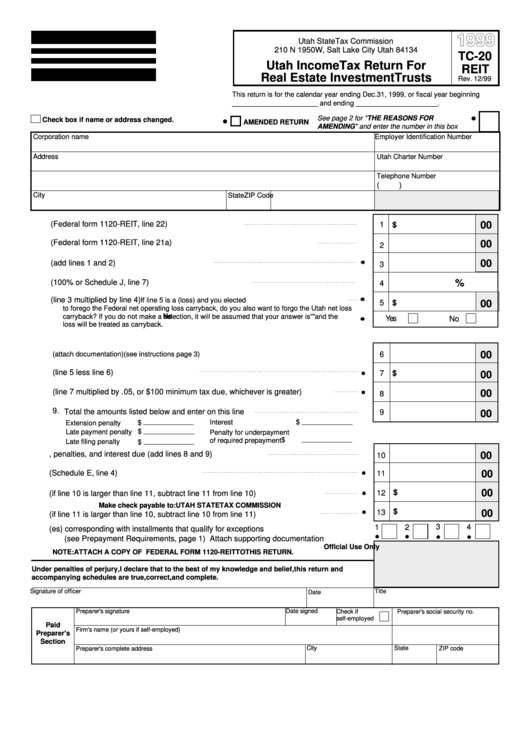

Form Tc-20 Reit - Utah Income Tax Return For Real Estate Investment Trusts - 1999

ADVERTISEMENT

1999

Utah State Tax Commission

210 N 1950 W, Salt Lake City Utah 84134

TC-20

Utah Income Tax Return For

REIT

Real Estate Investment Trusts

Rev. 12/99

This return is for the calendar year ending Dec. 31, 1999, or fiscal year beginning

______________________ and ending _____________________.

See page 2 for "

THE REASONS FOR

Check box if name or address changed.

AMENDED RETURN

AMENDING

" and enter the number in this box

Corporation name

Employer Identification Number

Address

Utah Charter Number

Telephone Number

(

)

City

State

ZIP Code

1. Net income/loss (Federal form 1120-REIT, line 22)

1

00

$

2. Federal net operating loss deduction (Federal form 1120-REIT, line 21a)

00

2

00

3. Apportionable income (add lines 1 and 2)

3

4. Apportionment fraction (100% or Schedule J, line 7)

%

4

5. Utah taxable income/loss (line 3 multiplied by line 4)

If line 5 is a (loss) and you elected

5

$

00

to forego the Federal net operating loss carryback, do you also want to forgo the Utah net loss

carryback? If you do not make a selection, it will be assumed that your answer is “

No

” and the

Yes

No

loss will be treated as carryback.

6. Utah net loss carried forward from prior years

00

(attach documentation)(see instructions page 3)

6

7. Net taxable income (line 5 less line 6)

7

$

00

8. Tax (line 7 multiplied by .05, or $100 minimum tax due, whichever is greater)

00

8

9.

Total the amounts listed below and enter on this line

9

00

$

$

Interest

Extension penalty

$

Late payment penalty

Penalty for underpayment

$

of required prepayment

Late filing penalty

$

10. Total tax, penalties, and interest due (add lines 8 and 9)

00

10

11. Total prepayments (Schedule E, line 4)

00

11

00

12

$

12. Total remitted (if line 10 is larger than line 11, subtract line 11 from line 10)

Make check payable to: UTAH STATE TAX COMMISSION

$

13

00

13. Total refund (if line 11 is larger than line 10, subtract line 10 from line 11)

3

1

2

4

14. Check box(es) corresponding with installments that qualify for exceptions

(see Prepayment Requirements, page 1) Attach supporting documentation

Official Use Only

NOTE: ATTACH A COPY OF FEDERAL FORM 1120-REIT TO THIS RETURN.

Under penalties of perjury, I declare that to the best of my knowledge and belief, this return and

accompanying schedules are true, correct, and complete.

Signature of officer

Title

Date

Date signed

Preparer's signature

Check if

Preparer's social security no.

self-employed

Paid

Firm's name (or yours if self-employed)

E.I. number

Preparer's

Section

City

State

Preparer's complete address

ZIP code

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2