Annual Report Instructions - Charitable Trusts Unit

ADVERTISEMENT

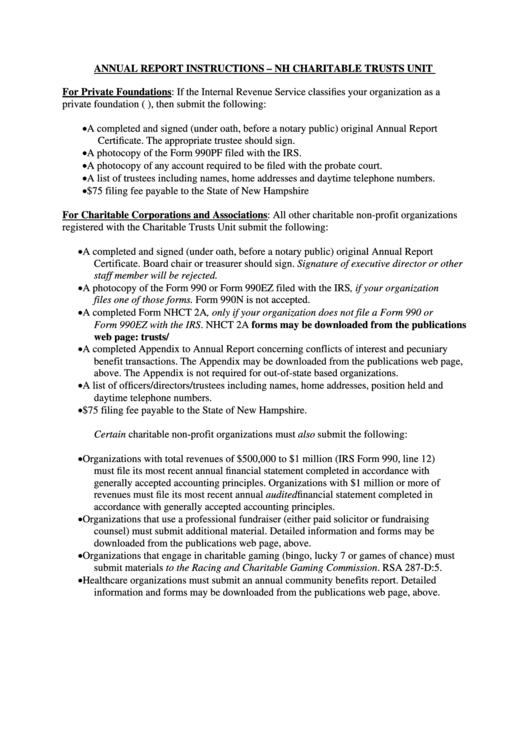

ANNUAL REPORT INSTRUCTIONS – NH CHARITABLE TRUSTS UNIT

For Private Foundations: If the Internal Revenue Service classifies your organization as a

private foundation (i.e. it files an IRS Form 990-PF), then submit the following:

• A completed and signed (under oath, before a notary public) original Annual Report

Certificate. The appropriate trustee should sign.

• A photocopy of the Form 990PF filed with the IRS.

• A photocopy of any account required to be filed with the probate court.

• A list of trustees including names, home addresses and daytime telephone numbers.

• $75 filing fee payable to the State of New Hampshire

For Charitable Corporations and Associations: All other charitable non-profit organizations

registered with the Charitable Trusts Unit submit the following:

• A completed and signed (under oath, before a notary public) original Annual Report

Certificate. Board chair or treasurer should sign. Signature of executive director or other

staff member will be rejected.

• A photocopy of the Form 990 or Form 990EZ filed with the IRS, if your organization

files one of those forms. Form 990N is not accepted.

• A completed Form NHCT 2A, only if your organization does not file a Form 990 or

Form 990EZ with the IRS. NHCT 2A forms may be downloaded from the publications

web page:

• A completed Appendix to Annual Report concerning conflicts of interest and pecuniary

benefit transactions. The Appendix may be downloaded from the publications web page,

above. The Appendix is not required for out-of-state based organizations.

• A list of officers/directors/trustees including names, home addresses, position held and

daytime telephone numbers.

• $75 filing fee payable to the State of New Hampshire.

Certain charitable non-profit organizations must also submit the following:

• Organizations with total revenues of $500,000 to $1 million (IRS Form 990, line 12)

must file its most recent annual financial statement completed in accordance with

generally accepted accounting principles. Organizations with $1 million or more of

revenues must file its most recent annual audited financial statement completed in

accordance with generally accepted accounting principles.

• Organizations that use a professional fundraiser (either paid solicitor or fundraising

counsel) must submit additional material. Detailed information and forms may be

downloaded from the publications web page, above.

• Organizations that engage in charitable gaming (bingo, lucky 7 or games of chance) must

submit materials to the Racing and Charitable Gaming Commission. RSA 287-D:5.

• Healthcare organizations must submit an annual community benefits report. Detailed

information and forms may be downloaded from the publications web page, above.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2