Form 807 - Michigan Compositeindividual Income Tax Return - 2000

ADVERTISEMENT

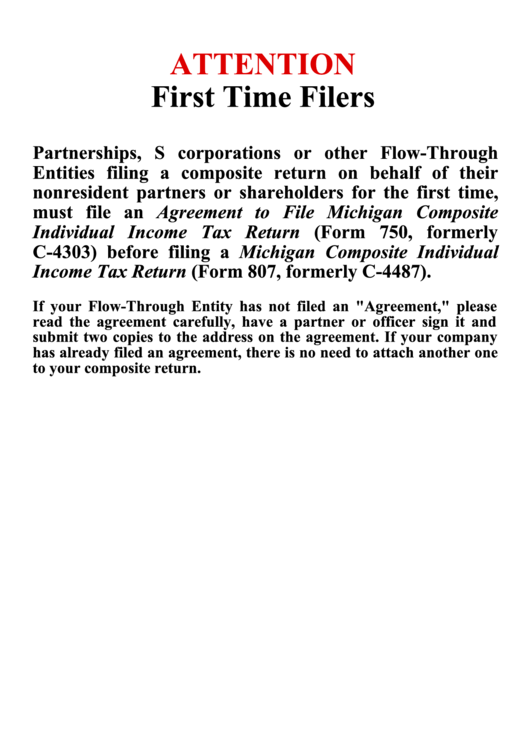

ATTENTION

First Time Filers

Partnerships, S corporations or other Flow-Through

Entities filing a composite return on behalf of their

nonresident partners or shareholders for the first time,

must file an Agreement to File Michigan Composite

Individual Income Tax Return (Form 750, formerly

C-4303) before filing a Michigan Composite Individual

Income Tax Return (Form 807, formerly C-4487).

If your Flow-Through Entity has not filed an "Agreement," please

read the agreement carefully, have a partner or officer sign it and

submit two copies to the address on the agreement. If your company

has already filed an agreement, there is no need to attach another one

to your composite return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3