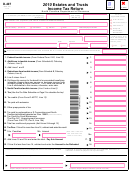

Form D-407 - Estates And Trusts Income Tax Return - 2011 Page 4

ADVERTISEMENT

Page 2

Legal Name (First 10 Characters)

Federal Employer ID Number

D-407TC

Web

11-11

Part 6. Tax Paid to Another State or Country

A. Allocation of Income and Tax Paid to Another State or Country

(See instructions.)

Attach other pages

Fiduciary

Beneficiary 1

Beneficiary 2

Beneficiary 3

if needed.

1.

Identifying Number

2.

Name

3.

Share of Gross Income

on which Tax was Paid to

Another State or Country

4.

Share of Tax Paid to

Another State or Country

B. Computation of Tax Credit for Tax Paid to Another State or Country

.

1.

Fiduciary’s share of gross income taxed in another state or country

1.

(From Fiduciary Column, Line 3 above)

00

.

2. Fiduciary’s share of total gross income

(See instructions)

2.

00

3. Percentage of income taxed in another state or country

3.

%

(Divide Line 1 by Line 2)

.

4. Amount of North Carolina tax

(From Form D-407, Page 1, Line 8)

4.

00

.

5. Computed tax credit

5.

(Mulitply Line 3 by Line 4)

00

.

6. Fiduciary’s share of tax paid to another state or country

6.

(From Fiduciary Column, Line 4 above.

00

Attach copy of return and proof of payment)

.

7

Enter the lesser of Line 5 or Line 6 here and on Part 1, Line 1

.

7.

00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5