Form Uct-62 - Power Of Attorney For Unemployment Tax

ADVERTISEMENT

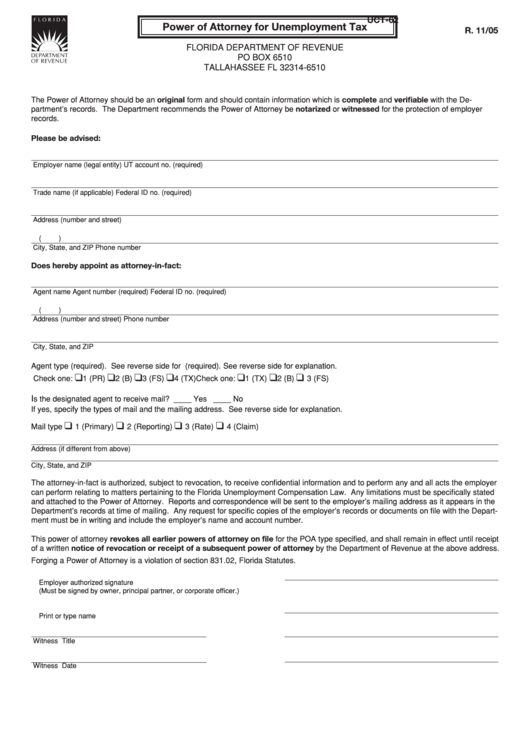

UCT-62

Power of Attorney for Unemployment Tax

R. 11/05

FLORIDA DEPARTMENT OF REVENUE

PO BOX 6510

TALLAHASSEE FL 32314-6510

The Power of Attorney should be an original form and should contain information which is complete and verifiable with the De-

partment’s records. The Department recommends the Power of Attorney be notarized or witnessed for the protection of employer

records.

Please be advised:

Employer name (legal entity)

UT account no. (required)

Trade name (if applicable)

Federal ID no. (required)

Address (number and street)

(

)

City, State, and ZIP

Phone number

Does hereby appoint as attorney-in-fact:

Agent name

Agent number (required)

Federal ID no. (required)

(

)

Address (number and street)

Phone number

City, State, and ZIP

Agent type (required). See reverse side for explanation.

POA type (required). See reverse side for explanation.

❑

❑

❑

❑

❑

❑

❑

Check one:

1 (PR)

2 (B)

3 (FS)

4 (TX)

Check one:

1 (TX)

2 (B)

3 (FS)

I

s the designated agent to receive mail? ____ Yes ____ No

If yes, specify the types of mail and the mailing address. See reverse side for explanation.

❑

❑

❑

❑

Mail type

1 (Primary)

2 (Reporting)

3 (Rate)

4 (Claim)

Address (if different from above)

City, State, and ZIP

The attorney-in-fact is authorized, subject to revocation, to receive confidential information and to perform any and all acts the employer

can perform relating to matters pertaining to the Florida Unemployment Compensation Law. Any limitations must be specifically stated

and attached to the Power of Attorney. Reports and correspondence will be sent to the employer’s mailing address as it appears in the

Department’s records at time of mailing. Any request for specific copies of the employer’s records or documents on file with the Depart-

ment must be in writing and include the employer’s name and account number.

This power of attorney revokes all earlier powers of attorney on file for the POA type specified, and shall remain in effect until receipt

of a written notice of revocation or receipt of a subsequent power of attorney by the Department of Revenue at the above address.

Forging a Power of Attorney is a violation of section 831.02, Florida Statutes.

Employer authorized signature

(Must be signed by owner, principal partner, or corporate officer.)

Print or type name

Witness

Title

Witness

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1