Form Nj-2450 - Employee'S Claim For Credit - 2000

ADVERTISEMENT

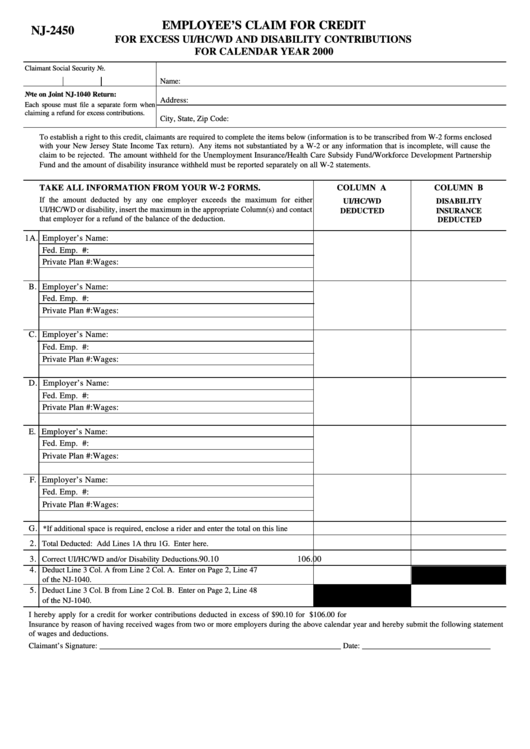

EMPLOYEE’S CLAIM FOR CREDIT

NJ-2450

FOR EXCESS UI/HC/WD AND DISABILITY CONTRIBUTIONS

FOR CALENDAR YEAR 2000

Claimant Social Security No.

Name:

Note on Joint NJ-1040 Return:

Address:

Each spouse must file a separate form when

claiming a refund for excess contributions.

City, State, Zip Code:

To establish a right to this credit, claimants are required to complete the items below (information is to be transcribed from W-2 forms enclosed

with your New Jersey State Income Tax return). Any items not substantiated by a W-2 or any information that is incomplete, will cause the

claim to be rejected. The amount withheld for the Unemployment Insurance/Health Care Subsidy Fund/Workforce Development Partnership

Fund and the amount of disability insurance withheld must be reported separately on all W-2 statements.

TAKE ALL INFORMATION FROM YOUR W-2 FORMS.

COLUMN A

COLUMN B

If the amount deducted by any one employer exceeds the maximum for either

UI/HC/WD

DISABILITY

UI/HC/WD or disability, insert the maximum in the appropriate Column(s) and contact

DEDUCTED

INSURANCE

that employer for a refund of the balance of the deduction.

DEDUCTED

1A. Employer’s Name:

Fed. Emp. I.D. #:

Private Plan #:

Wages:

B. Employer’s Name:

Fed. Emp. I.D. #:

Private Plan #:

Wages:

C. Employer’s Name:

Fed. Emp. I.D. #:

Private Plan #:

Wages:

D. Employer’s Name:

Fed. Emp. I.D. #:

Private Plan #:

Wages:

E. Employer’s Name:

Fed. Emp. I.D. #:

Private Plan #:

Wages:

F. Employer’s Name:

Fed. Emp. I.D. #:

Private Plan #:

Wages:

G.

*If additional space is required, enclose a rider and enter the total on this line

2.

Total Deducted: Add Lines 1A thru 1G. Enter here.

3.

90.10

106.00

Correct UI/HC/WD and/or Disability Deductions.

4.

Deduct Line 3 Col. A from Line 2 Col. A. Enter on Page 2, Line 47

of the NJ-1040.

5.

Deduct Line 3 Col. B from Line 2 Col. B. Enter on Page 2, Line 48

of the NJ-1040.

I hereby apply for a credit for worker contributions deducted in excess of $90.10 for N.J. UI/HC/WD and in excess of $106.00 for N.J. Disability

Insurance by reason of having received wages from two or more employers during the above calendar year and hereby submit the following statement

of wages and deductions.

Claimant’s Signature: ______________________________________________________________ Date: _________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1