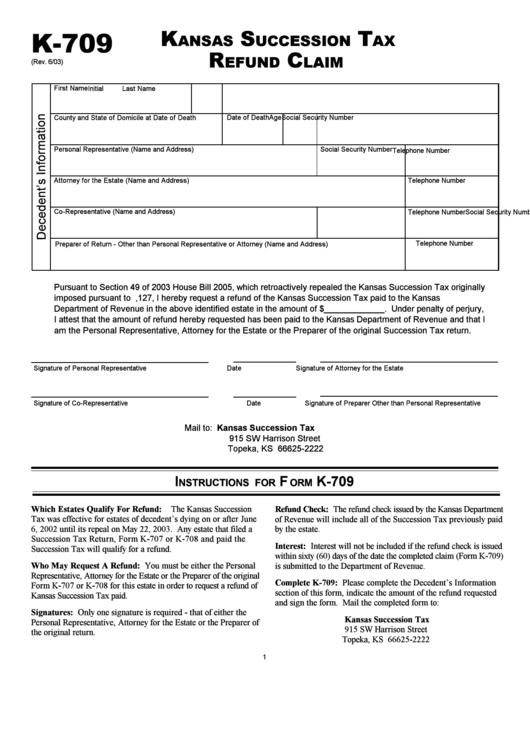

Form K-709 - Kansas Succession Tax Refund Claim

ADVERTISEMENT

K

S

T

K-709

ANSAS

UCCESSION

AX

R

C

EFUND

LAIM

(Rev. 6/03)

First Name

Initial

Last Name

County and State of Domicile at Date of Death

Date of Death

Age

Social Security Number

Personal Representative (Name and Address)

Social Security Number

Telephone Number

Attorney for the Estate (Name and Address)

Telephone Number

Co-Representative (Name and Address)

Social Security Number

Telephone Number

Telephone Number

Preparer of Return - Other than Personal Representative or Attorney (Name and Address)

Pursuant to Section 49 of 2003 House Bill 2005, which retroactively repealed the Kansas Succession Tax originally

imposed pursuant to K.S.A. 79-15,127, I hereby request a refund of the Kansas Succession Tax paid to the Kansas

Department of Revenue in the above identified estate in the amount of $_____________. Under penalty of perjury,

I attest that the amount of refund hereby requested has been paid to the Kansas Department of Revenue and that I

am the Personal Representative, Attorney for the Estate or the Preparer of the original Succession Tax return.

Signature of Personal Representative

Date

Signature of Attorney for the Estate

Signature of Co-Representative

Date

Signature of Preparer Other than Personal Representative

Mail to: Kansas Succession Tax

915 SW Harrison Street

Topeka, KS 66625-2222

I

F

K-709

NSTRUCTIONS FOR

ORM

Which Estates Qualify For Refund:

The Kansas Succession

Refund Check: The refund check issued by the Kansas Department

Tax was effective for estates of decedent’s dying on or after June

of Revenue will include all of the Succession Tax previously paid

6, 2002 until its repeal on May 22, 2003. Any estate that filed a

by the estate.

Succession Tax Return, Form K-707 or K-708 and paid the

Interest: Interest will not be included if the refund check is issued

Succession Tax will qualify for a refund.

within sixty (60) days of the date the completed claim (Form K-709)

Who May Request A Refund: You must be either the Personal

is submitted to the Department of Revenue.

Representative, Attorney for the Estate or the Preparer of the original

Complete K-709: Please complete the Decedent’s Information

Form K-707 or K-708 for this estate in order to request a refund of

section of this form, indicate the amount of the refund requested

Kansas Succession Tax paid.

and sign the form. Mail the completed form to:

Signatures: Only one signature is required - that of either the

Kansas Succession Tax

Personal Representative, Attorney for the Estate or the Preparer of

915 SW Harrison Street

the original return.

Topeka, KS 66625-2222

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1