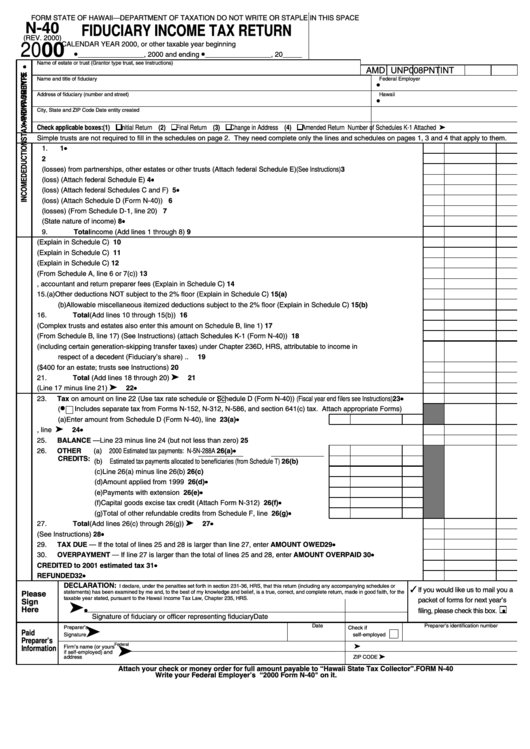

Form N-40 - Fiduciary Income Tax Return - 2000

ADVERTISEMENT

FORM

STATE OF HAWAII—DEPARTMENT OF TAXATION

DO NOT WRITE OR STAPLE IN THIS SPACE

N-40

FIDUCIARY INCOME TAX RETURN

(REV. 2000)

CALENDAR YEAR 2000, or other taxable year beginning

2000

•

•

_________________, 2000 and ending

_________________ , 20_____

Name of estate or trust (Grantor type trust, see Instructions)

AMD UNP

008

PNT

INT

Name and title of fiduciary

Federal Employer I.D. No.

•

Address of fiduciary (number and street)

Hawaii G.E./Use I.D. No.

•

City, State and ZIP Code

Date entity created

Number of Schedules K-1 Attached

Check applicable boxes: (1)

Initial Return (2)

Final Return (3)

Change in Address (4)

Amended Return

Simple trusts are not required to fill in the schedules on page 2. They need complete only the lines and schedules on pages 1, 3 and 4 that apply to them.

1.

Interest..............................................................................................................................................................................

1•

2.

Dividends ..........................................................................................................................................................................

2

3.

Income or (losses) from partnerships, other estates or other trusts (Attach federal Schedule E) (See Instructions).............

3

4.

Net rent and royalty income or (loss) (Attach federal Schedule E) ...................................................................................

4•

5.

Net business and farm income or (loss) (Attach federal Schedules C and F) ..................................................................

5•

6.

Capital gain or (loss) (Attach Schedule D (Form N-40)) .................................................................................................

6

7.

Ordinary gains or (losses) (From Schedule D-1, line 20) ................................................................................................

7

8.

Other income (State nature of income).............................................................................................................................

8•

9.

Total income (Add lines 1 through 8) .......................................................................................................................

9

10.

Interest (Explain in Schedule C) .......................................................................................................................................

10

11.

Taxes (Explain in Schedule C) .........................................................................................................................................

11

12.

Fiduciary fees (Explain in Schedule C) .............................................................................................................................

12

13.

Charitable deduction (From Schedule A, line 6 or 7(c)) ....................................................................................................

13

14.

Attorney, accountant and return preparer fees (Explain in Schedule C)...........................................................................

14

15.

(a) Other deductions NOT subject to the 2% floor (Explain in Schedule C)...................................................................

15(a)

(b) Allowable miscellaneous itemized deductions subject to the 2% floor (Explain in Schedule C) ...............................

15(b)

16.

Total (Add lines 10 through 15(b)) ...........................................................................................................................

16

17.

Line 9 minus line 16 (Complex trusts and estates also enter this amount on Schedule B, line 1)....................................

17

18.

Income distribution deduction (From Schedule B, line 17) (See Instructions) (attach Schedules K-1 (Form N-40)) ........

18

19.

Estate tax (including certain generation-skipping transfer taxes) under Chapter 236D, HRS, attributable to income in

respect of a decedent (Fiduciary’s share).........................................................................................................................

19

20.

Exemption ($400 for an estate; trusts see Instructions)....................................................................................................

20

21.

Total (Add lines 18 through 20)............................................................................................................................

21

22.

Taxable income of fiduciary (Line 17 minus line 21)....................................................................................................

22•

23.

Tax on amount on line 22 (Use tax rate schedule or

Schedule D (Form N-40)) (Fiscal year end filers see Instructions) .......

23•

•

(

Includes separate tax from Forms N-152, N-312, N-586, and section 641(c) tax. Attach appropriate Forms)

(a) Enter amount from Schedule D (Form N-40), line 41 ..............................................

23(a)•

24.

Total nonrefundable credits from Schedule E, line 8 ....................................................................................................

24•

25.

BALANCE — Line 23 minus line 24 (but not less than zero) ...........................................................................................

25

26.

OTHER

(a) 2000 Estimated tax payments: N-5

N-288A

26(a)•

CREDITS: (b) Estimated tax payments allocated to beneficiaries (from Schedule T) .....................

26(b)

(c)

Line 26(a) minus line 26(b) ...................................................................

26(c)

(d) Amount applied from 1999 return .........................................................

26(d)•

(e) Payments with extension .....................................................................

26(e)•

(f)

Capital goods excise tax credit (Attach Form N-312) ...........................

26(f)•

(g) Total of other refundable credits from Schedule F, line 6 .....................

26(g)•

27.

Total (Add lines 26(c) through 26(g)) ...................................................................................................................

27•

28.

Penalty for underpayment of estimated tax.(See Instructions) .........................................................................................

28•

29.

TAX DUE — If the total of lines 25 and 28 is larger than line 27, enter AMOUNT OWED ...............................................

29•

30.

OVERPAYMENT — If line 27 is larger than the total of lines 25 and 28, enter AMOUNT OVERPAID ...........................

30•

31.

Enter the amount of line 30 to be CREDITED to 2001 estimated tax ............................................................................

31•

32.

Enter the amount of line 30 to be REFUNDED.................................................................................................................

32•

DECLARATION:

I declare, under the penalties set forth in section 231-36, HRS, that this return (including any accompanying schedules or

%

If you would like us to mail you a

statements) has been examined by me and, to the best of my knowledge and belief, is a true, correct, and complete return, made in good faith, for the

Please

taxable year stated, pursuant to the Hawaii Income Tax Law, Chapter 235, HRS.

packet of forms for next year’s

Sign

•

Here

•

filing, please check this box.

Signature of fiduciary or officer representing fiduciary

Date

Date

Preparer’s identification number

Preparer’s

Check if

Paid

Signature

self-employed

Preparer’s

Federal

Firm’s name (or yours

Information

E.I. No.

if self-employed) and

address

ZIP CODE

Attach your check or money order for full amount payable to “Hawaii State Tax Collector”.

FORM N-40

Write your Federal Employer’s I.D. No. and “2000 Form N-40" on it.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4