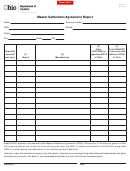

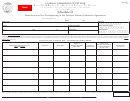

Form Et-60 - Master Settlement Agreement Report Page 2

ADVERTISEMENT

Instructions for Completing Master Settlement Agreement Report

(Form ET-60)

The State of Ohio is a signatory to the agreement that

Alternate Reporting:

was reached between various cigarette manufactur-

ers/importers and the states. This agreement is com-

Under certain circumstances you may qualify to report

monly known as the Master Settlement Agreement

on a less than monthly basis. If all products sold by you

(MSA).

are manufactured by signatories to the MSA or you han-

dle no cigarette or roll your own tobacco products then

Ohio’s participation in the MSA mandated legislation

we are permitted to allow annual, rather than monthly,

requiring manufacturers who are not signatories to the

reporting. If you fall into this category and wish to file

MSA to pay into an escrow account a sum roughly

on an annual basis, submit your initial report along with

equivalent to that which is paid by the participating

a letter stating that you only handle cigarette or roll your

manufacturers. This legislation also requires this De-

own products that are produced/imported by manufac-

partment to gather information concerning sales of ciga-

turers/importers who are signatories to the MSA and

rette and roll-your-own tobacco into Ohio that is manu-

request an annual filing status.

factured/imported by non-participating manufactur-

ers/importers. This information will be provided to the

Heading – Complete the month or other period covered

Ohio Attorney General for use in administering the

by this report. Reports must cover one-month periods

agreement. An administrative rule requiring this infor-

unless you have requested and have been approved to

mation has been promulgated.

file on an annual basis.

Column #1 – Cigarette wholesalers: report the brand of

Schedule of Brands Covered by the MSA:

any cigarettes sold with an Ohio tax stamp in Ohio that

is NOT listed on the Schedule of Covered Brands.

A schedule of brands covered by the Master Settlement

Agreement can be found by going to the National Asso-

OTP Distributors: report only sales of roll your

ciation of Attorney General’s Web site. The address is:

own tobacco to a retailer or consumer in Ohio that is

NOT listed on the Schedule of Covered Brands.

OTP distributors should not report cigarette sales.

Column #2 – List the product manufacturer for any of

Master Settlement Agreement Report:

the brands listed in column # 1. If the manufacturer is

not known, report the supplier.

The Master Settlement Report (ET-60) must be filed by

all stamping cigarette wholesalers and licensed Other

Column #3 – Report the number of cartons of cigarettes

Tobacco Products Distributors. This report must be

you stamped with an Ohio tax stamp for each brand re-

filed monthly and is due by the last day of the month

ported in column #1. For purposes of this report, a car-

following the reporting period.

ton refers to cartons containing 200 cigarettes. If you

have sold cartons of other than 200, please indicate such

in this column.

Alternate Reports:

Column #4 – Report in ounces the quantity of roll your

You may elect to design your own reports utilizing your

own tobacco sold to a retailer or consumer in Ohio for

own software or database. Alternate forms are permis-

each brand listed in column #1.

sible as long as all the required information is provided

and in the same format as the Master Settlement Agree-

Sign and date the report and return it to:

ment Report.

Ohio Department of Taxation

Excise Tax Unit

P. O. Box 530

Columbus, OH 43216-0530

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2