Form Par-14-0147 - Workers' Compensation Commissioner - State Of Iowa Page 2

ADVERTISEMENT

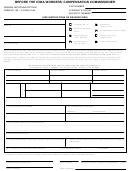

STATE OF IOWA - WORKERS' COMPENSATION COMMISSIONER

PAYMENT ACTIVITY REPORT (FORM PAR)

INSTRUCTIONS

This form is designed to assist with meeting the various filing requirements of the Iowa Workers’ Compensation Act and Administrative Rules. The form (or photocopy of the

front side) is to not be filed with the Iowa Workers’ Compensation Commissioner's Office, except to support settlement applications.

This form may be used to notify an employee of denial of liability pursuant to section 85.26(2) or a final report pursuant to rule 876 IAC 2.6

THE INFORMATION PROVIDED WILL BE OPEN FOR PUBLIC INSPECTION UNDER IOWA CODE § 22.11.

SECTION A - NAMES AND ADDRESSES OF THE PARTIES:

Example: The period from May 1st thru

This section is to be used to provide the complete names and addresses of the

May 8th is 8 days of disability,

insurer (or adjusting company), employee, and employer.

which if subject to the three

day waiting period is 5 days

SECTION B - REPORT OF CHANGE IN PAYMENT

payable, or .714 weeks.

STATUS/COMMENTS:

TPD AMOUNT EARNED

- If TYPE OF PAYMENT checked is TPD,

This section is to be used to provide information concerning any changes in

enter the actual amount of wages earned

payment status or any comments pertinent to the handling of the claim.

from the employer during the period being

reported.

AMOUNT PAID

- Enter the amount paid for the period.

SECTION C - RATE CALCULATION:

Example: To calculate TTD/HP, PTD, or

This section is to be used to verify the employee’s weekly compensation rate. If

DEA multiply the WEEKLY

the information upon which the compensation rate is based is the same as the

RATE times the decimal

information reflected on the Employer’s First Report of Injury, this form may be

equivalent of the WEEKS/

filed as a “Rate Agreement.” If the information upon which the rate is based

DAYS PAYABLE.

differs from the information reflected on the Employer’s First Report of Injury, a

Form 2B must be filed as a “Rate Agreement.”

To calculate TPD multiply the

GROSS WEEKLY WAGE times

SECTION D - COMMENCEMENT OF PAYMENT NOTICE OR DENIAL:

the WEEKS/DAYS PAYABLE

minus the TPD AMOUNT

EARNED during the period

This section is to be used by the insurer to indicate whether or not payment of

times .66667.

disability benefits to the employee have been initiated.

Conversion Rule 876 - 8.6

D1.

Check this box if this is a “Commencement of Payment

1 day = .143 week

2 days = .286 week

Notice” pursuant to 86.13.

3 days = .429 week

4 days = .571 week

D2.

Check this box if this is “Denial of Liability” pursuant to

5 days = .714 week

6 days = .857 week

85.26.

7 days = 1.000 week

D3.

Check this box if payment of disability benefits is not being

made for reasons other than Denial, then check Insufficient

E3.

Enter payment for PPD:

Lost Time (if disability is 3 days or less), or Other (and

include an explanation).

PART OF BODY

- Enter the part of the body upon which

benefits are based.

% PPD

- Enter extent of disability as a percentage.

NO. OF WEEKS

- Multiply the % PPD times the scheduled

number of weeks for the PART OF BODY

pursuant to 85.34(2) (a-u).

SECTION E - PAYMENT REPORT:

This section is to be used by the insurer to report the benefits paid to date, and to

Example: A 25% loss of an arm equals

indicate whether an “Interim Report” or “Final Report” is being filed pursuant to

.25 x 250 weeks or 62.5

Rule 876 - 3.1(2). Attach a separate sheet if necessary.

weeks.

E1.

Check and complete the appropriate box for the type of

AMOUNT PAID

- Multiply the PPD WEEKLY RATE times the

“Payment Report” being made.

NO. OF WEEKS and enter the amount

paid.

“Final Report” - Disability benefits have been terminated. Enter

the Date of Last Payment.

E4.

Enter other benefit payments:

“Interim Report” - Disability benefits are continuing. Enter the

Estimated Completion Date when termination

TYPE OF BENEFIT -Find the appropriate box(es) for other

of benefits is anticipated.

benefits paid. If a type of benefit is not

shown, specify the type of benefit in the

E2.

Enter the payment(s) for the period(s) of disability:

MISC. box. The number in parentheses

TYPE OF PAYMENT

- Check if TTD/HP, TPD, PTD, or DEA

under each type of benefit refers to the

benefits.

section of the Iowa Code applicable to

DATE BEGAN

- Enter the first date of disability for the

these payments.

type and period being reported.

AMOUNT PAID

- Enter the amount paid.

DATE ENDED

- Enter the last date of disability for the

E5

Enter settlement/commutation payment(s) approved by the workers'

type and period being reported.

compensation commissioner:

WEEKS/DAYS PAYABLE - Enter the number of weeks and days

TYPE - Indicate type

SPCS

= Special Case Settlement

payable during the period.

pursuant to 85.35

AGFS

= Agreement for Settlement

pursuant to 86.13

FCOMM = Full Commutation pursuant to

85.45 & 85.47.

PCOMM = Partial Commutation pursuant

to 85.45 & 85.48.

DATE APPROVED - Enter the date the workers' compensation

commissioner approved the settlement/commutation.

AMOUNT - Enter the amount of the settlement/

commutation.

E6

Check this box if a “Medical Report” is attached pursuant to rule 876-

3.1(2). A medical report must be filed if an injury involves PPD or

PTD, or if the disability period exceeds 13 weeks on TTD/HP or TPD.

Please sign and date this report where indicated.

14-0147 back (11/03)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2