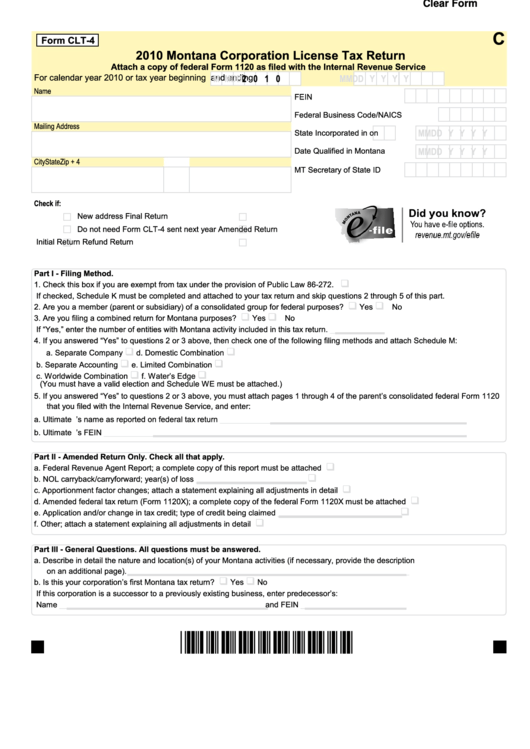

Clear Form

C

Form CLT-4

2010 Montana Corporation License Tax Return

Attach a copy of federal Form 1120 as filed with the Internal Revenue Service

For calendar year 2010 or tax year beginning

M M D D

2 0 1 0

and ending

M M D D Y Y Y Y

Name

FEIN

Federal Business Code/NAICS

Mailing Address

M M D D Y Y Y Y

State Incorporated in

on

M M D D Y Y Y Y

Date Qualified in Montana

City

State

Zip + 4

MT Secretary of State ID

Check if:

New address

Final Return

Do not need Form CLT-4 sent next year

Amended Return

Initial Return

Refund Return

Part I - Filing Method.

1. Check this box if you are exempt from tax under the provision of Public Law 86-272. ...................................................

If checked, Schedule K must be completed and attached to your tax return and skip questions 2 through 5 of this part.

2. Are you a member (parent or subsidiary) of a consolidated group for federal purposes? .......................................

Yes

No

3. Are you filing a combined return for Montana purposes? .........................................................................................

Yes

No

If “Yes,” enter the number of entities with Montana activity included in this tax return.

___________

4. If you answered “Yes” to questions 2 or 3 above, then check one of the following filing methods and attach Schedule M:

a. Separate Company

d. Domestic Combination

b. Separate Accounting

e. Limited Combination

c. Worldwide Combination

f. Water’s Edge

(You must have a valid election and Schedule WE must be attached.)

5. If you answered “Yes” to questions 2 or 3 above, you must attach pages 1 through 4 of the parent’s consolidated federal Form 1120

that you filed with the Internal Revenue Service, and enter:

a. Ultimate U.S. parent’s name as reported on federal tax return

_____________________________________________

b. Ultimate U.S. parent’s FEIN

________________________________________________________________________

Part II - Amended Return Only. Check all that apply.

a. Federal Revenue Agent Report; a complete copy of this report must be attached .......................................................a.

b. NOL carryback/carryforward; year(s) of loss

_________________________

...........................................................b.

c. Apportionment factor changes; attach a statement explaining all adjustments in detail ...............................................c.

d. Amended federal tax return (Form 1120X); a complete copy of the federal Form 1120X must be attached .................d.

e. Application and/or change in tax credit; type of credit being claimed

____________________________

................e.

f. Other; attach a statement explaining all adjustments in detail .......................................................................................f.

Part III - General Questions. All questions must be answered.

a. Describe in detail the nature and location(s) of your Montana activities (if necessary, provide the description

on an additional page).

________________________________________________________________

b. Is this your corporation’s first Montana tax return? ...................................................................................................

Yes

No

If this corporation is a successor to a previously existing business, enter predecessor’s:

Name

______________________________________________

and FEIN

_______________________

*20010101*

1

1 2

2 3

3 4

4