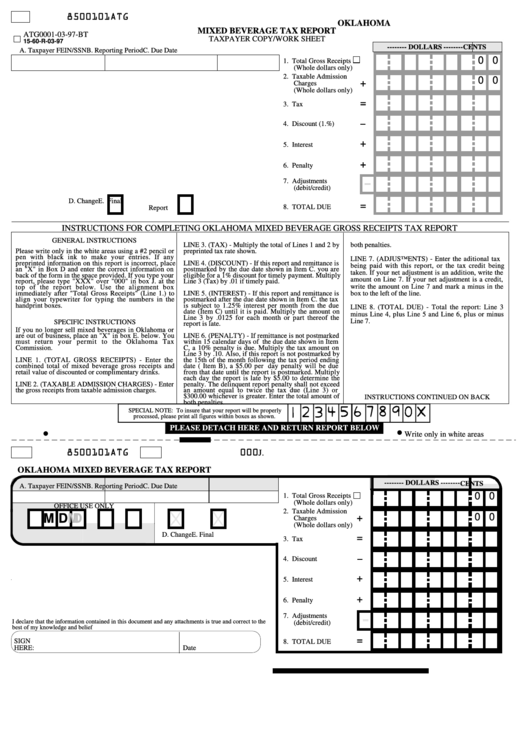

Oklahoma Mixed Beverage Tax Report Form

ADVERTISEMENT

ATG

8500101

OKLAHOMA

MIXED BEVERAGE TAX REPORT

ATG0001-03-97-BT

TAXPAYER COPY/WORK SHEET

15-60-R-03-97

-------- DOLLARS --------

CENTS

A. Taxpayer FEIN/SSN

B. Reporting Period

C. Due Date

0 0

1.

Total Gross Receipts

(Whole dollars only)

2.

Taxable Admission

0 0

+

Charges

(Whole dollars only)

=

3.

Tax

4.

Discount (1.%)

+

5.

Interest

+

6.

Penalty

7.

Adjustments

(debit/credit)

D. Change

E. Final

=

8.

TOTAL DUE

Report

INSTRUCTIONS FOR COMPLETING OKLAHOMA MIXED BEVERAGE GROSS RECEIPTS TAX REPORT

GENERAL INSTRUCTIONS

LINE 3. (TAX) - Multiply the total of Lines 1 and 2 by

both penalties.

Please write only in the white areas using a #2 pencil or

preprinted tax rate shown.

pen with black ink to make your entries. If any

LINE 7. (ADJUSTMENTS) - Enter the aditional tax

preprinted information on this report is incorrect, place

LINE 4. (DISCOUNT) - If this report and remittance is

being paid with this report, or the tax credit being

an "X" in Box D and enter the correct information on

postmarked by the due date shown in Item C. you are

taken. If your net adjustment is an addition, write the

back of the form in the space provided. If you type your

eligible for a 1% discount for timely payment. Multiply

amount on Line 7. If your net adjustment is a credit,

report, please type "XXX" over "000" in box J. at the

Line 3 (Tax) by .01 if timely paid.

write the amount on Line 7 and mark a minus in the

top of the report below. Use the alignment box

immediately after "Total Gross Receipts" (Line 1.) to

LINE 5. (INTEREST) - If this report and remittance is

box to the left of the line.

align your typewriter for typing the numbers in the

postmarked after the due date shown in Item C. the tax

handprint boxes.

is subject to 1.25% interest per month from the due

LINE 8. (TOTAL DUE) - Total the report: Line 3

date (Item C) until it is paid. Multiply the amount on

minus Line 4, plus Line 5 and Line 6, plus or minus

Line 3 by .0125 for each month or part thereof the

Line 7.

SPECIFIC INSTRUCTIONS

report is late.

If you no longer sell mixed beverages in Oklahoma or

are out of business, place an "X" in box E. below. You

LINE 6. (PENALTY) - If remittance is not postmarked

must return your permit to the Oklahoma Tax

within 15 calendar days of the due date shown in Item

Commission.

C, a 10% penalty is due. Multiply the tax amount on

Line 3 by .10. Also, if this report is not postmarked by

LINE 1. (TOTAL GROSS RECEIPTS) - Enter the

the 15th of the month following the tax period ending

combined total of mixed beverage gross receipts and

date ( Item B), a $5.00 per day penalty will be due

retail value of discounted or complimentary drinks.

from that date until the report is postmarked. Multiply

each day the report is late by $5.00 to determine the

LINE 2. (TAXABLE ADMISSION CHARGES) - Enter

penalty. The delinquent report penalty shall not exceed

the gross receipts from taxable admission charges.

an amount equal to twice the tax due (Line 3) or

$300.00 whichever is greater. Enter the total amount of

INSTRUCTIONS CONTINUED ON BACK

both penalties.

SPECIAL NOTE: To insure that your report will be properly

processed, please print all figures within boxes as shown.

PLEASE DETACH HERE AND RETURN REPORT BELOW

Write only in white areas

ATG

8500101

J.

000

OKLAHOMA MIXED BEVERAGE TAX REPORT

-------- DOLLARS --------

CENTS

A. Taxpayer FEIN/SSN

B. Reporting Period

C. Due Date

0 0

1.

Total Gross Receipts

(Whole dollars only)

OFFICE USE ONLY

2.

Taxable Admission

0 0

M

M

D

D

+

Charges

(Whole dollars only)

F.C.

P.T.

D. Change

E. Final Report

=

3.

Tax

4.

Discount

+

5.

Interest

+

6.

Penalty

7.

Adjustments

I declare that the information contained in this document and any attachments is true and correct to the

(debit/credit)

best of my knowledge and belief

=

SIGN

8.

TOTAL DUE

HERE:

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2