Form Au-524 - Assignment Of Retailer'S Rights For Refund 2015

ADVERTISEMENT

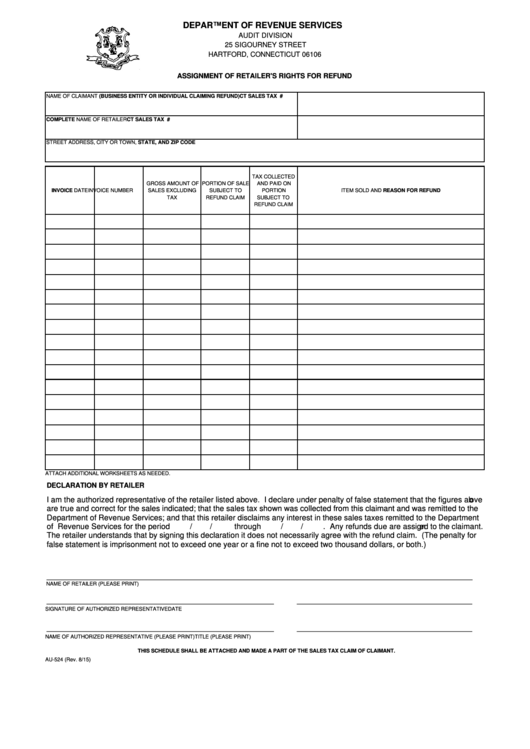

DEPARTMENT OF REVENUE SERVICES

AUDIT DIVISION

25 SIGOURNEY STREET

HARTFORD, CONNECTICUT 06106

ASSIGNMENT OF RETAILER'S RIGHTS FOR REFUND

NAME OF CLAIMANT (BUSINESS ENTITY OR INDIVIDUAL CLAIMING REFUND)

CT SALES TAX I.D.#

COMPLETE NAME OF RETAILER

CT SALES TAX I.D.#

STREET ADDRESS, CITY OR TOWN, STATE, AND ZIP CODE

TAX COLLECTED

GROSS AMOUNT OF

PORTION OF SALE

AND PAID ON

INVOICE DATE

INVOICE NUMBER

SALES EXCLUDING

SUBJECT TO

PORTION

ITEM SOLD AND REASON FOR REFUND

TAX

REFUND CLAIM

SUBJECT TO

REFUND CLAIM

ATTACH ADDITIONAL WORKSHEETS AS NEEDED.

DECLARATION BY RETAILER

I am the authorized representative of the retailer listed above. I declare under penalty of false statement that the figures above

are true and correct for the sales indicated; that the sales tax shown was collected from this claimant and was remitted to the

Department of Revenue Services; and that this retailer disclaims any interest in these sales taxes remitted to the Department

of Revenue Services for the period

/

/

through

/

/

. Any refunds due are assigned to the claimant.

The retailer understands that by signing this declaration it does not necessarily agree with the refund claim. (The penalty for

false statement is imprisonment not to exceed one year or a fine not to exceed two thousand dollars, or both.)

__________________________________________________________________________________________

NAME OF RETAILER (PLEASE PRINT)

________________________________________________

_____________________________________

SIGNATURE OF AUTHORIZED REPRESENTATIVE

DATE

________________________________________________

_____________________________________

NAME OF AUTHORIZED REPRESENTATIVE (PLEASE PRINT)

TITLE (PLEASE PRINT)

THIS SCHEDULE SHALL BE ATTACHED AND MADE A PART OF THE SALES TAX CLAIM OF CLAIMANT.

AU-524 (Rev. 8/15)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1