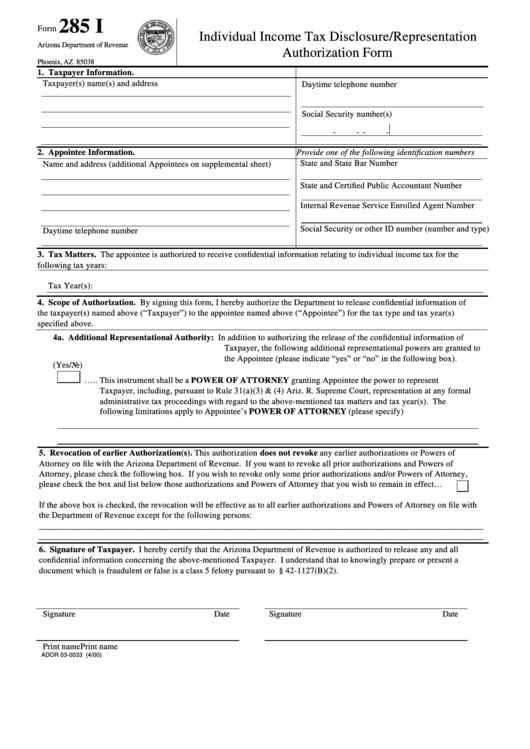

285 I

Form

Individual Income Tax Disclosure/Representation

Arizona Department of Revenue

Authorization Form

P.O. Box 29080

Phoenix, AZ 85038

1. Taxpayer Information.

Taxpayer(s) name(s) and address

Daytime telephone number

Social Security number(s)

-

-

-

-

2. Appointee Information.

Provide one of the following identification numbers

State and State Bar Number

Name and address (additional Appointees on supplemental sheet)

State and Certified Public Accountant Number

Internal Revenue Service Enrolled Agent Number

Social Security or other ID number (number and type)

Daytime telephone number

3. Tax Matters. The appointee is authorized to receive confidential information relating to individual income tax for the

following tax years:

Tax Year(s):

4. Scope of Authorization. By signing this form, I hereby authorize the Department to release confidential information of

the taxpayer(s) named above (“Taxpayer”) to the appointee named above (“Appointee”) for the tax type and tax year(s)

specified above.

4a. Additional Representational Authority:

In addition to authorizing the release of the confidential information of

Taxpayer, the following additional representational powers are granted to

the Appointee (please indicate “yes” or “no” in the following box).

(Yes/No)

….. This instrument shall be a POWER OF ATTORNEY granting Appointee the power to represent

Taxpayer, including, pursuant to Rule 31(a)(3) & (4) Ariz. R. Supreme Court, representation at any formal

administrative tax proceedings with regard to the above-mentioned tax matters and tax year(s). The

following limitations apply to Appointee’s POWER OF ATTORNEY (please specify)

5. Revocation of earlier Authorization(s). This authorization does not revoke any earlier authorizations or Powers of

Attorney on file with the Arizona Department of Revenue. If you want to revoke all prior authorizations and Powers of

Attorney, please check the following box. If you wish to revoke only some prior authorizations and/or Powers of Attorney,

please check the box and list below those authorizations and Powers of Attorney that you wish to remain in effect…......

If the above box is checked, the revocation will be effective as to all earlier authorizations and Powers of Attorney on file with

the Department of Revenue except for the following persons:

______________________________________________________________________________________________________

______________________________________________________________________________________________________

6. Signature of Taxpayer. I hereby certify that the Arizona Department of Revenue is authorized to release any and all

confidential information concerning the above-mentioned Taxpayer. I understand that to knowingly prepare or present a

document which is fraudulent or false is a class 5 felony pursuant to A.R.S. § 42-1127(B)(2).

Signature

Date

Signature

Date

Print name

Print name

ADOR 03-0033 (4/00)

1

1