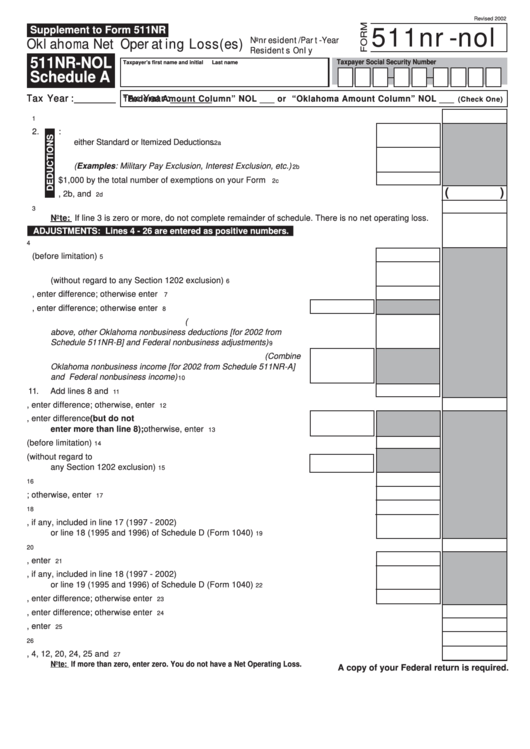

Form 511nr-Nol - Schedule A - Oklahoma Net Operating Loss(Es) - 2002

ADVERTISEMENT

Revised 2002

Supplement to Form 511NR

511nr-nol

Nonresident/Part-Year

Oklahoma Net Operating Loss(es)

Residents Only

511NR-NOL

Taxpayer Social Security Number

Taxpayer’s first name and initial

Last name

Schedule A

“Federal Amount Column” NOL ___ or “Oklahoma Amount Column” NOL ___

Tax Year:________

Tax Year:________

Tax Year:________

Tax Year:________

Tax Year:________

(Check One)

1.

Adjusted gross income from Oklahoma NOL Schedule A instructions.........................................................

1

2.

a.

Enter amount from the Schedule A Instructions:

either Standard or Itemized Deductions . ......................................................................

2a

b.

Enter Adjustments to Oklahoma Adjusted Gross Income

(Examples: Military Pay Exclusion, Interest Exclusion, etc.) ...............................

2b

c.

Multiply $1,000 by the total number of exemptions on your Form 511NR............

2c

(

)

d.

Add lines 2a, 2b, and 2c...................................................................................................................

2d

3.

Combine lines 1 and 2d. Enter the total here..............................................................................................

3

Note: If line 3 is zero or more, do not complete remainder of schedule. There is no net operating loss.

ADJUSTMENTS: Lines 4 - 26 are entered as positive numbers.

4.

Exemptions from line 2c above....................................................................................................................

4

5.

Enter Oklahoma nonbusiness capital losses (before limitation).......................................

5

6.

Enter Oklahoma nonbusiness capital gains.

(without regard to any Section 1202 exclusion)...............................................................

6

7.

If line 5 is larger than line 6, enter difference; otherwise enter zero................................

7

8.

If line 6 is larger than line 5, enter difference; otherwise enter zero.....

8

Oklahoma nonbusiness deductions (i.e. included in line 2a and 2b

9.

above, other Oklahoma nonbusiness deductions [for 2002 from

Schedule 511NR-B] and Federal nonbusiness adjustments) ...........................................

9

10.

Oklahoma nonbusiness income - other than capital gains. (Combine

Oklahoma nonbusiness income [for 2002 from Schedule 511NR-A]

and Federal nonbusiness income) .....................................................

10

11.

Add lines 8 and 10..........................................................................................................

11

12.

If line 9 is larger than line 11, enter difference; otherwise, enter zero.........................................................

12

13.

If line 11 is larger than line 9, enter difference (but do not

enter more than line 8); otherwise, enter zero..................................

13

14.

Enter Oklahoma business capital losses (before limitation)............................................

14

15.

Enter Oklahoma business capital gains (without regard to

any Section 1202 exclusion)...............................................................

15

16.

Add lines 13 and 15........................................................................................................

16

17.

If line 14 is larger than line 16 enter difference; otherwise, enter zero............................

17

18.

Add lines 7 and 17..........................................................................................................

18

19.

Enter Net Oklahoma Loss, if any, included in line 17 (1997 - 2002)

or line 18 (1995 and 1996) of Schedule D (Form 1040)..................................................

19

20.

Oklahoma Section 1202 exclusion..............................................................................................................

20

21.

Subtract line 20 from line 19. If zero or less, enter zero..................................................

21

22.

Enter Net Oklahoma Loss, if any, included in line 18 (1997 - 2002)

or line 19 (1995 and 1996) of Schedule D (Form 1040)..................................................

22

23.

If line 21 is more than line 22, enter difference; otherwise enter zero.............................

23

24.

If line 22 is more than line 21, enter difference; otherwise enter zero.........................................................

24

25.

Subtract line 23 from line 18. If zero or less, enter zero..............................................................................

25

26.

Oklahoma Net Operating Loss from other years.........................................................................................

26

27.

Combine lines 3, 4, 12, 20, 24, 25 and 26..................................................................................................

27

Note: If more than zero, enter zero. You do not have a Net Operating Loss.

A copy of your Federal return is required.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3