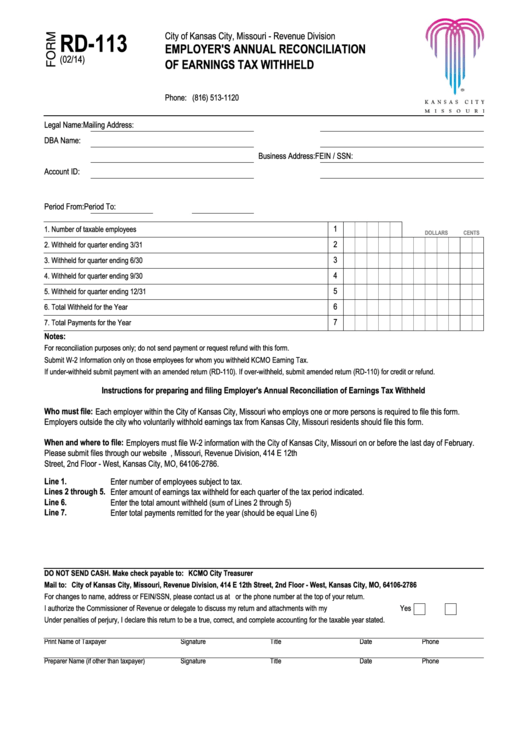

Form Rd-113 - Employer'S Annual Reconciliation Of Earnings Tax Withheld

ADVERTISEMENT

City of Kansas City, Missouri - Revenue Division

RD-113

EMPLOYER'S ANNUAL RECONCILIATION

(02/14)

OF EARNINGS TAX WITHHELD

Phone:

(816) 513-1120

Legal Name:

Mailing Address:

DBA Name:

FEIN / SSN:

Business Address:

Account ID:

Period From:

Period To:

1. Number of taxable employees

1

DOLLARS

CENTS

2. Withheld for quarter ending 3/31

2

3

3. Withheld for quarter ending 6/30

4

4. Withheld for quarter ending 9/30

5. Withheld for quarter ending 12/31

5

6

6. Total Withheld for the Year

7

7. Total Payments for the Year

Notes:

For reconciliation purposes only; do not send payment or request refund with this form.

Submit W-2 Information only on those employees for whom you withheld KCMO Earning Tax.

If under-withheld submit payment with an amended return (RD-110). If over-withheld, submit amended return (RD-110) for credit or refund.

Instructions for preparing and filing Employer's Annual Reconciliation of Earnings Tax Withheld

Who must file: Each employer within the City of Kansas City, Missouri who employs one or more persons is required to file this form.

Employers outside the city who voluntarily withhold earnings tax from Kansas City, Missouri residents should file this form.

When and where to file: Employers must file W-2 information with the City of Kansas City, Missouri on or before the last day of February.

Please submit files through our website or mail them to City of Kansas City, Missouri, Revenue Division, 414 E 12th

Street, 2nd Floor - West, Kansas City, MO, 64106-2786.

Line 1.

Enter number of employees subject to tax.

Lines 2 through 5.

Enter amount of earnings tax withheld for each quarter of the tax period indicated.

Line 6.

Enter the total amount withheld (sum of Lines 2 through 5)

Enter total payments remitted for the year (should be equal Line 6)

Line 7.

DO NOT SEND CASH. Make check payable to:

KCMO City Treasurer

Mail to:

City of Kansas City, Missouri, Revenue Division, 414 E 12th Street, 2nd Floor - West, Kansas City, MO, 64106-2786

For changes to name, address or FEIN/SSN, please contact us at or the phone number at the top of your return.

I authorize the Commissioner of Revenue or delegate to discuss my return and attachments with my preparer.

Yes

No

Under penalties of perjury, I declare this return to be a true, correct, and complete accounting for the taxable year stated.

Print Name of Taxpayer

Signature

Title

Date

Phone

Preparer Name (if other than taxpayer)

Signature

Title

Date

Phone

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1