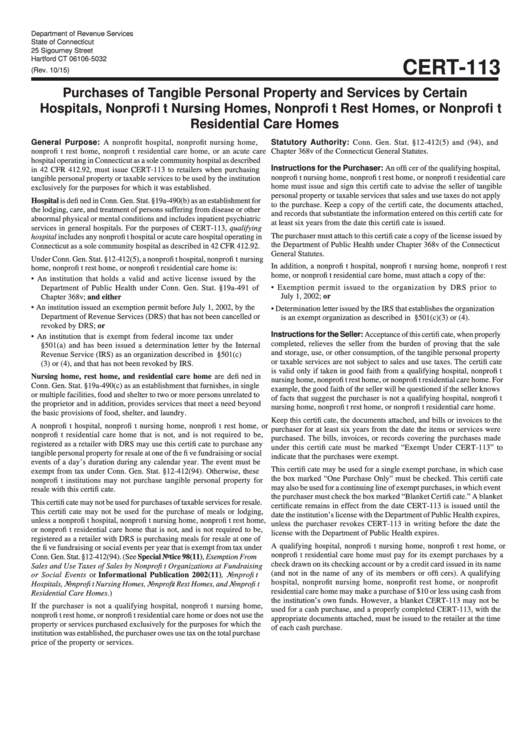

Form Cert-113 - Purchases Of Tangible Personal Property And Services By Certain Hospitals, Nonprofi T Nursing Homes, Nonprofi T Rest Homes, Or Nonprofi T Residential Care Homes

ADVERTISEMENT

Department of Revenue Services

State of Connecticut

25 Sigourney Street

Hartford CT 06106-5032

CERT-113

(Rev. 10/15)

Purchases of Tangible Personal Property and Services by Certain

Hospitals, Nonprofi t Nursing Homes, Nonprofi t Rest Homes, or Nonprofi t

Residential Care Homes

General Purpose: A nonprofit hospital, nonprofit nursing home,

Statutory Authority: Conn. Gen. Stat. §12-412(5) and (94), and

nonprofi t rest home, nonprofi t residential care home, or an acute care

Chapter 368v of the Connecticut General Statutes.

hospital operating in Connecticut as a sole community hospital as described

Instructions for the Purchaser: An offi cer of the qualifying hospital,

in 42 CFR 412.92, must issue CERT-113 to retailers when purchasing

nonprofi t nursing home, nonprofi t rest home, or nonprofi t residential care

tangible personal property or taxable services to be used by the institution

home must issue and sign this certifi cate to advise the seller of tangible

exclusively for the purposes for which it was established.

personal property or taxable services that sales and use taxes do not apply

Hospital is defi ned in Conn. Gen. Stat. §19a-490(b) as an establishment for

to the purchase. Keep a copy of the certifi cate, the documents attached,

the lodging, care, and treatment of persons suffering from disease or other

and records that substantiate the information entered on this certifi cate for

abnormal physical or mental conditions and includes inpatient psychiatric

at least six years from the date this certifi cate is issued.

services in general hospitals. For the purposes of CERT-113, qualifying

The purchaser must attach to this certifi cate a copy of the license issued by

hospital includes any nonprofi t hospital or acute care hospital operating in

the Department of Public Health under Chapter 368v of the Connecticut

Connecticut as a sole community hospital as described in 42 CFR 412.92.

General Statutes.

Under Conn. Gen. Stat. §12-412(5), a nonprofi t hospital, nonprofi t nursing

In addition, a nonprofi t hospital, nonprofi t nursing home, nonprofi t rest

home, nonprofi t rest home, or nonprofi t residential care home is:

home, or nonprofi t residential care home, must attach a copy of the:

• An institution that holds a valid and active license issued by the

• Exemption permit issued to the organization by DRS prior to

Department of Public Health under Conn. Gen. Stat. §19a-491 of

July 1, 2002; or

Chapter 368v; and either

• An institution issued an exemption permit before July 1, 2002, by the

• Determination letter issued by the IRS that establishes the organization

Department of Revenue Services (DRS) that has not been cancelled or

is an exempt organization as described in I.R.C. §501(c)(3) or (4).

revoked by DRS; or

Instructions for the Seller: Acceptance of this certifi cate, when properly

• An institution that is exempt from federal income tax under I.R.C.

completed, relieves the seller from the burden of proving that the sale

§501(a) and has been issued a determination letter by the Internal

and storage, use, or other consumption, of the tangible personal property

Revenue Service (IRS) as an organization described in I.R.C. §501(c)

or taxable services are not subject to sales and use taxes. The certifi cate

(3) or (4), and that has not been revoked by IRS.

is valid only if taken in good faith from a qualifying hospital, nonprofi t

Nursing home, rest home, and residential care home are defi ned in

nursing home, nonprofi t rest home, or nonprofi t residential care home. For

Conn. Gen. Stat. §19a-490(c) as an establishment that furnishes, in single

example, the good faith of the seller will be questioned if the seller knows

or multiple facilities, food and shelter to two or more persons unrelated to

of facts that suggest the purchaser is not a qualifying hospital, nonprofi t

the proprietor and in addition, provides services that meet a need beyond

nursing home, nonprofi t rest home, or nonprofi t residential care home.

the basic provisions of food, shelter, and laundry.

Keep this certifi cate, the documents attached, and bills or invoices to the

A nonprofi t hospital, nonprofi t nursing home, nonprofi t rest home, or

purchaser for at least six years from the date the items or services were

nonprofi t residential care home that is not, and is not required to be,

purchased. The bills, invoices, or records covering the purchases made

registered as a retailer with DRS may use this certifi cate to purchase any

under this certifi cate must be marked “Exempt Under CERT-113” to

tangible personal property for resale at one of the fi ve fundraising or social

indicate that the purchases were exempt.

events of a day’s duration during any calendar year. The event must be

This certifi cate may be used for a single exempt purchase, in which case

exempt from tax under Conn. Gen. Stat. §12-412(94). Otherwise, these

the box marked “One Purchase Only” must be checked. This certifi cate

nonprofi t institutions may not purchase tangible personal property for

may also be used for a continuing line of exempt purchases, in which event

resale with this certifi cate.

the purchaser must check the box marked “Blanket Certifi cate.” A blanket

This certifi cate may not be used for purchases of taxable services for resale.

certifi cate remains in effect from the date CERT-113 is issued until the

This certifi cate may not be used for the purchase of meals or lodging,

date the institution’s license with the Department of Public Health expires,

unless a nonprofi t hospital, nonprofi t nursing home, nonprofi t rest home,

unless the purchaser revokes CERT-113 in writing before the date the

or nonprofi t residential care home that is not, and is not required to be,

license with the Department of Public Health expires.

registered as a retailer with DRS is purchasing meals for resale at one of

A qualifying hospital, nonprofi t nursing home, nonprofi t rest home, or

the fi ve fundraising or social events per year that is exempt from tax under

nonprofi t residential care home must pay for its exempt purchases by a

Conn. Gen. Stat. §12-412(94). (See Special Notice 98(11), Exemption From

check drawn on its checking account or by a credit card issued in its name

Sales and Use Taxes of Sales by Nonprofi t Organizations at Fundraising

(and not in the name of any of its members or offi cers). A qualifying

or Social Events or Informational Publication 2002(11), Nonprofi t

hospital, nonprofit nursing home, nonprofit rest home, or nonprofit

Hospitals, Nonprofi t Nursing Homes, Nonprofi t Rest Homes, and Nonprofi t

residential care home may make a purchase of $10 or less using cash from

Residential Care Homes.)

the institution’s own funds. However, a blanket CERT-113 may not be

If the purchaser is not a qualifying hospital, nonprofi t nursing home,

used for a cash purchase, and a properly completed CERT-113, with the

nonprofi t rest home, or nonprofi t residential care home or does not use the

appropriate documents attached, must be issued to the retailer at the time

property or services purchased exclusively for the purposes for which the

of each cash purchase.

institution was established, the purchaser owes use tax on the total purchase

price of the property or services.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2