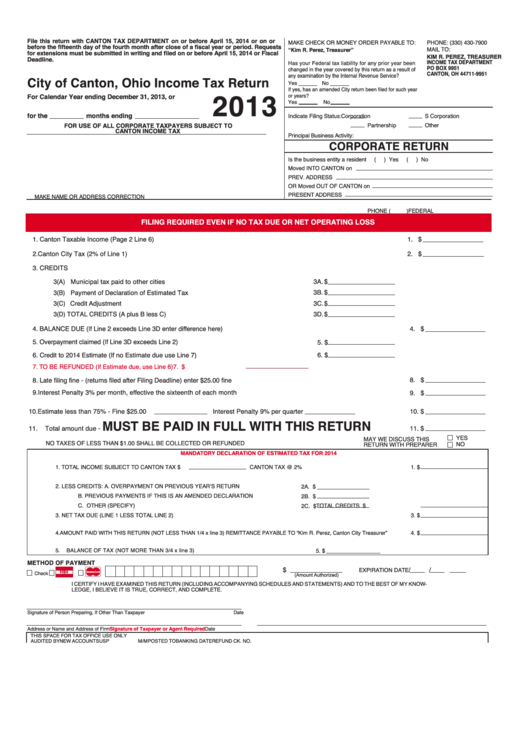

Ohio Income Tax Return - City Of Canton - 2013

ADVERTISEMENT

K

File this return with CANTON TAX DEPARTMENT on or before April 15, 2014 or on or

MAKE CHECK OR MONEY ORDER PAYABLE TO:

PHONE: (330) 430-7900

C

before the fifteenth day of the fourth month after close of a fiscal year or period. Requests

MAIL TO:

“Kim R. Perez, Treasurer”

for extensions must be submitted in writing and filed on or before April 15, 2014 or Fiscal

I

KIM R. PEREZ, TREASURER

Deadline.

INCOME TAX DEPARTMENT

P

Has your Federal tax liability for any prior year been

PO BOX 9951

changed in the year covered by this return as a result of

C

CANTON, OH 44711-9951

any examination by the Internal Revenue Service?

City of Canton, Ohio Income Tax Return

Yes

No

2013

If yes, has an amended City return been filed for such year

For Calendar Year ending December 31, 2013, or

or years?

Yes

No

for the

months ending

Indicate Filing Status:

Corporation

S Corporation

FOR USE OF ALL CORPORATE TAXPAYERS SUBJECT TO

Partnership

Other

CANTON INCOME TAX

Principal Business Activity:

CORPORATE RETURN

Is the business entity a resident

(

) Yes

(

) No

Moved INTO CANTON on

*

PREV. ADDRESS

OR Moved OUT OF CANTON on

PRESENT ADDRESS

MAKE NAME OR ADDRESS CORRECTION

K

C

ACCT. NUMBER

FEDERAL I.D. NUMBER

PHONE (

)

I

FILING REQUIRED EVEN IF NO TAX DUE OR NET OPERATING LOSS

P

C

1. Canton Taxable Income (Page 2 Line 6)

1. $

2. Canton City Tax (2% of Line 1)

2. $

3. CREDITS

3(A) Municipal tax paid to other cities

3A. $

3(B) Payment of Declaration of Estimated Tax

3B. $

3(C) Credit Adjustment

3C. $

3(D) TOTAL CREDITS (A plus B less C)

3D. $

*

4. BALANCE DUE (If Line 2 exceeds Line 3D enter difference here)

4. $

5.

Overpayment claimed (If Line 3D exceeds Line 2)

5. $

6. Credit to 2014 Estimate (If no Estimate due use Line 7)

6. $

K

C

7.

TO BE REFUNDED (If Estimate due, use Line 6)

7. $

I

8. Late filing fine - (returns filed after Filing Deadline) enter $25.00 fine

8. $

P

C

9. Interest Penalty 3% per month, effective the sixteenth of each month

9. $

10.

Estimate less than 75% - Fine $25.00

Interest Penalty 9% per quarter

10. $

MUST BE PAID IN FULL WITH THIS RETURN

11.

Total amount due -

11. $

YES

MAY WE DISCUSS THIS

NO TAXES OF LESS THAN $1.00 SHALL BE COLLECTED OR REFUNDED

NO

RETURN WITH PREPARER

MANDATORY DECLARATION OF ESTIMATED TAX FOR 2014

1.

TOTAL INCOME SUBJECT TO CANTON TAX $

CANTON TAX @ 2%

1. $

2.

LESS CREDITS:

A. OVERPAYMENT ON PREVIOUS YEAR’S RETURN

2A. $

*

B. PREVIOUS PAYMENTS IF THIS IS AN AMENDED DECLARATION

2B. $

C. OTHER (SPECIFY)

TOTAL CREDITS $

2C. $

K

3.

NET TAX DUE (LINE 1 LESS TOTAL LINE 2)

3. $

C

I

4.

AMOUNT PAID WITH THIS RETURN (NOT LESS THAN 1/4 x line 3) REMITTANCE PAYABLE TO “Kim R. Perez, Canton City Treasurer”

4. $

P

C

5.

BALANCE OF TAX (NOT MORE THAN 3/4 x line 3)

5. $

METHOD OF PAYMENT

$

/

/

EXPIRATION DATE

Check

MasterCard

(Amount Authorized)

I CERTIFY I HAVE EXAMINED THIS RETURN (INCLUDING ACCOMPANYING SCHEDULES AND STATEMENTS) AND TO THE BEST OF MY KNOW-

LEDGE, I BELIEVE IT IS TRUE, CORRECT, AND COMPLETE.

Signature of Person Preparing, If Other Than Taxpayer

Date

Address or Name and Address of Firm

Signature of Taxpayer or Agent Required

Date

THIS SPACE FOR TAX OFFICE USE ONLY

AUDITED BY

NEW ACCOUNT

SUSP

M/M

POSTED TO

BANKING DATE

REFUND CK. NO.

*

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2