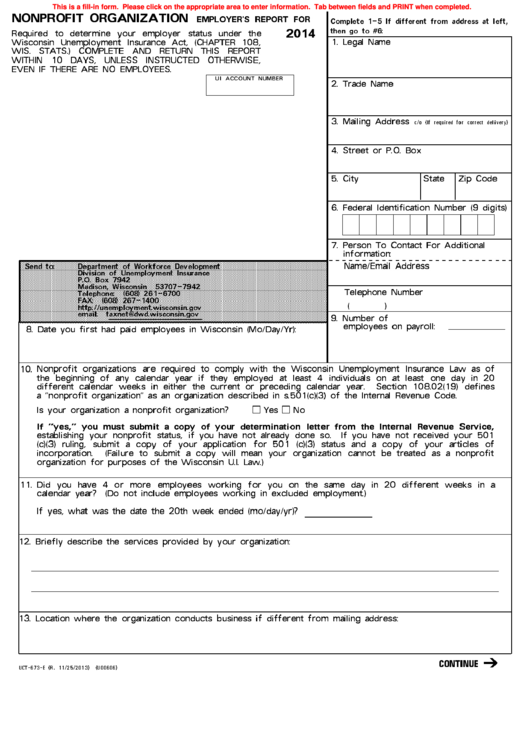

NONPROFIT ORGANIZATION

This is a fill-in form. Please click on the appropriate area to enter information. Tab between fields and PRINT when completed.

Complete 1-5 If different from address at left,

2014

EMPLOYER'S

REPORT

FOR

then go to #6:

Required

to

determine

your

employer

status

under

the

Wisconsin

Unemployment

Insurance

Act,

(CHAPTER

108,

1. Legal Name

WIS.

STATS.)

COMPLETE

AND

RETURN

THIS

REPORT

WITHIN

10

DAYS,

UNLESS

INSTRUCTED

OTHERWISE,

EVEN IF THERE ARE NO EMPLOYEES.

UI ACCOUNT NUMBER

2. Trade Name

3. Mailing Address

c/o

(If

required

for

correct

delivery)

4. Street or P.O. Box

5. City

State

Zip Code

6. Federal Identification Number (9 digits)

7. Person To Contact For Additional

information:

Name/Email Address

Send to:

Department of Workforce Development

Division of Unemployment Insurance

P.O. Box 7942

Madison, Wisconsin 53707-7942

Telephone Number

Telephone: (608) 261-6700

FAX: (608) 267-1400

(

)

email: taxnet@dwd.wisconsin.gov

9. Number of

employees on payroll:

8. Date you first had paid employees in Wisconsin (Mo/Day/Yr):

Nonprofit

organizations

are

required

to

comply

with

the

Wisconsin

Unemployment

Insurance

Law

as

of

10.

the

beginning

of

any

calendar

year

if

they

employed

at

least

4

individuals

on

at

least

one

day

in

20

different

calendar

weeks

in

either

the

current

or

preceding

calendar

year.

Section

108.02(19)

defines

a "nonprofit organization" as an organization described in s.501(c)(3) of the Internal Revenue Code.

Is your organization a nonprofit organization?

Yes

No

If

"yes,"

you

must

submit

a

copy

of

your

determination

letter

from

the

Internal

Revenue

Service,

establishing

your

nonprofit

status,

if

you

have

not

already

done

so.

If

you

have

not

received

your

501

(c)(3)

ruling,

submit

a

copy

of

your

application

for

501

(c)(3)

status

and

a

copy

of

your

articles

of

incorporation.

(Failure

to

submit

a

copy

will

mean

your

organization

cannot

be

treated

as

a

nonprofit

organization for purposes of the Wisconsin U.I. Law.)

11.

Did

you

have

4

or

more

employees

working

for

you

on

the

same

day

in

20

different

weeks

in

a

calendar year? (Do not include employees working in excluded employment.)

If yes, what was the date the 20th week ended (mo/day/yr)?

_______

12. Briefly describe the services provided by your organization:

13. Location where the organization conducts business if different from mailing address:

�

CONTINUE

UCT-673-E

(R.

11/25/2013)

(U00606)

1

1 2

2