Form Ct-1040x Line Instructions - Amended Connecticut Income Tax Return For Individuals

ADVERTISEMENT

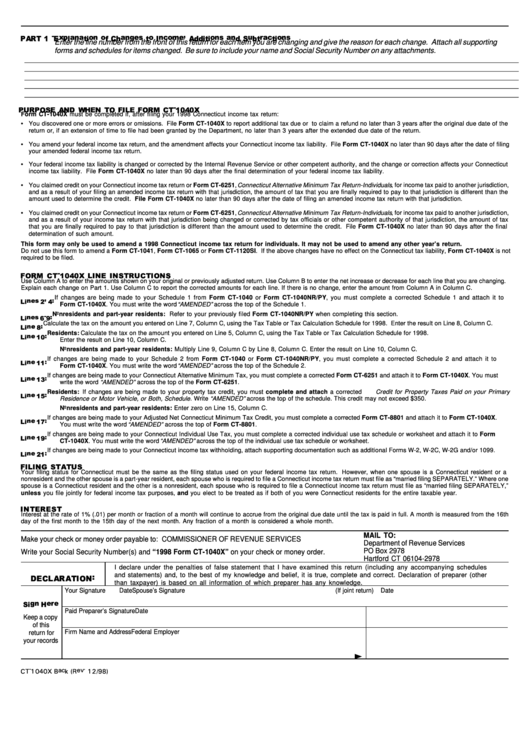

Enter the line number from the front of this return for each item you are changing and give the reason for each change. Attach all supporting

forms and schedules for items changed. Be sure to include your name and Social Security Number on any attachments.

______________________________________________________________________________________________________________________

______________________________________________________________________________________________________________________

______________________________________________________________________________________________________________________

______________________________________________________________________________________________________________________

______________________________________________________________________________________________________________________

Form CT-1040X must be completed if, after filing your 1998 Connecticut income tax return:

• You discovered one or more errors or omissions. File Form CT-1040X to report additional tax due or to claim a refund no later than 3 years after the original due date of the

return or, if an extension of time to file had been granted by the Department, no later than 3 years after the extended due date of the return.

• You amend your federal income tax return, and the amendment affects your Connecticut income tax liability. File Form CT-1040X no later than 90 days after the date of filing

your amended federal income tax return.

• Your federal income tax liability is changed or corrected by the Internal Revenue Service or other competent authority, and the change or correction affects your Connecticut

income tax liability. File Form CT-1040X no later than 90 days after the final determination of your federal income tax liability.

• You claimed credit on your Connecticut income tax return or Form CT-6251, Connecticut Alternative Minimum Tax Return-Individuals , for income tax paid to another jurisdiction,

and as a result of your filing an amended income tax return with that jurisdiction, the amount of tax that you are finally required to pay to that jurisdiction is different than the

amount used to determine the credit. File Form CT-1040X no later than 90 days after the date of filing an amended income tax return with that jurisdiction.

• You claimed credit on your Connecticut income tax return or Form CT-6251, Connecticut Alternative Minimum Tax Return-Individuals , for income tax paid to another jurisdiction,

and as a result of your income tax return with that jurisdiction being changed or corrected by tax officials or other competent authority of that jurisdiction, the amount of tax

that you are finally required to pay to that jurisdiction is different than the amount used to determine the credit. File Form CT-1040X no later than 90 days after the final

determination of such amount.

This form may only be used to amend a 1998 Connecticut income tax return for individuals. It may not be used to amend any other year’s return.

Do not use this form to amend a Form CT-1041, Form CT-1065 or Form CT-1120SI. If the above changes have no effect on the Connecticut tax liability, Form CT-1040X is not

required to be filed.

Use Column A to enter the amounts shown on your original or previously adjusted return. Use Column B to enter the net increase or decrease for each line that you are changing.

Explain each change on Part 1. Use Column C to report the corrected amounts for each line. If there is no change, enter the amount from Column A in Column C.

If changes are being made to your Schedule 1 from Form CT-1040 or Form CT-1040NR/PY, you must complete a corrected Schedule 1 and attach it to

Form CT-1040X. You must write the word “AMENDED” across the top of the Schedule 1.

Nonresidents and part-year residents: Refer to your previously filed Form CT-1040NR/PY when completing this section.

Calculate the tax on the amount you entered on Line 7, Column C, using the Tax Table or Tax Calculation Schedule for 1998. Enter the result on Line 8, Column C.

Residents: Calculate the tax on the amount you entered on Line 5, Column C, using the Tax Table or Tax Calculation Schedule for 1998.

Enter the result on Line 10, Column C.

Nonresidents and part-year residents: Multiply Line 9, Column C by Line 8, Column C. Enter the result on Line 10, Column C.

If changes are being made to your Schedule 2 from Form CT-1040 or Form CT-1040NR/PY, you must complete a corrected Schedule 2 and attach it to

Form CT-1040X. You must write the word “AMENDED” across the top of the Schedule 2.

If changes are being made to your Connecticut Alternative Minimum Tax, you must complete a corrected Form CT-6251 and attach it to Form CT-1040X. You must

write the word “AMENDED” across the top of the Form CT-6251.

Residents: If changes are being made to your property tax credit, you must complete and attach a corrected Credit for Property Taxes Paid on your Primary

Residence or Motor Vehicle, or Both, Schedule . Write “AMENDED” across the top of the schedule. This credit may not exceed $350.

Nonresidents and part-year residents: Enter zero on Line 15, Column C.

If changes are being made to your Adjusted Net Connecticut Minimum Tax Credit, you must complete a corrected Form CT-8801 and attach it to Form CT-1040X.

You must write the word “AMENDED” across the top of Form CT-8801.

If changes are being made to your Connecticut Individual Use Tax, you must complete a corrected individual use tax schedule or worksheet and attach it to Form

CT-1040X. You must write the word “AMENDED” across the top of the individual use tax schedule or worksheet.

If changes are being made to your Connecticut income tax withholding, attach supporting documentation such as additional Forms W-2, W-2C, W-2G and/or 1099.

Your filing status for Connecticut must be the same as the filing status used on your federal income tax return. However, when one spouse is a Connecticut resident or a

nonresident and the other spouse is a part-year resident, each spouse who is required to file a Connecticut income tax return must file as “married filing SEPARATELY.” Where one

spouse is a Connecticut resident and the other is a nonresident, each spouse who is required to file a Connecticut income tax return must file as “married filing SEPARATELY,”

unless you file jointly for federal income tax purposes, and you elect to be treated as if both of you were Connecticut residents for the entire taxable year.

Interest at the rate of 1% (.01) per month or fraction of a month will continue to accrue from the original due date until the tax is paid in full. A month is measured from the 16th

day of the first month to the 15th day of the next month. Any fraction of a month is considered a whole month.

MAIL TO:

Make your check or money order payable to: COMMISSIONER OF REVENUE SERVICES

Department of Revenue Services

PO Box 2978

Write your Social Security Number(s) and “1998 Form CT-1040X” on your check or money order.

Hartford CT 06104-2978

I declare under the penalties of false statement that I have examined this return (including any accompanying schedules

and statements) and, to the best of my knowledge and belief, it is true, complete and correct. Declaration of preparer (other

than taxpayer) is based on all information of which preparer has any knowledge.

Your Signature

Date

Spouse’s Signature (If joint return)

Date

Paid Preparer’s Signature

Date

Keep a copy

of this

Firm Name and Address

Federal Employer I.D. Number

return for

your records

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1