLUSIONS.

Please

count

the

weeks

in

which

your

employees

actually

worked,

not

the

weeks

in

which

they

were paid. A week is considered to be from Sunday through Saturday.

A. Enter the exact number of weeks through the date you are filling out this form.

B. If you have had 20 weeks, enter the week-ending date of the 20th week.

C. Enter the number of employees.

DO

NOT

INCLUDE

ANY

18.

Did

you

have

20

weeks

in

2012

or

2013

in

which

at

least

one

employee

worked

full

or

part-time?

PERSON

FROM

THE

ABOVE

PERMITTED

EXCLUSIONS.

Count

the

exact

number

of

weeks

that

your

employee

worked,

not

when

they were paid.

8

8

2012

YES

NO

8

8

If yes, week ending date of the 20th week:

2013

YES

NO

If yes, week ending date of the 20th week:

19.

Enter

your

gross

quarterly

payrolls

below.

Include

all

wages

paid

through

the

date

that

you

complete

this

report.

Do

not

estimate

the

amount

of

wages

you

expect

to

pay

in

the

future.

Show

wages

paid

only

for

work

performed

solely

or

primarily

in

Wisconsin.

DO

NOT

ENTER

THE

WAGES

OF

WISCONSIN

RESIDENTS

WHO

WORK

ENTIRELY

OUTSIDE

OF

WISCONSIN.

DO

NOT

INCLUDE

WAGES PAID TO PERSONS FROM THE ABOVE PERMITTED EXCLUSIONS.

1st QTR. JAN.-MARCH

2nd QTR. APRIL-JUNE

3rd QTR. JULY-SEPT.

4th QTR. OCT.-DEC.

2012

2013

2014

20. Name and address of financial institution through which you will maintain your business checking account.

Name

Street Address

City/State

Checking Account Number

Your signature indicates this report is true and complete to the best of your knowledge.

Signature

Position

Please print name of above signature:

Date Signed

‘

CONTINUED ON NEXT PAGE

Print Form

Clear Form

(U00586) (R. 01/28/2014)

1

1 2

2