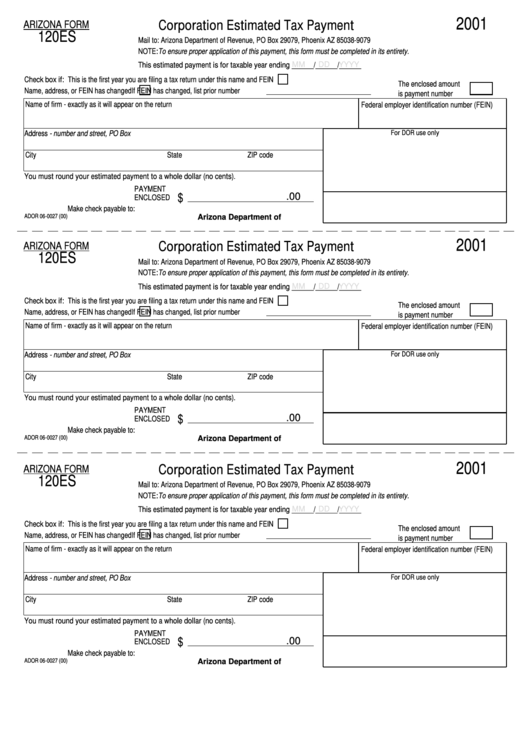

Form 120es/w - Corporation Estimated Tax Payment 2001

ADVERTISEMENT

2001

Corporation Estimated Tax Payment

ARIZONA FORM

120ES

Mail to: Arizona Department of Revenue, PO Box 29079, Phoenix AZ 85038-9079

NOTE: To ensure proper application of this payment, this form must be completed in its entirety.

This estimated payment is for taxable year ending ______/______/______

MM

DD

YYYY

Check box if: This is the first year you are filing a tax return under this name and FEIN

The enclosed amount

Name, address, or FEIN has changed

If FEIN has changed, list prior number

is payment number

Name of firm - exactly as it will appear on the return

Federal employer identification number (FEIN)

Address - number and street, PO Box

For DOR use only

City

State

ZIP code

You must round your estimated payment to a whole dollar (no cents).

PAYMENT

$

.00

ENCLOSED

Make check payable to:

ADOR 06-0027 (00)

Arizona Department of

2001

Corporation Estimated Tax Payment

ARIZONA FORM

120ES

Mail to: Arizona Department of Revenue, PO Box 29079, Phoenix AZ 85038-9079

NOTE: To ensure proper application of this payment, this form must be completed in its entirety.

This estimated payment is for taxable year ending ______/______/______

MM

DD

YYYY

Check box if: This is the first year you are filing a tax return under this name and FEIN

The enclosed amount

Name, address, or FEIN has changed

If FEIN has changed, list prior number

is payment number

Name of firm - exactly as it will appear on the return

Federal employer identification number (FEIN)

For DOR use only

Address - number and street, PO Box

City

State

ZIP code

You must round your estimated payment to a whole dollar (no cents).

PAYMENT

$

ENCLOSED

.00

Make check payable to:

ADOR 06-0027 (00)

Arizona Department of

2001

Corporation Estimated Tax Payment

ARIZONA FORM

120ES

Mail to: Arizona Department of Revenue, PO Box 29079, Phoenix AZ 85038-9079

NOTE: To ensure proper application of this payment, this form must be completed in its entirety.

This estimated payment is for taxable year ending ______/______/______

MM

DD

YYYY

Check box if: This is the first year you are filing a tax return under this name and FEIN

The enclosed amount

Name, address, or FEIN has changed

If FEIN has changed, list prior number

is payment number

Name of firm - exactly as it will appear on the return

Federal employer identification number (FEIN)

For DOR use only

Address - number and street, PO Box

City

State

ZIP code

You must round your estimated payment to a whole dollar (no cents).

PAYMENT

$

ENCLOSED

.00

Make check payable to:

ADOR 06-0027 (00)

Arizona Department of

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3