Meals Tax Monthly Report Form - Town Of Gordonsville

ADVERTISEMENT

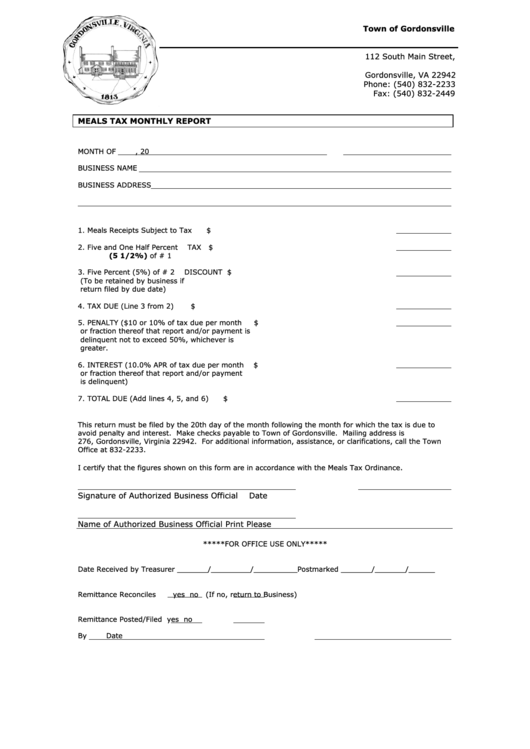

Town of Gordonsville

112 South Main Street,

P.O. Box 276

Gordonsville, VA 22942

Phone: (540) 832-2233

Fax: (540) 832-2449

MEALS TAX MONTHLY REPORT

MONTH OF

, 20

BUSINESS NAME

BUSINESS ADDRESS

1.

Meals Receipts Subject to Tax

$

2.

Five and One Half Percent

TAX

$

(5 1/2%) of # 1

3.

Five Percent (5%) of # 2

DISCOUNT

$

(To be retained by business if

return filed by due date)

4.

TAX DUE (Line 3 from 2)

$

5.

PENALTY ($10 or 10% of tax due per month

$

or fraction thereof that report and/or payment is

delinquent not to exceed 50%, whichever is

greater.

6.

INTEREST (10.0% APR of tax due per month

$

or fraction thereof that report and/or payment

is delinquent)

7.

TOTAL DUE (Add lines 4, 5, and 6)

$

This return must be filed by the 20th day of the month following the month for which the tax is due to

avoid penalty and interest. Make checks payable to Town of Gordonsville. Mailing address is P.O. Box

276, Gordonsville, Virginia 22942. For additional information, assistance, or clarifications, call the Town

Office at 832-2233.

.

I certify that the figures shown on this form are in accordance with the Meals Tax Ordinance

Signature of Authorized Business Official

Date

Name of Authorized Business Official Print Please

*****FOR OFFICE USE ONLY*****

Date Received by Treasurer _______/_________/__________Postmarked _______/_______/______

Remittance Reconciles

yes

no

(If no, return to Business)

Remittance Posted/Filed

yes

no

By

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1