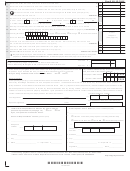

Form It-40 Draft - Indiana Full-Year Resident Individual Income Tax Return - 2008 Page 4

ADVERTISEMENT

Indiana’s Earned Income Credit Instructions

Generally, Indiana’s earned income credit is 6% (.06) of the

Section B - Qualifying Child

earned income credit allowed on your federal income tax re-

turn.

You must complete Section B if you fi led the federal Sched-

ule EIC, Earned Income Credit.

If, during 2008:

•

you were an Indiana resident, and/or

Enter in Column 1 (and Column 2) information for the same child

(or children) you entered on your federal Schedule EIC.

•

had income from Indiana sources, and

Note: If you have more than two children who meet the require-

•

you claimed the earned income credit on your federal

ments to be eligible to claim them for the federal earned income

income tax return (Form 1040, 1040A or 1040EZ),

credit on federal Schedule EIC, please enter the additional

child’s information (up to two additional children) in Column 3

then you are eligible to claim Indiana’s Earned Income Credit.

(and Column 4, if applicable). Note: This will not increase or

decrease your Indiana earned income credit.

Indiana’s Earned Income Credit will lower the tax you owe and

may give you a refund even if you don’t owe any tax.

In Section B-1, the ‘Other’ box (box f) includes:

•

a related foster child, or

Note: Do not complete this schedule if fi ling Indiana’s Form

•

IT-40EZ. Instead, complete the worksheet on the back of Form

your brother, sister, stepbrother, stepsister, or

IT-40EZ to claim your earned income credit.

•

a descendant of your brother and/or sister, etc. (for ex-

ample, your niece or nephew), whom you cared for as

your own child.

Section A – Figure Your Credit

Note: In Section B-2, box i, the child must be under age 24.

Enter on Line A-1 the amount of earned credit* from your

•

Caution: You must know what your federal earned income

Federal Form 1040, line 64a or

credit is before you can fi gure your Indiana earned income

•

credit. Some individuals ask the Internal Revenue Service

Federal Form 1040A, line 40a or

(IRS) to fi gure their federal earned income credit for them. If

•

you have chosen to do this, you must wait to claim Indiana’s

Federal Form 1040EZ, line 8a.

earned income credit until you fi nd out what your earned income

credit is from the IRS. Your Indiana income tax return, Form

* Important: This amount must be at least $9.00 or more (a

IT-40, IT-40PNR, or IT-40EZ, must be fi led by April 15, 2009.

smaller federal earned income credit will create an Indiana

If you don’t know what your federal earned income credit is by

credit of less than $1).

Indiana’s fi ling due date, go ahead and fi le your Indiana return

without claiming the earned income credit. Then, when you fi nd

Multiply the amount on Line A1 by .06 (6%) and enter the result

out what your federal earned income credit is, fi le an amended

on line A-2. This is your Indiana earned income credit. Enter

(corrected) Indiana tax return, Form IT-40X, to claim your Indiana

this amount on your Form IT-40, line 27, or on Form IT-40PNR,

earned income credit.

line 23.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4