Form Ptf6664 - Request For Information: Betr Applicants Who Receive Tif Credit Enhancement Reimbursements

ADVERTISEMENT

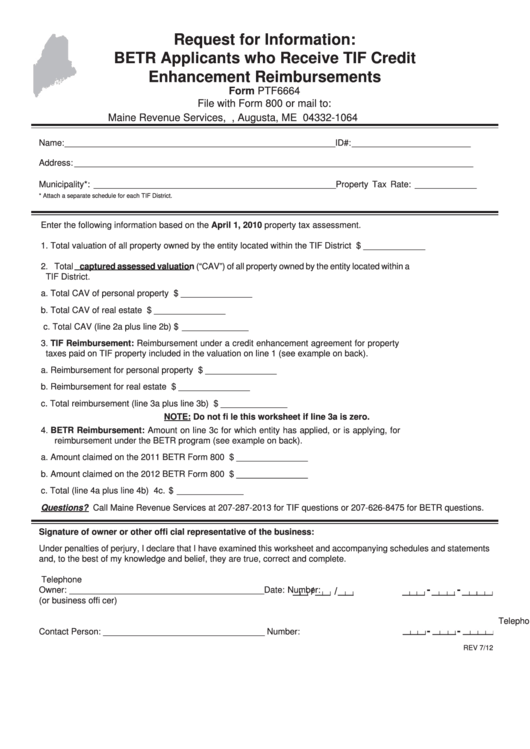

Request for Information:

BETR Applicants who Receive TIF Credit

Enhancement Reimbursements

Form PTF6664

File with Form 800 or mail to:

Maine Revenue Services, P.O. Box 1064, Augusta, ME 04332-1064

Name: _________________________________________________________ ID#: _________________________

Address: ____________________________________________________________________________________

Municipality*: ___________________________________________________ Property Tax Rate: _____________

* Attach a separate schedule for each TIF District.

Enter the following information based on the April 1, 2010 property tax assessment.

1. Total valuation of all property owned by the entity located within the TIF District ................. 1. $ _____________

2. Total captured assessed valuation (“CAV”) of all property owned by the entity located within a

TIF District.

a. Total CAV of personal property ..............................................2a. $ _______________

b. Total CAV of real estate .........................................................2b. $ _______________

c. Total CAV (line 2a plus line 2b) ...................................................................................... 2c. $ ______________

3. TIF Reimbursement: Reimbursement under a credit enhancement agreement for property

taxes paid on TIF property included in the valuation on line 1 (see example on back).

a. Reimbursement for personal property ...................................3a. $ _______________

b. Reimbursement for real estate ..............................................3b. $ _______________

c. Total reimbursement (line 3a plus line 3b) ..................................................................... 3c. $ ______________

NOTE: Do not fi le this worksheet if line 3a is zero.

4. BETR Reimbursement: Amount on line 3c for which entity has applied, or is applying, for

reimbursement under the BETR program (see example on back).

a. Amount claimed on the 2011 BETR Form 800 ......................4a. $ _______________

b. Amount claimed on the 2012 BETR Form 800 ......................4b. $ _______________

c. Total (line 4a plus line 4b) .............................................................................................. 4c. $ ______________

Questions? Call Maine Revenue Services at 207-287-2013 for TIF questions or 207-626-8475 for BETR questions.

Signature of owner or other offi cial representative of the business:

Under penalties of perjury, I declare that I have examined this worksheet and accompanying schedules and statements

and, to the best of my knowledge and belief, they are true, correct and complete.

Telephone

-

-

Owner: _________________________________________ Date:

Number:

/

/

(or business offi cer)

Telephone

-

-

Contact Person: __________________________________

Number:

REV 7/12

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2