Arizona Form 220 - Underpayment Of Estimated Tax By Corporations - 2002

ADVERTISEMENT

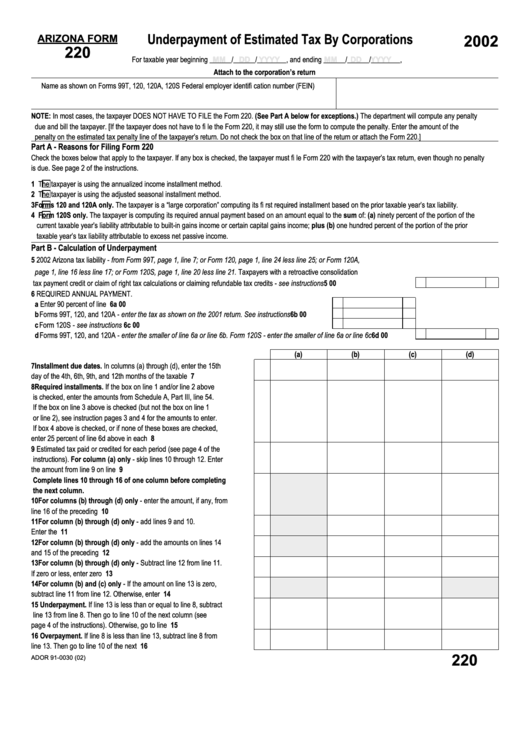

Underpayment of Estimated Tax By Corporations

ARIZONA FORM

2002

220

For taxable year beginning ______/______/________, and ending ______/______/________,

MM

MM

DD

DD

YYYY

YYYY

MM

MM

DD

DD

YYYY

YYYY

Attach to the corporation’s return

Name as shown on Forms 99T, 120, 120A, 120S

Federal employer identifi cation number (FEIN)

NOTE: In most cases, the taxpayer DOES NOT HAVE TO FILE the Form 220. (See Part A below for exceptions.) The department will compute any penalty

due and bill the taxpayer. [If the taxpayer does not have to fi le the Form 220, it may still use the form to compute the penalty. Enter the amount of the

penalty on the estimated tax penalty line of the taxpayer’s return. Do not check the box on that line of the return or attach the Form 220.]

Part A - Reasons for Filing Form 220

Check the boxes below that apply to the taxpayer. If any box is checked, the taxpayer must fi le Form 220 with the taxpayer’s tax return, even though no penalty

is due. See page 2 of the instructions.

1

The taxpayer is using the annualized income installment method.

2

The taxpayer is using the adjusted seasonal installment method.

3

Forms 120 and 120A only. The taxpayer is a “large corporation” computing its fi rst required installment based on the prior taxable year’s tax liability.

4

Form 120S only. The taxpayer is computing its required annual payment based on an amount equal to the sum of: (a) ninety percent of the portion of the

current taxable year’s liability attributable to built-in gains income or certain capital gains income; plus (b) one hundred percent of the portion of the prior

taxable year’s tax liability attributable to excess net passive income.

Part B - Calculation of Underpayment

5

2002 Arizona tax liability - from Form 99T, page 1, line 7; or Form 120, page 1, line 24 less line 25; or Form 120A,

page 1, line 16 less line 17; or Form 120S, page 1, line 20 less line 21. Taxpayers with a retroactive consolidation

tax payment credit or claim of right tax calculations or claiming refundable tax credits - see instructions .........................................

5

00

6

REQUIRED ANNUAL PAYMENT.

a Enter 90 percent of line 5 ...............................................................................................................

6a

00

b Forms 99T, 120, and 120A - enter the tax as shown on the 2001 return. See instructions............

6b

00

c Form 120S - see instructions .........................................................................................................

6c

00

d Forms 99T, 120, and 120A - enter the smaller of line 6a or line 6b. Form 120S - enter the smaller of line 6a or line 6c..............

6d

00

(a)

(b)

(c)

(d)

7

Installment due dates. In columns (a) through (d), enter the 15th

day of the 4th, 6th, 9th, and 12th months of the taxable year..................

7

8

Required installments. If the box on line 1 and/or line 2 above

is checked, enter the amounts from Schedule A, Part III, line 54.

If the box on line 3 above is checked (but not the box on line 1

or line 2), see instruction pages 3 and 4 for the amounts to enter.

If box 4 above is checked, or if none of these boxes are checked,

enter 25 percent of line 6d above in each column ...................................

8

9

Estimated tax paid or credited for each period (see page 4 of the

instructions). For column (a) only - skip lines 10 through 12. Enter

the amount from line 9 on line 13............................................................

9

Complete lines 10 through 16 of one column before completing

the next column.

10

For columns (b) through (d) only - enter the amount, if any, from

line 16 of the preceding column ..............................................................

10

11

For column (b) through (d) only - add lines 9 and 10.

Enter the total..........................................................................................

11

12

For column (b) through (d) only - add the amounts on lines 14

and 15 of the preceding column..............................................................

12

13

For column (b) through (d) only - Subtract line 12 from line 11.

If zero or less, enter zero ........................................................................

13

14

For column (b) and (c) only - If the amount on line 13 is zero,

subtract line 11 from line 12. Otherwise, enter zero ................................

14

15

Underpayment. If line 13 is less than or equal to line 8, subtract

line 13 from line 8. Then go to line 10 of the next column (see

page 4 of the instructions). Otherwise, go to line 16 ...............................

15

16

Overpayment. If line 8 is less than line 13, subtract line 8 from

line 13. Then go to line 10 of the next column.........................................

16

220

ADOR 91-0030 (02)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4