Form Ap-206-1 - Application For Exemption - Homeowners' Association - Specific Instructions - 2002

ADVERTISEMENT

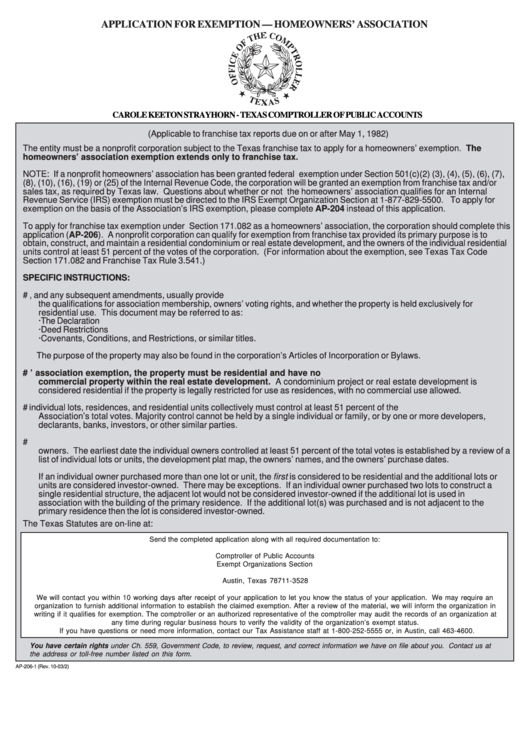

APPLICATION FOR EXEMPTION — HOMEOWNERS’ ASSOCIATION

CAROLE KEETON STRAYHORN - TEXAS COMPTROLLER OF PUBLIC ACCOUNTS

(Applicable to franchise tax reports due on or after May 1, 1982)

The entity must be a nonprofit corporation subject to the Texas franchise tax to apply for a homeowners’ exemption. The

homeowners’ association exemption extends only to franchise tax.

NOTE: If a nonprofit homeowners’ association has been granted federal exemption under Section 501(c)(2) (3), (4), (5), (6), (7),

(8), (10), (16), (19) or (25) of the Internal Revenue Code, the corporation will be granted an exemption from franchise tax and/or

sales tax, as required by Texas law. Questions about whether or not the homeowners’ association qualifies for an Internal

Revenue Service (IRS) exemption must be directed to the IRS Exempt Organization Section at 1-877-829-5500. To apply for

exemption on the basis of the Association’s IRS exemption, please complete AP-204 instead of this application.

To apply for franchise tax exemption under Section 171.082 as a homeowners’ association, the corporation should complete this

application (AP-206). A nonprofit corporation can qualify for exemption from franchise tax provided its primary purpose is to

obtain, construct, and maintain a residential condominium or real estate development, and the owners of the individual residential

units control at least 51 percent of the votes of the corporation. (For information about the exemption, see Texas Tax Code

Section 171.082 and Franchise Tax Rule 3.541.)

SPECIFIC INSTRUCTIONS:

#1. The filed document of record that establishes the purpose of the property, and any subsequent amendments, usually provide

the qualifications for association membership, owners’ voting rights, and whether the property is held exclusively for

residential use. This document may be referred to as:

·

The Declaration

·

Deed Restrictions

·

Covenants, Conditions, and Restrictions, or similar titles.

The purpose of the property may also be found in the corporation’s Articles of Incorporation or Bylaws.

#2. To be eligible for a homeowners’ association exemption, the property must be residential and have no

commercial property within the real estate development. A condominium project or real estate development is

considered residential if the property is legally restricted for use as residences, with no commercial use allowed.

#3. The owners of individual lots, residences, and residential units collectively must control at least 51 percent of the

Association’s total votes. Majority control cannot be held by a single individual or family, or by one or more developers,

declarants, banks, investors, or other similar parties.

#4. The collective voting percentage of individual owners is determined by comparing the voting rights of owners and non-

owners. The earliest date the individual owners controlled at least 51 percent of the total votes is established by a review of a

list of individual lots or units, the development plat map, the owners’ names, and the owners’ purchase dates.

If an individual owner purchased more than one lot or unit, the first is considered to be residential and the additional lots or

units are considered investor-owned. There may be exceptions. If an individual owner purchased two lots to construct a

single residential structure, the adjacent lot would not be considered investor-owned if the additional lot is used in

association with the building of the primary residence. If the additional lot(s) was purchased and is not adjacent to the

primary residence then the lot is considered investor-owned.

The Texas Statutes are on-line at:

Send the completed application along with all required documentation to:

Comptroller of Public Accounts

Exempt Organizations Section

P.O. Box 13528

Austin, Texas 78711-3528

We will contact you within 10 working days after receipt of your application to let you know the status of your application. We may require an

organization to furnish additional information to establish the claimed exemption. After a review of the material, we will inform the organization in

writing if it qualifies for exemption. The comptroller or an authorized representative of the comptroller may audit the records of an organization at

any time during regular business hours to verify the validity of the organization’s exempt status.

If you have questions or need more information, contact our Tax Assistance staff at 1-800-252-5555 or, in Austin, call 463-4600.

You have certain rights under Ch. 559, Government Code, to review, request, and correct information we have on file about you. Contact us at

the address or toll-free number listed on this form.

AP-206-1 (Rev. 10-03/2)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1