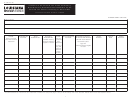

R -10610i (1/16)

INVENTORY TAX or AD VALOREM NATURAL GAS CREDIT

Line 1 – Enter the amount of the ad valorem taxes paid to local subdivisions in Loui-

Line 5C – Complete column 2 only if both the Inventory and Ad Valorem credits are

siana on inventory held by manufacturers, distributors, retailers OR natural gas held,

claimed. Enter this amount from Schedule F (Individual) or Schedule RC (Business) of

used, or consumed in providing natural gas storage services or operating natural gas

your tax return or the amount on Line 9, column 1.

storage facilities. Enter the amount paid on inventory in column 1 and natural gas in

Line 5D – Add Lines 5A through 5C in each column.

column 2.

Line 6 – Subtract Line 5D from Line 4 to calculate your tax liability before applying the

Line 2 – If you have a credit carried forward from the prior tax year due to Act 133

Inventory Credit or Ad Valorem Natural Gas credit. Enter this amount in column 1 only.

reduction, enter the tax year in the space provided on Line 2 and enter the amount of

the carry forward in the appropriate column. This amount can be found on line 10 of

Line 7 – Subtract Line 6 from Line 3 and enter the result. This is the amount of the

the prior tax year’s Form R-620CRW or R-540CRW.

credit that exceeds tax. If this amount is less than or equal to zero, enter the amount

from Line 3 on Schedule F or Schedule RC with the identifying three-digit code. If you

Line 3 – Add Lines 1 and 2 to figure the amount of credit available for use.

are not claiming both credits, stop here; you are finished with the worksheet.

Line 4 – Enter the amount of your total tax from your tax return. If you are claiming

If you are claiming both the Inventory and Ad Valorem credits:

both credits, enter your total tax in column 1 only. For individuals enter the Total tax

and Consumer Use tax. See chart below for line numbers.

• If the amount in column 1, Line 7 is greater than or equal to zero, your tax liability

(Line 6) for the purpose of calculating column 2 is zero.

IT-540

IT-540B

IT-540BNRA

IT-541

R-6922

CIFT-620

• If the amount in column 1, Line 7 is less than zero, subtract Line 3, column 1,

Line 18

Line 18

Line 14

Line 12

Line 4

Lines 4 & 9

from Line 6, column 1, and enter the result on Line 6, column 2. This is your

remaining tax liability (Line 6) for the purpose of calculating column 2.

Line 5A – Enter the amount of your Refundable Child Care credit, Refundable School

Line 8 – If Line 7 is greater than zero, multiply Line 7 by 75 percent. This is the refund-

Readiness credit and/or Earned Income credit. These credits are only claimed on

able portion of your credit.

individual income tax returns. If you are claiming both the Inventory and Ad Valorem

credits, enter these amounts in column 1 only. See chart below for line numbers.

Line 9 – Add Line 6 and Line 8. Enter the amount on Schedule F (Individual) or

Schedule RC (Business) with the identifying three digit code.

Credit

IT-540

IT-540B

Line 10 – Subtract Line 8 from Line 7. This amount is your carryforward of the reduced

Refundable Child Care credit

Line 19

Line 19

inventory or ad valorem credit. Please refer to Act 133 for more information.

Refundable School Readiness

Line 20

Line 20

Earned Income credit

Line 21

N/A

Line 5B – Enter the amount of your Louisiana Citizens Insurance credit from your

tax return. If you are claiming both the Inventory and Ad Valorem credits, enter this

amount in column 1 only. See chart below for line numbers.

IT-540

IT-540B

IT-540BNRA

IT-541

R-6922

CIFT-620

Line 22

Line 21

Line 15A

Line 13

Line 5A

Line 11A

3

1

1 2

2 3

3