Form L-1040pv - Income Tax Return Payment Voucher - City Of Lansing, 2011

ADVERTISEMENT

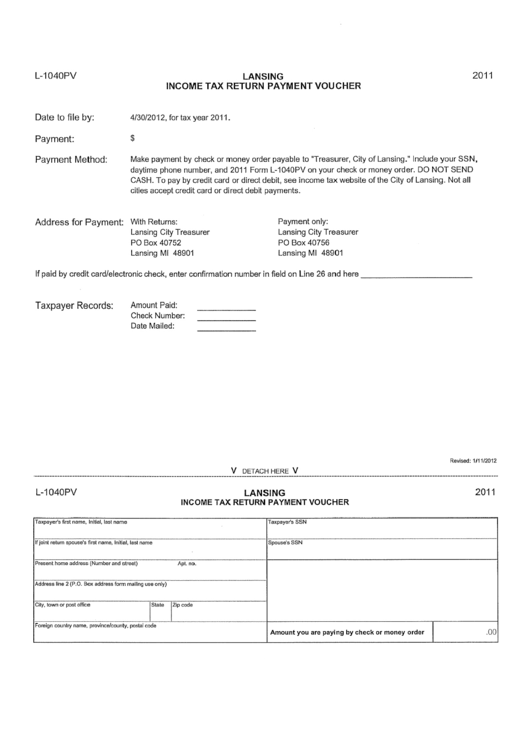

L-1040PV

LANSING

2011

INCOME TAX RETURN PAYMENT VOUCHER

Date to file by:

4/30/2012, for tax year 2011.

Payment:

$

Payment Method:

Make payment by check or money order payable to "Treasurer, City of Lansing." Include your SSN,

daytime phone number, and 2011 Form L-1040PV on your check or money order. DO NOT SEND

CASH. To pay by credit card or direct debit, see income tax website of the City of Lansing. Not all

cities accept credit card or direct debit payments.

Address for Payment:

With Returns:

Payment only:

Lansing City Treasurer

Lansing City Treasurer

PO Box 40752

PO Box 40756

Lansing MI 48901

Lansing MI 48901

If paid by credit card/electronic check, enter confirmation number in field on Line 26 and here

Taxpayer Records:

Amount Paid:

Check Number:

Date Mailed:

Revised: 1/11/2012

V

DETACH HERE

V

LANSING

INCOME TAX RETURN PAYMENT VOUCHER

L-1040PV

2011

Taxpayer's first name, Initial, last name

Ifjoint return spouse's first name, Initial, last name

Taxpayer's SSN

Spouse's SSN

Present home address (Number and street)

Address line 2 (P.O. Box address form mailing use only)

Apt. no.

--

-

--

City, town or post office

State

Zip code

Foreign country name, province/county, postal code

Amount you are paying by check or money order

.00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1